Africa-Press – Malawi. The International Monetary Fund (IMF) Executive Board has called for decisive and urgent policy action to stabilise Malawi’s economy.

The Board made the observation in a statement issued on Tuesday in Washington DC, following the conclusion of Article IV consultations with Malawi.

The consultations were based on a visit by an IMF staff mission in May this year.

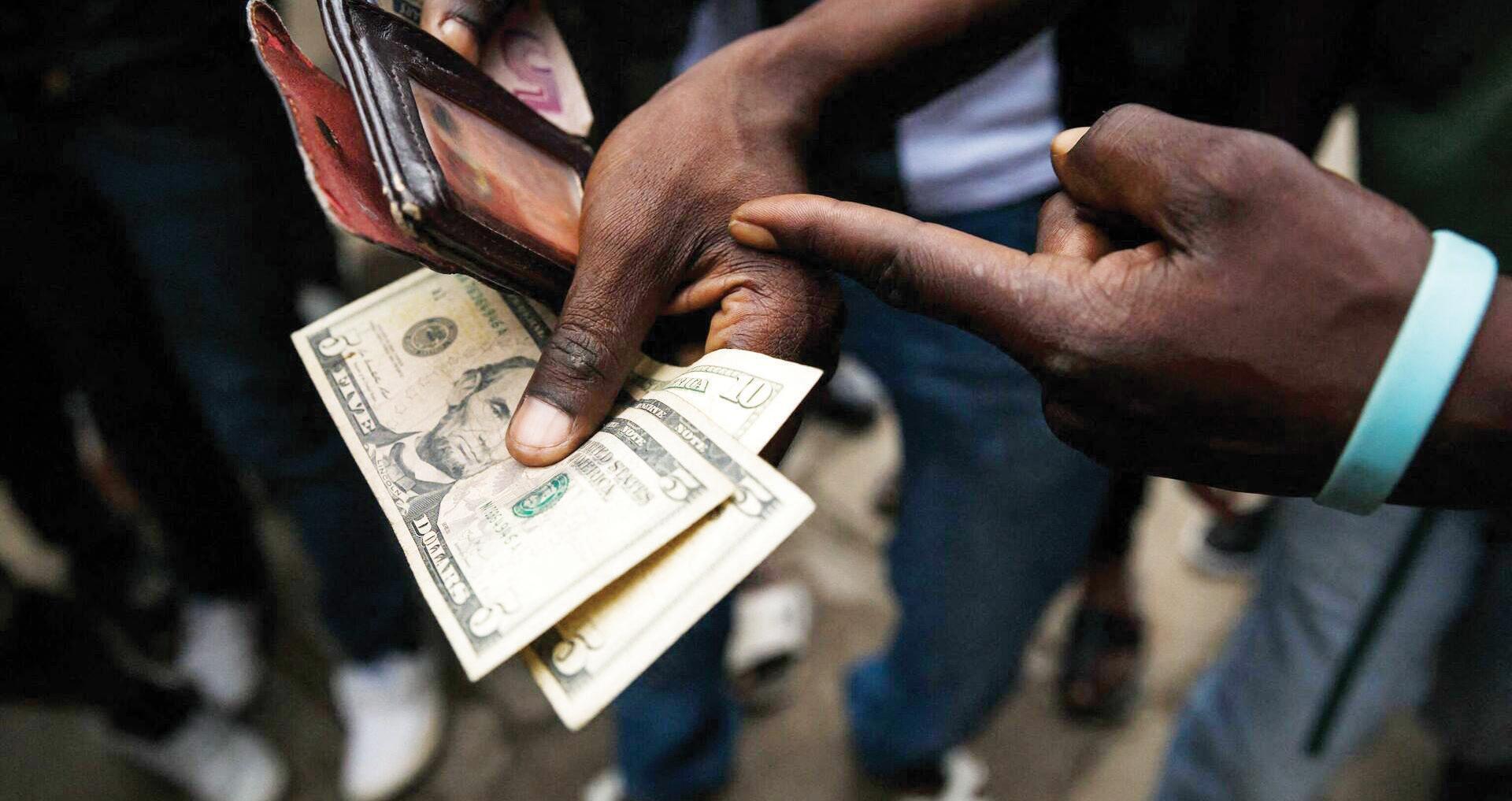

Among other points, the IMF directors said Malawi is at a critical juncture, facing high inflation, an unsustainable fiscal and debt outlook, foreign exchange shortages and fuel scarcity.

They observed that stabilising the economy and implementing reforms to promote sustained and inclusive growth are essential to improving living conditions for Malawians.

The directors noted that the official exchange rate against the United States dollar has been fixed since April last year, largely erasing the benefits of the November 2023 devaluation.

They further observed that inflation, driven by high food prices, elevated money growth and a wide official-parallel exchange rate spread, peaked at 30.7 percent year-on-year in February 2024, before easing to 27.7 percent in May 2025 during the harvest season.

“The current account deficit worsened significantly due to elevated import demand. Public debt dynamics remain unsustainable, with total public debt projected to reach 88 percent of GDP by the end of 2024.

“The interest bill on public debt is estimated to be approaching 7 percent of GDP,” the directors said.

They also underscored the importance of advancing governance and structural reforms to enhance the investment climate and promote economic diversification.

They highlighted the need to reduce economic distortions and regulatory burdens, and to intensify the fight against corruption.

The Fund has since urged Malawian authorities to take decisive steps to restore public debt sustainability within the framework of a medium-term adjustment programme.

“Completing external debt restructuring and addressing the high cost of domestic borrowing are both critical. Strengthening debt management and securing concessional financing will also be key,” IMF said.

Finance Minister Simplex Chithyola Banda and Reserve Bank of Malawi Governor Macdonald Mafuta Mwale were not immediately available for comment Wednesday.

Earlier last month, Mafuta Mwale told Times that unification of the two exchange rate markets could only occur through the elimination of the illegal parallel market, not by devaluation.

According to Mafuta Mwale, the authorities cannot unify with illegal activities.

On May 14, Malawi’s $175 million Extended Credit Facility programme with the IMF automatically terminated, as no review had been completed over an 18-month period.

For More News And Analysis About Malawi Follow Africa-Press