Africa-Press – Mauritius. Citizen Nishal Joyram’s 22-day hunger strike to demand lower fuel prices (gasoline and diesel) in the wake of falling oil prices on the world market has drawn public attention to the problem inflation in Mauritius.

In general, most of the inflation in Mauritius is imported through the import prices that the country has to pay for all its daily consumer products. However, only the exogenous factor (import price) does not explain the high fuel prices.

There is also an endogenous factor, notably the various taxes and contributions levied by the State on each liter of fuel. This poses a more fundamental problem, that of tax fairness in society. International context

Before getting to the heart of the matter, it is necessary to understand the international economic context of the prices of petroleum products and the mechanism for setting fuel prices in Mauritius.

World oil prices are determined by the law of supply and demand in the world, which is itself influenced by the production of the exporting OPEC countries, among other factors.

Crude oil prices have been on a rollercoaster ride over the past few years with ups followed by downs. Table 1 shows the comparable evolution of the price in dollars of Brent oil per barrel and the price of gasoline in Mauritius from December 16, 2019 to December 6, 2022.

In many countries, retail fuel prices reflect movements in world oil prices. This is not the case in Mauritius where fuel prices are set by the State Trading Corporation (STC), a state body which has a monopoly on the import of petroleum products.

According to figures from STC, the price of petrol has increased from Rs 44 per liter in December 2019 (referring to Brent price of $65.70/barrel) to Rs 74.10 since May 2022 (referring to Brent oil price of $112.20/barrel).

There is therefore a negative correlation between the world price of oil and the local price of gasoline that no reason can explain, other than the government’s desire to maintain fuel prices at high levels in order to continue milking a cash cow on behalf of the state.

Local context Indeed, if we examine the composition of fuel prices, we will see a big difference between the purchase price (Cost, Insurance, Freight) and the sale price at the pump.

Table 2 shows the different elements that enter into the composition of the retail price. We see that the CIF value is only Rs 36.33 on the price of Rs 74.10 per liter. The difference is accounted for mainly by factors unrelated to STC’s import and operating costs.

These foreign factors are the taxes (Excise tax and VAT) and the various contributions levied on the sale price for various financing needs such as the contribution to the Road Development Authority (RDA), the contribution to transport costs to Rodrigues, the contribution for the construction of storage facilities, and the subsidy on basic foodstuffs (rice, flour, natural gas).

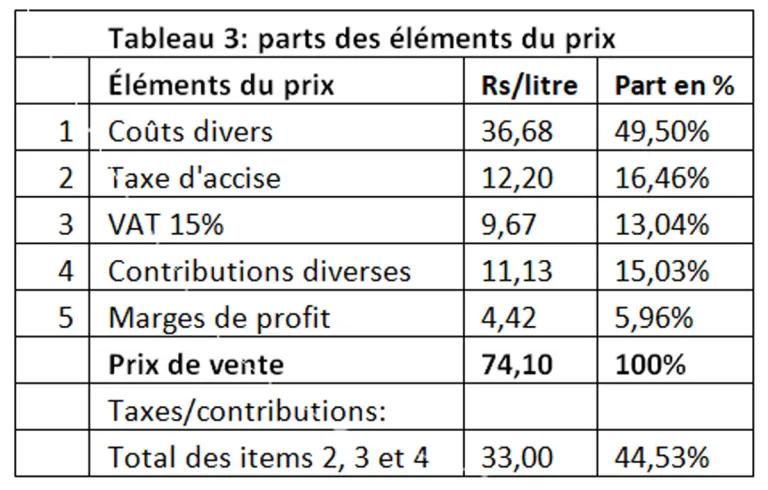

As shown in Table 3, taxes and contributions levied at source total Rs 33 per liter of gasoline, or 44.53% of the retail selling price. For comparison, gasoline taxes are 30% of the price at the pump in Ontario, Canada.

They include federal excise tax (10 cents per litre), provincial sales tax (9 cents per litre), federal VAT (13%) and federal carbon tax (11.10 cents per litre).

On December 19, 2022, the price per liter of regular gasoline in Ontario, Canada was $1.36 (Canadian dollar), or Rs 43.52 at the exchange rate of Rs 32 per dollar.

In terms of purchasing power parity, we therefore see that the price of gasoline is much cheaper in Ontario (Canada) than in Mauritius, while the minimum wage is higher in Ontario ($15/Rs 480 per hour) in comparison with Mauritius.

Fuel prices have a multiplier effect in the economy in general. When the price of gasoline goes up, it always causes a domino effect by pushing the cost of living even higher.

Carriers will pass the bill on to their customers, who will pass it on to consumers. It is a vicious circle that perpetuates the spiral of inflation. This in Mauritius reached 11.9% in November 2022, according to official figures.

However, according to the evidence that comes to us from the field, everything points to a greater inflationary surge, hence this growing concern about the cost of living which pushed a citizen to a hunger strike, without however succeeding in changing one iota.

official policy. Weight of indirect taxes Why is the government refusing to lower taxes on fuel prices? There are three reasons The STC is forced to replenish its coffers after having paid Rs5.4 billion in damages to the company Betamax which won its case against the State after the termination of its contract for the transport of petroleum products.

STC paid dividends to the state, which reduced its reserves. The state wants to use fuel taxes to raise additional funds for the payment of universal old age pension, superannuation and other social benefits which are disbursed from its Consolidated Revenue Fund .

The CSG, introduced to replace the National Pension Fund, does not collect enough funds to feed the pension funds. And this is the main reason, the State’s treasury depends massively on indirect taxes (VAT, excise taxes) and contributions deducted at source from fuel prices to finance public expenditure.

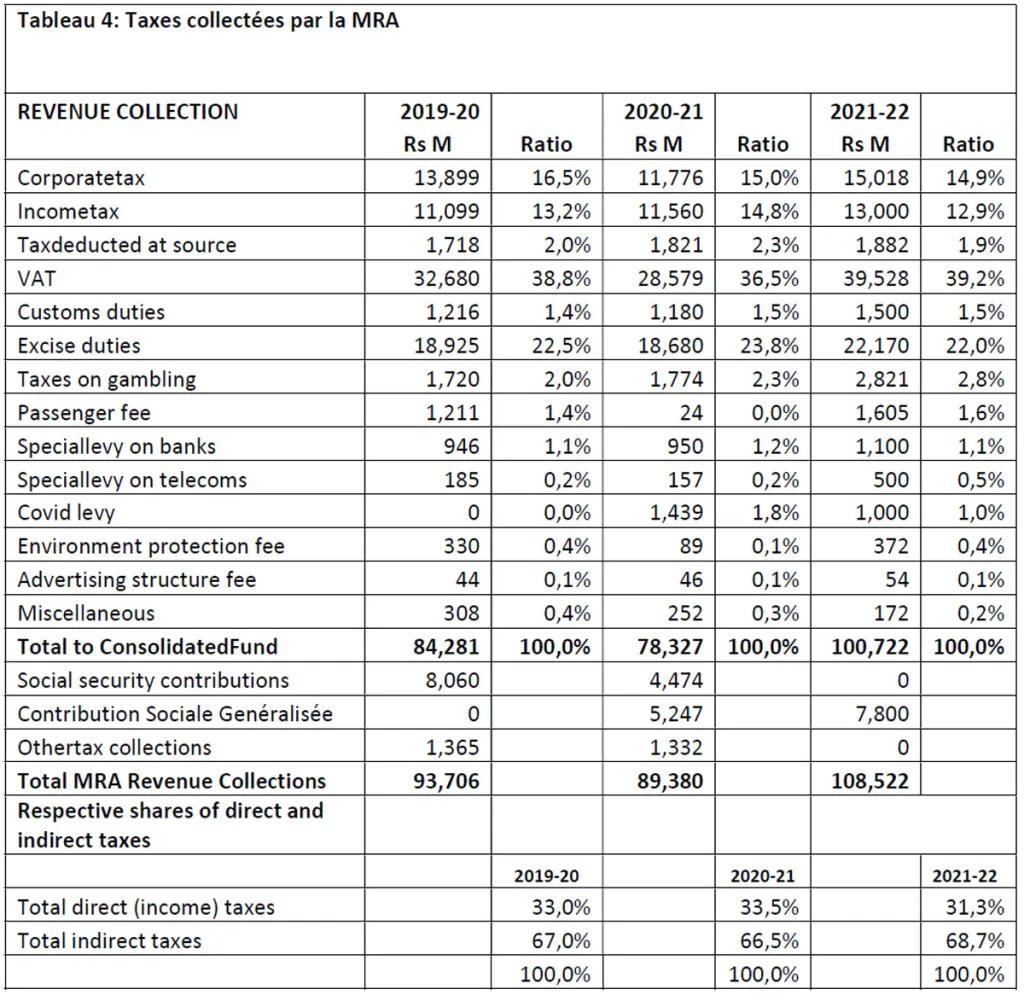

The higher fuel prices are, the more indirect taxes bring to the state in terms of tax revenue. Inflation increases revenue from VAT, the largest source of tax revenue, as shown in Table 4. VAT alone accounts for 39% of total government tax revenue. Direct taxes

Since 2006, there has been a paradigm shift in Mauritian taxation which has decreased the share of direct taxes (personal income tax and corporation tax) in the country’s total tax revenue and increased the share of indirect taxes.

.

As shown in Table 4, the share of indirect taxes in the country’s total tax revenue is 67% compared to 33% for direct taxes (personal and corporate income tax).

this neoliberal philosophy that wants taxation to focus more on consumption than on income. The reasoning behind this policy is that income tax should be kept low to be an incentive for work, effort and investment.

However, it is the wealthy taxpayers who benefit from this light direct taxation. Thus, the flat 15% income tax was introduced in 2006 for all taxpayers (individuals and companies).

Since then, a basic tax rate of 10% and a solidarity tax of 25% on the income bracket above Rs 3 million per year have been added to the tax base. Unlike the social democratic countries of the West, Mauritius has abandoned progressive direct taxation in favor of the flat tax of 15% and regressive indirect taxation.

Indirect taxes affect the poor and middle class the most as they represent an increasing proportion of their income. The fiscal burden of indirect taxes is higher for low- and middle-income households than for high-income households.

For More News And Analysis About Mauritius Follow Africa-Press