Africa-Press – Mauritius. In the 2023-2024 budget, the Minister of Finance introduced an income tax reform that replaces the flat tax rate of 15% with a graduated scale. From July 1, 2023, income tax will be calculated according to a graduated scale ranging from 0% to 20% with an addition of 2% for each higher income bracket.

The Minister presented the new formula as a progressive tax system. What is it really ? Before answering this question, let’s first look at the structure of the new scale.

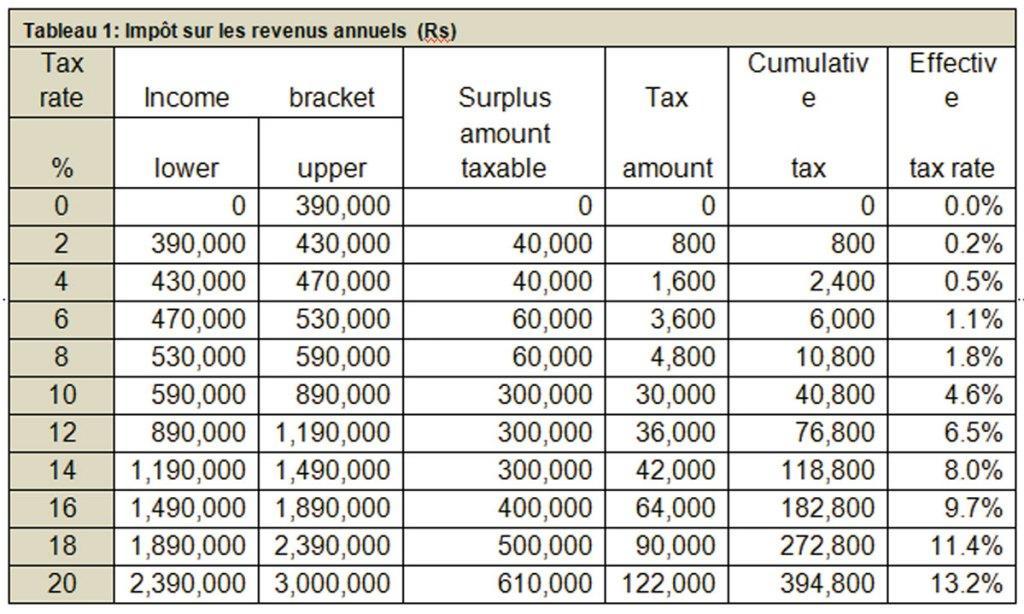

As shown in Table 1, the graduated scale has 10 Marginal Tax Rates applicable to different income brackets. The first Rs 390,000 of the taxpayer’s annual income will not be taxable with a tax rate of 0%.

Income tax will apply after this exemption bracket. Thus, a tax rate of 2% will hit the first Rs 40,000 after the exemption bracket of Rs 390,000 (in the range of Rs 390,000 to Rs 430,000). The tax due on the Rs 40,000 will be Rs 800.

For More News And Analysis About Mauritius Follow Africa-Press