Africa-Press – Mauritius. Africa might be poor, but some of its people are also filthy rich: $2.4-trillion in private wealth is held on the continent, and the number of millionaires is expected to increase by 42% in the next decade, according to the latest 2023 Africa Wealth Report, published by Henley & Partners in partnership with New World Wealth.

The wealth growth rate of Mauritius, which spans just 2,040km2, is expected to increase by 75% in the next decade. This will make the tiny nation’s growth rate in the number of millionaires the fourth-highest in the world after Vietnam, India and New Zealand.

The report reveals that Africa’s “Big 5” private wealth markets – South Africa, Egypt, Nigeria, Kenya and Morocco – account for 56% of the continent’s high-net-worth individuals and more than 90% of its billionaires.

There are 138,000 high-net-worth individuals with private wealth of $1-million (R17.8-million) or more living in Africa, along with 328 centimillionaires (worth $100-million or more), and 23 dollar billionaires.

South Africa has at least twice as many high-net-worth individuals as any other African country, and 30% of the continent’s centimillionaires. It is ranked 30th in the world for its number of high-net-worth individuals, ahead of major economies such as Indonesia, Malaysia and Thailand.

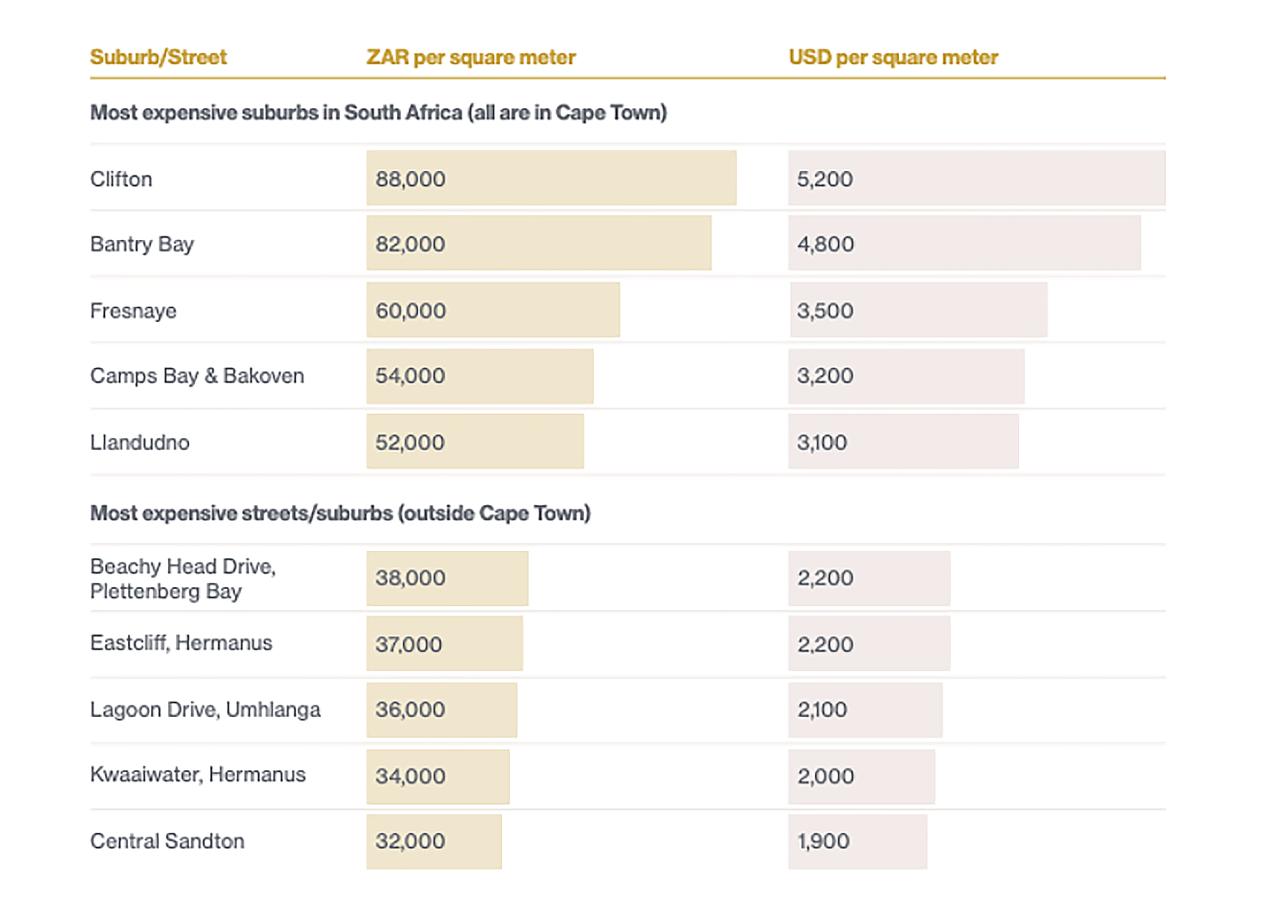

A little more than 40% of South Africa’s million-dollar homes are located in the “Prime 7” suburbs of Cape Town: Bantry Bay, Bishopscourt, Camps Bay, Clifton, Constantia, Fresnaye and Llandudno. Mauritius is Africa’s big success story. It is now home to about 4,900 high-net-worth individuals, compared with less than 3,000 a decade ago.

Not only does it have glorious beaches, nature, scenery and weather, but the island nation also has a fast-growing financial services sector and stock market, and is highly respected thanks to the country’s strong democracy and political stability.

Mauritius is ranked first in Africa and 13th worldwide in the World Bank’s 2020 Ease of Doing Business Report (no newer editions available). Mauritius has low taxes, which encourages entrepreneurship and appeals to retirees, as there is no estate duty nor capital gains tax in Mauritius.

It ranks as the safest country in Africa and is among the 20 safest countries on Earth. In 2020, the World Bank officially classified Mauritius as a high-income country, and it has prime property in exclusive residential areas.

Namibia is expected to see private wealth growing by more than 60% in the next decade, driven by the recent launch of its “golden visa” (residence by investment offering), which is likely to attract high-net-worth individuals from around the world.

Catherine Shipushu of the Namibia Investment Promotion and Development Board says the country – which has a population of 2.5 million people inhabiting 825,615km2 – is known for its vast spaces and airy experiences away from the fast life.

Namibia also has one of the largest uranium reserves in the world and its recent discoveries of gas and oil reserves are attracting international attention.

“For the discerning traveller, Namibia offers a plethora of exquisite sights and exhilarating activities, from sand dunes plunging down to the Atlantic Ocean at Sandwich Harbour, to the world’s second-largest canyon – the Fish River Canyon – to unforgettable stargazing experiences in the NamibRand Nature Reserve, the first African location to obtain International Dark Sky certification,” Shipushu says.

Namibia has also positioned itself as a lucrative investment destination, endowed with abundant natural resources, including diamonds, uranium, copper and gold.

“With bold ambitions of becoming the sustainable energy capital of Africa, Namibia’s strategic location and world-class port make it an ideal gateway to over 300 million people in other African markets.

Dominic Volek, group head of private clients at Henley & Partners, says more African countries are setting their sights on attracting high-net-worth individuals by providing residence and citizenship by investment opportunities that have the potential to transform their economies.

“As wealth grows on the continent, we expect to see investment migration continue to gain ground in Africa – not only on the demand side from African high-net-worth individuals looking to improve their travel freedom and economic mobility, secure location optionality and mitigate risk, but also on the supply side, with more and more African nations looking to launch their own programmes to increase the inflow of capital and talent.

Volek said the investment migration sector has been on a growth trajectory for the past 25 years, but the surge in Africa is a relatively new phenomenon.

Henley says it has seen a significant spike in interest in residence- and citizenship-by-investment globally, with a 46% increase in inquiries in 2022.

Africa is a growth market, with 23% more inquiries coming in over the past year. South Africa, Nigeria, Egypt and Algeria were among the 20 most inquired-after nations last year.

“In the first two months of 2023 alone, we had already received 27% of the total 2022 inquiries.

This trend will no doubt continue throughout the year as wealthy African investors focus on diversifying their domiciles and building a complementary portfolio of residence permits and citizenships to secure greater global access and optionality in order to mitigate unrelenting market and political instability.

The top three programmes chosen by African families in 2022 were the Portugal Golden Residence Permit, the St Kitts and Nevis Citizenship by Investment, and the Antigua and Barbuda Citizenship by Investment. The report notes that wealth is a far better measure of the financial health of an economy than GDP.

It identifies the key drivers of wealth as: Strong safety and security: The safety levels in a country and the efficiency of the local police are probably the most critical factors in encouraging long-term wealth growth.

New World Wealth’s in-house safety index for 2022 ranks Mauritius as the safest country in Africa, followed by Namibia. Tax rate: The UAE, Mauritius and Singapore are examples of the power that competitive tax rates can have in encouraging business formation.

Growth in key sectors: Most industries boost GDP, but few boost wealth. Generally, only industries that bring foreign exchange into a country help to build its wealth.

Notable examples include export sectors such as tech, mining and manufacturing, as well as tourism sectors such as luxury hotels and lodges. Wealth migration: The migration of high-net-worth individuals to a country increases foreign exchange inflows, boosting wealth growth.

Well-developed banking systems and stock market: This ensures that individuals invest and grow their wealth locally. On this count, Kenya, Mauritius and South Africa all score highly.

Robust ownership rights: Zimbabwe is a case study of the consequences of taking away people’s legal rights of ownership. Once assets are stripped, they tend to devalue and potential investors are no longer willing to risk investing in a country.

Media freedom: It is vital for major news outlets in a country to be neutral and objective. A well-developed financial media is especially important as it helps to disseminate information to investors. South Africa scores strongly in this aspect.

For More News And Analysis About Mauritius Follow Africa-Press