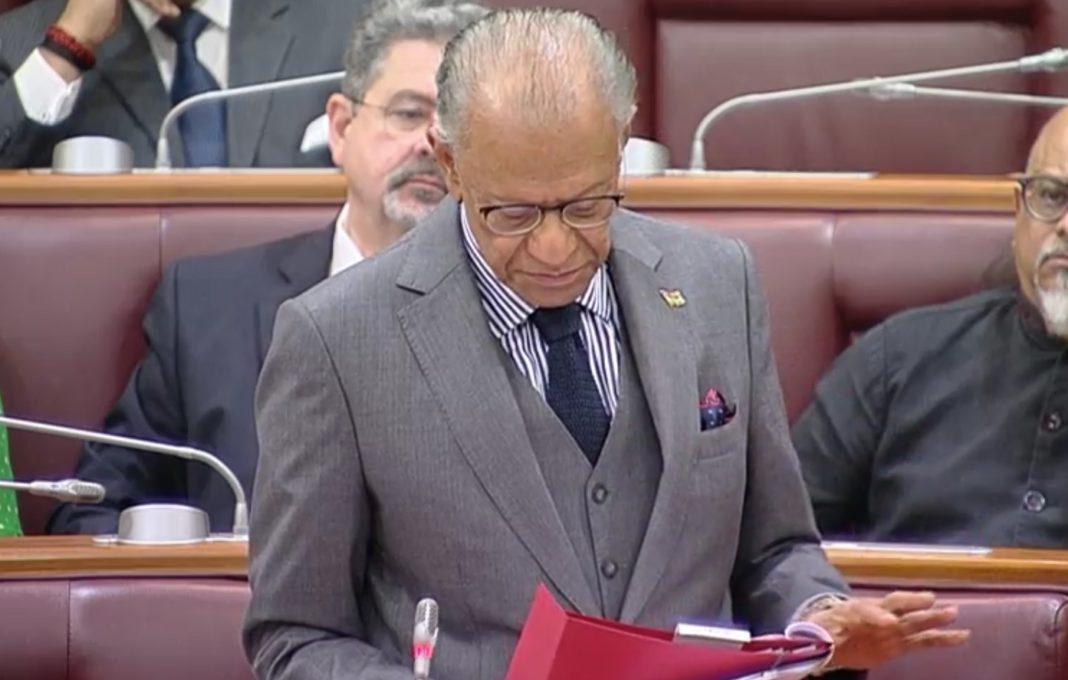

Africa-Press – Mauritius. Facing a worrying economic situation marked by a depreciating rupee and persistent inflation, Prime Minister Navin Ramgoolam detailed concrete measures taken by his government to revive the economy and restore financial stability. His statement, in response to a parliamentary question, outlined a two-pronged approach encompassing monetary and fiscal policies.

The Bank of Mauritius (BOM) has issued strict directives to banking institutions. All foreign exchange transactions must now be conducted through BOM-licensed entities to prevent any parallel market activity that could worsen the rupee’s decline. The Prime Minister stressed the importance of fair and transparent banking practices.

On the monetary policy front, the government points to the February 2025 increase in the Key Rate from 4% to 4.5% as a key step. The BOM is committed to working closely with banks to ensure adherence to regulations and transparency in all financial operations.

In addition to monetary measures, the government is relying on budgetary measures announced in the 2025/26 budget to stimulate the economy and lessen the burden on households. These include fuel price reductions, targeted price controls on essential goods, and the removal of VAT on certain essential food items.

Prime Minister Ramgoolam criticized the previous government’s economic management, referring to it as a “monetary illusion,” specifically citing excessive “money printing” to finance budget deficits. He stated that Rs 180 billion was injected into the banking system to cover government spending, directly contributing to the rupee’s devaluation. He reiterated the government’s commitment to rectifying the economic situation.

For More News And Analysis About Mauritius Follow Africa-Press