Africa-Press – Malawi. Malawi’s public debt may aggravate amid risks that include pre and post-election spending and geopolitical factors, the International Monetary Fund (IMF) and local experts have warned.

This comes at a time Malawi’s public debt is estimated at between 85 and 90 percent of gross domestic product (GDP).

Statistics show that as at September 2024, public debt was at K16.2 trillion, representing 86.4 percent of GDP.

Discussing the public debt situation on Wednesday in Lilongwe, Economics Association of Malawi (Ecama) Executive Director Esmie Kanyumbu said the debt situation was worrying amid signs of heavy-post election spending.

“The figures show that public debt continues to rise and it’s something that we need to discuss to find a solution and the direction that we have to take, especially now that the country is headed towards elections. What the political parties commit on debt management is crucial,” she said.

She further suggested fiscal consolidation and revenue mobilisation measures as some practical solutions towards containing the debt pressure.

The event was facilitated by the National Democratic Institute (NDI) to facilitate discussions among civil society, experts and political parties on the debt situation and how to contain the debt that affects macroeconomic situation.

Ecama presented that the debt situation has been steadily worsening over the years and cited a number of factors that include high deficits, inflation, devaluation of the currency and external shocks as major contributors to the debt situation.

Meanwhile, the IMF has released the full Article IV consultation report that shows the extent of debt stress, calling for immediate measures to avert the situation.

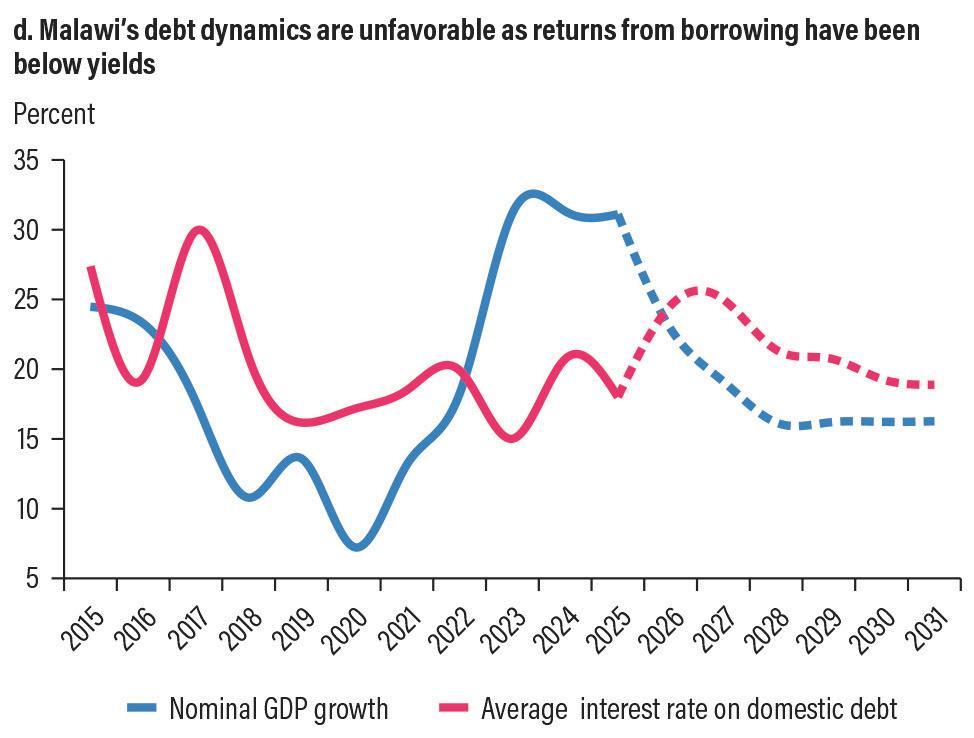

It says the recent increase in domestic debt poses broader risks to public debt and macroeconomic sustainability, saying the stock of domestic public debt has risen sharply in recent years and is projected to continue rising under the baseline.

“Elevated debt levels represent a source of fragility in the context of a shifting geopolitical landscape and Malawi’s vulnerability to shocks.

“Even with an external debt restructuring, reducing risks to public debt sustainability will require a sustained medium-term macroeconomic adjustment and steps to substantially reduce the domestic interest bill, including through a sustained fiscal adjustment and new external concessional financing,” the report reads.

The IMF further discloses in the report that it observed some outstanding arrears with commercial creditors worth $690 million at the end of 2024 while several breaches in debt burden were also evident, putting the debt-to-GDP ratio at 88 percent.

For More News And Analysis About Malawi Follow Africa-Press