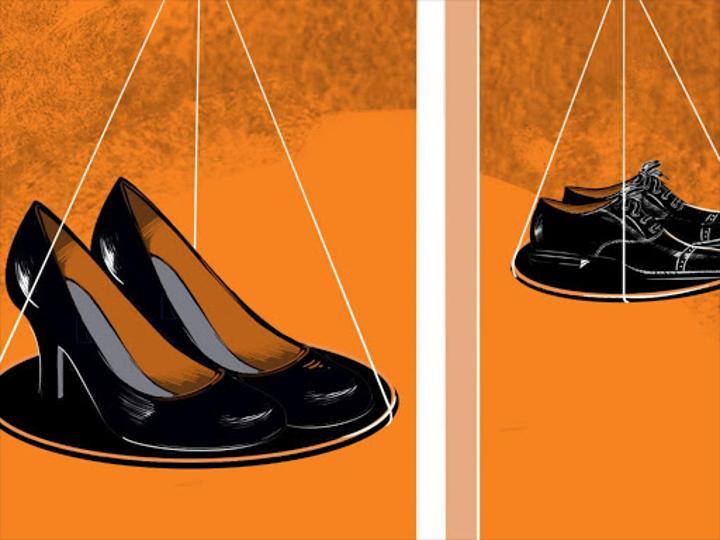

Africa-Press – Mozambique. Women still perceive a slightly higher level of gender bias than men when accessing financial services such as loans, a new study has said.

Conducted by the digital lending firm Tala, the survey notes that out of the sample groups surveyed countrywide, 65 per cent of women respondents rated gender bias in financial services at ‘moderate’ to ‘extreme’.

Generally, the majority of both men and women perceive some level of gender bias in the sector.

However, more men reported no gender bias, 58 per cent of them saying financial services cater to the needs of all genders equally.

Notably regarding access to credit, 64 per cent of women respondents reported experiencing challenges accessing financial services.

As a result, 56 per cent of them said they found it tough to finance their businesses.

The majority of the male respondents however said it is ‘very easy’ to finance their businesses. Only seven per cent of women reported the same.

On the contrary, 62 per cent of respondents said gender does not impact getting a loan.

Another notable trend is that slightly more men use a bank account regularly than women respondents, the report reads in part.

According to Tala’s general manager Annstella Mumbi, the continued perception of gender bias in accessing financial services has led more women, especially in emerging markets such as Kenya, to self-select themselves out of borrowing or even applying for credit.

“Should these numbers be anything to go by, as players in the credit market, we must intentionally equip our female customers with knowledge and skills to enhance their strategic business ability,” Mumbi said.

“Key focus areas include financial management, leadership and technology which will give them confidence to utilise financial services and unleash their financial power within the larger economy.”

As a player in the sector, Tala says it intends to use leading machine learning-powered infrastructure to harness the best of next-generation technologies to build trusted, real-world financial solutions for the global majority, and that includes women.

“We hope that our mobile-first financial platform makes a difference for millions of customers, providing instant access to capital and the financial tools they need to grow their income today and build wealth for tomorrow,” Mumbi added.

Nevertheless, the report provides a sneak peek of the country’s financial services use.

It notes that 50 per cent of women respondents consider taking a loan to start their business, but end up not doing so.

“Of the women entrepreneurs who have taken a loan for their business, 49 per cent report using it to purchase inventory or equipment, 25 per cent report for education, and 25 report using it to expand their space,” the report says.

The lender surveyed over 800 Kenyans to identify the challenges and opportunities faced by women entrepreneurs in emerging markets, especially regarding accessing financial services.

For More News And Analysis About Mozambique Follow Africa-Press