Africa-Press – Mauritius. As the October 1 deadline approaches, when the European Union (EU) decides whether to place Mauritius on the blacklist of high-risk jurisdictions for money laundering and terrorist financing, the Government is struggles to remedy certain shortcomings in our laws and correct certain management practices in regulatory and supervisory institutions.

Is there a real political will to fight fraud, corruption and money laundering? Looking at the proceedings in several areas (institutional, legal and diplomatic), there is a certain frenzy in the action to present the Mauritian case before the crucial meeting.

After the laissez-faire of the past two decades, the impression is given that there is a cookie-cutter regulatory approach to respond to all of the charges against the Mauritian jurisdiction.

However, it is not simply a question of putting a little order where everything is going adrift; it is necessary to assume the fight with all the force of the law and -displicinaries available for investigative purposes and all the resources required to track down, prosecute and convict white-collar crimes in the financial (banking and offshore) and non-financial (real estate, betting operators, casinos and gambling sectors, jewelry, etc.

). Strategic deficiencies

Technically, the country still has five efficiency criteria to meet on a list of 58 criteria drawn up by the Financial Action Group (FATF-FATF) of the OECD to assess the effectiveness of our anti-money laundering system.

‘money.

Will the new legal measures taken as part of the Anti-Money Laundering and Combatting the Financing of Terrorism (Miscellaneous Provisions) Bill 2020 (AML-CFT) convince the EU of our desire to remedy the shortcomings strategies of the anti-money laundering system? In its decision-making, will the EU stick only to the AML-CFT law or will it also be interested in what is happening in the financial sector in general in terms of capital movements? and governance?

Recently there has been information published in the foreign press about holding companies that have been incorporated into our offshore business to do shady business through subsidiaries based in Europe.

For example, Ayanda Capital Ltd, based in London but owned by a holding company incorporated in Mauritius, had a £ 252.5 million contract to supply the British government with medical equipment without tendering.

The Good Law Project organization is asking for a judicial review of this contract awarded under an emergency procurement procedure. “This is not just about value for money, important as that is.

Transparent, competitive tendering is a crucial defense against cronyism and corruption ”, commented George Monbiot in The Guardian of July 15, 2020. IMF warning

In its bulletin Corruption and Covid-19 ’published on July 28, 2020, the International Monetary Fund (IMF) warns against corrupt practices in the context of measures taken by governments.

The IMF says: “First, governments around the world are playing a bigger role in the economy to combat the pandemic and provide economic lifelines to people and firms. This expanded role is crucial but it also increases opportunities for corruption.

To help ensure the money and measures are helping the people who need it most, governments need timely and transparent reporting, ex-post audits and accountability procedures, and close cooperation with civil society and the private sector.

” With good reason, the IMF emphasizes the need for transparency, ex-post audits and accountability for money spent.

With us, contracts for the supply of drugs and medical equipment for Rs 1.5 billion have been allocated without a call for tenders to local and foreign entities. There is a presumption of favoritism.

Will the ICAC, which has taken up the case, live up to its responsibilities this time around to dispel the gray areas? Instead of questioning the actions of policymakers, authorities persecute whistleblowers in state departments that spread scandals.

The Official Secrets Act is being used to hunt them down when there was a need for a Public Service Act to protect the right of public servants to issue whistleblowers.

Yet section 44 of the Prevention of Corruption Act 2002 requires a public body official to report any corruption he sees to the ICAC. The country is constantly under the watchful eye of international organizations that rate countries according to standards of good governance.

According to Transparency International’s corruption index, in 2019, Mauritius was ranked 56th out of 198 countries with a score of 52 out of 100, which places it in the middle of the ranking between clean countries (90-100) and corrupt countries ( 1-20).

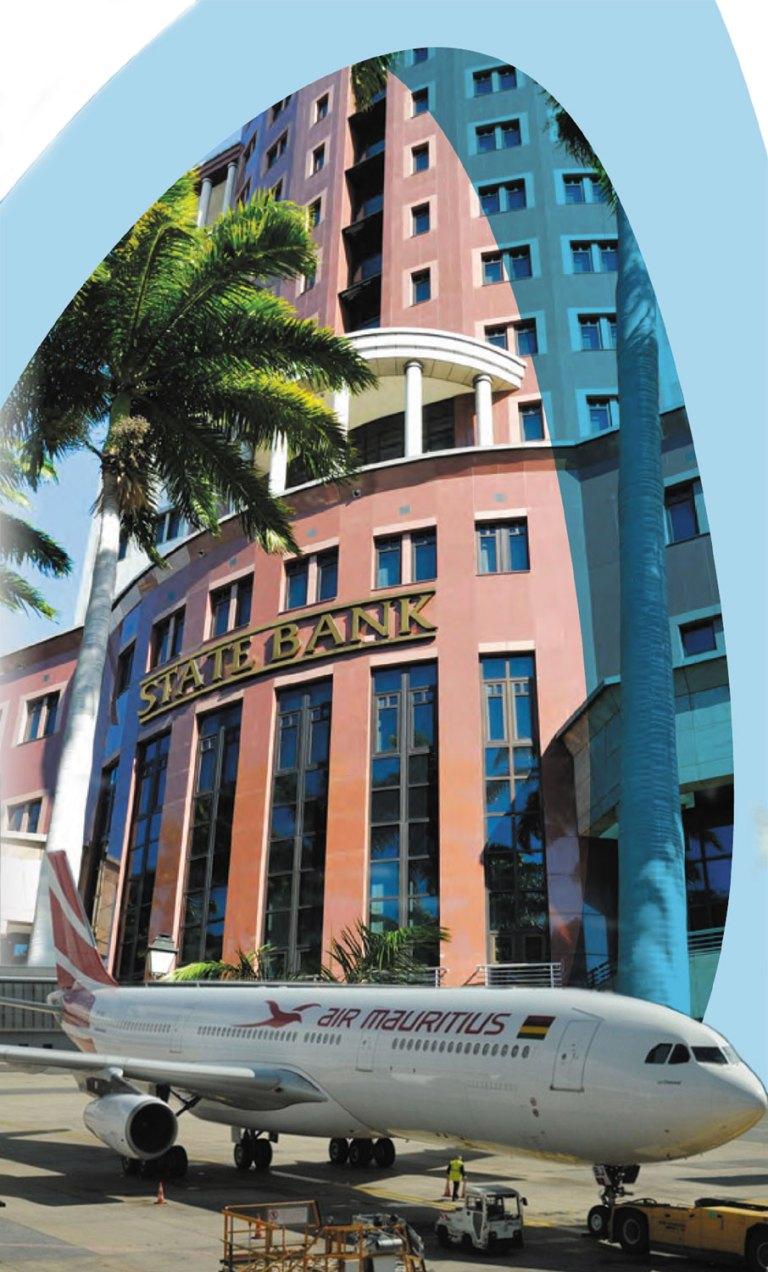

This Mauritius ranking precedes all cases involving alleged practices of fraud or corruption (Saint-Louis Gate, Covid-19 contracts awarded without a call for tenders) or mismanagement practices (SBM, Air Mauritius, STC) which have all have a relationship with foreign stakeholders (suppliers, clients-borrowers).

For its part, Amnesty International is monitoring the anti-democratic drifts in the wake of the Covid-19. The International Consortium of Investigative Journalists (ICIJ) is monitoring developments in the offshore sector with the recent Mauritius Leaks and the Ayanda Capital and Wirecard cases (German firm accused of fraud committed from a fund in Mauritius).

New tip The Government has discovered a new trick to dodge embarrassing questions in parliament: to refer a case to the ICAC and put it on hold until the public forgets it, so many scandals are so similar.

We are impatiently awaiting the conclusion of so many investigations. The country’s reputation for cracking down on corruption depends on the efficiency of the ICAC.

However, for the past two years, nothing has been heard from the Task Force set up under the aegis of the ICAC to implement the report of the Lam Shang Leen Commission of Inquiry into drug trafficking.

The lawyers whose names are mentioned there contest the report in court. There is also a perception that professional orders of lawyers, accountants and notaries often display corporatism.

It is essential that they call to order the black sheep of the profession who endorse suspicious acts, dubious financial arrangements or shady land transactions.

It is not only the movement of capital in the offshore sector, including funds of dubious origin invested in shell companies, that are calling on foreign authorities.

In terms of legal and financial framework, there are also all these financial institutions (SBM, MCB, AfrAsia), regulatory institutions (FSC, BOM) and monitoring / control institutions (ICAC, Integrity Reporting Agency) which attract the attention by their respective roles and the way they perform their task.

The banks SBM, MCB, AfrAsia are all involved in loans granted to the NMC Healthcare company of Indian businessman B. R. Shetty, declared insolvent in the United Arab Emirates. Apparently, the BOM recommended changes to the credit committees or boards of directors associated with this transaction. Willpower test

A first test of the will to clean the Augean stables in financial institutions will take place today during the annual general meeting of the SBM, whose directors will be called upon to explain themselves to the shareholders on the scandals that have splashed this state banking flagship.

The profits of the SBM fell from Rs 2.6 billion in 2017 to Rs 15 million in 2019 while the provisions for bad debts (unpaid loans) are Rs 3 billion in 2019. The unsecured loan of Rs 1, 7 billion granted to NMC Healthcare has a lot to do with it.

It is not enough to replace members of the boards of directors of SBM Group companies with others; it is also necessary to prosecute all those who have sinned by negligence or complicity for breach of professional duty.

The shareholders could have sued in court under section 160 of the Companies Act to hold them accountable. They did not do it. On the contrary, the former members of the boards of directors were transferred to other state institutions or subsidiaries of the SBM Group.

It’s a game of musical chairs for state nominees. If the SBM does not pull itself together to fundamentally change its credit and risk assessment practices, it is doomed to failure like Air Mauritius.

Air Mauritius, under voluntary administration since April 21, suffered a financial crash that was predictable due to heavy losses linked to the purchase of planes.

The ex-directors, responsible for the disaster, left with “golden handshakes” as many employees are dismissed or forced to retire without a pension guarantee (the pension fund is in deficit).

The appointed directors have no magic recipe to turn the company around. The creditors’ meeting on December 7 could spell the end of the company unless the state injects Rs 10 billion into it.

Regulatory, the FSC is not as efficient as it gets with its haphazard audits that leave obscure companies moving into the offshore industry. Asset management companies are no more effective at detecting dubious funds that end up there.

When it comes to illicit enrichment, the investigation is not efficient either. The only time we heard about the Integrity Reporting Agency was when it laundered a tailor in a case of accumulated funds of Rs 10 million. The moment of truth has come for our institutions engaged in the fight against fraud, corruption and money laundering.

For More News And Analysis About Mauritius Follow Africa-Press