Africa-Press – Malawi. The Registrar of Financial Institutions has given trustees of the Public Service Pension Trust Fund (PSPTF) seven days to rescind the controversial acquisition of Amaryllis Hotel — or face administrative penalties for defying regulatory orders and breaching prudential limits.

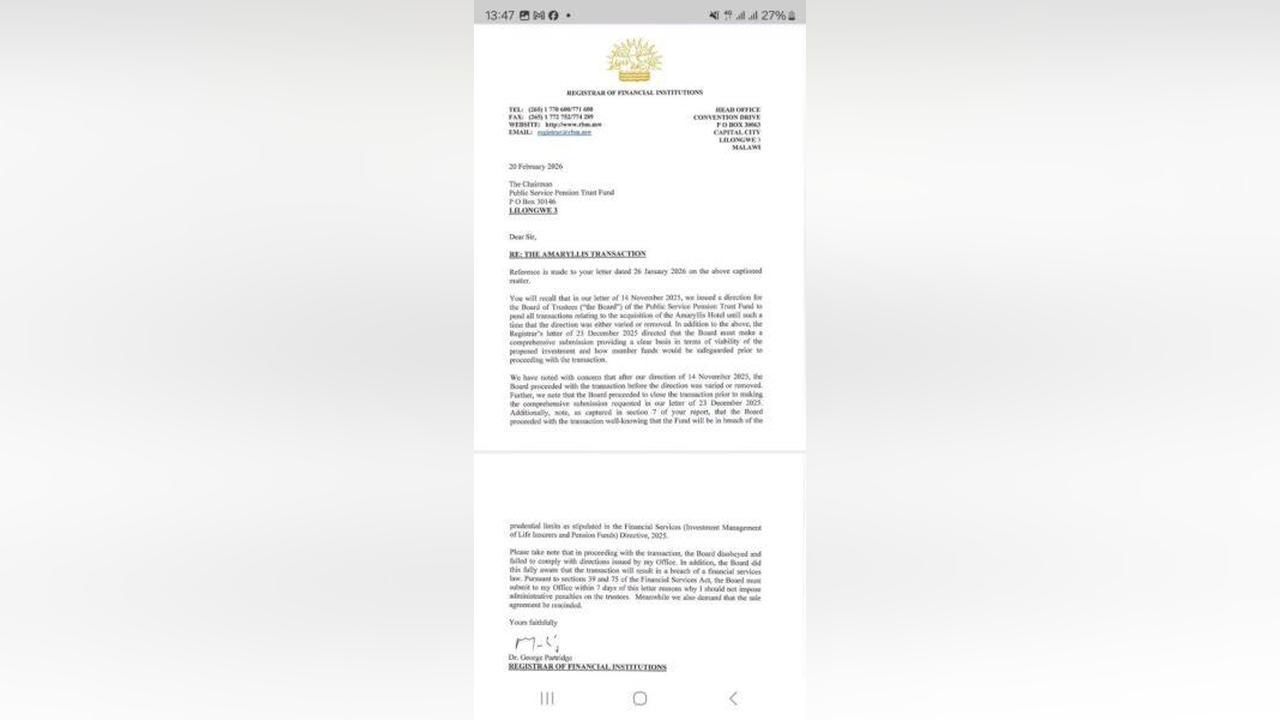

In a hard-hitting letter dated February 20, 2026, Registrar George Partridge accuses the Board of proceeding with the transaction despite an explicit directive to halt it.

The acquisition, already clouded by public controversy, now faces formal regulatory scrutiny.

According to the Registrar, a direction was issued on November 14, 2025 ordering trustees to suspend all transactions relating to the hotel purchase. That directive was never lifted. Yet the Board moved ahead and closed the deal.

“We have noted with concern that after our direction of 14 November 2025, the Board proceeded with the transaction before the direction was varied or removed,” the Registrar states in the letter.

The regulator further reveals that on December 23, 2025, the Board was instructed to submit a comprehensive report detailing the viability of the investment and how members’ pension funds would be safeguarded. Instead of complying first, trustees concluded the deal before providing the requested submission.

More troubling is the allegation that the Board proceeded “well-knowing that the Fund will be in breach of prudential limits” under the Financial Services (Investment Management of Life Insurers and Pension Funds) Directive of 2025.

In other words, this was not just a timing issue. It was a regulatory breach.

Citing Sections 39 and 75 of the Financial Services Act, the Registrar has now formally demanded that trustees show cause within seven days why administrative penalties should not be imposed.

The directive puts the spotlight firmly on governance standards within the Public Service Pension Trust Fund — an institution entrusted with safeguarding the retirement savings of thousands of public servants.

The Amaryllis acquisition has been controversial from the outset. Reports indicate the property was valued at approximately K47 billion in 2024, but the purchase price reportedly ballooned to K128.75 billion by the time the contract was signed in November 2025 — nearly three times the earlier valuation.

That sharp escalation in price, combined with claims of procedural irregularities, had already triggered public concern. Now, regulatory intervention has intensified scrutiny.

At stake is more than a hotel transaction. It is the integrity of pension fund management and compliance with financial laws designed to protect contributors.

If penalties are imposed, it could mark one of the most consequential enforcement actions against pension fund trustees in recent years.

The clock is now ticking.

Trustees must either reverse the transaction or convince the regulator why they should not be sanctioned for pressing ahead in the face of a clear directive.

For public servants whose retirement savings are tied to these decisions, the outcome will determine whether accountability is real — or optional.

For More News And Analysis About Malawi Follow Africa-Press