Africa-Press – Mozambique. The Mozambican civil society coalition, the Budget Monitoring Forum (FMO), has welcomed the decisions by US and British financial regulators to fine the bank Credit Suisse because of its deep involvement in the corrupt scheme, known as the “hidden debts”.

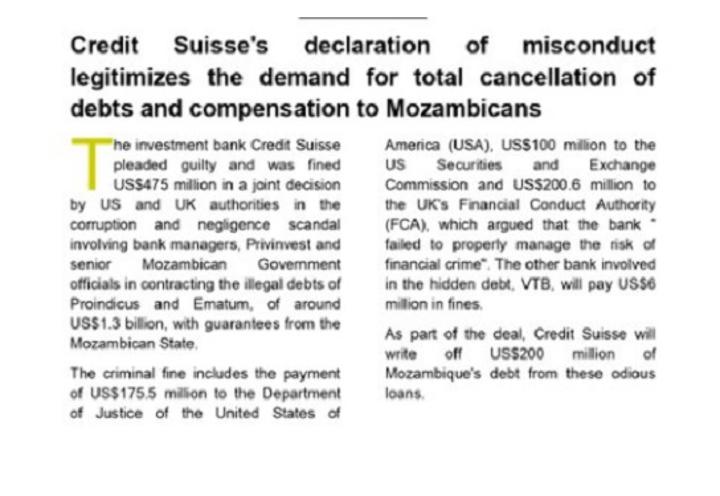

Under this scheme, three fraudulent companies, Proindicus, Ematum (Mozambique Tuna Company) and MAM (Mozambique Asset Management) obtained over two billion dollars in loans from Credit Suisse and the Russian bank VTB, on the basis of illicit loan guarantees issued by the Mozambican government of the day, under the then Presidenr Armando Guebuza.

The loans were riddled with corruption from the start. Three of the Credit Suisse bankers who negotiated the loans, Andrew Pearse, Detelina Subeva and Surjan Singh, confessed to a New York court in 2019 that they had taken enormous bribes from the Abu Dhabi based group Privinvest, which became the sole contractor for the three Mozambican companies.

The US Securities and Exchange Commission (SEC) announced on Tuesday that Credit Suisse had agreed to pay fines of around 475 million dollars – 99 million dollars to the SEC itself, a 175 million dollars fine imposed by the US Department of Justice, and over 200 million dollars to the British Financial Conduct Authority (FCA).

In a separate statement, the FCA added that Credit Suisse has agreed to cancel 200 million dollars of debt owed by Mozambique. There was nothing charitable about this gesture. Mark Steward, Executive Director of Enforcement and Market Oversight at the FCA, said “The fine would have been higher if not for Credit Suisse agreeing to provide the debt write-off of 200 million dollars”.

In its statement on the fines, the FMO said that Credit Suisse’s recognition of its illegal and negligent behaviour “strengthens the idea that the debts are odious and were never intended to benefit Mozambique”.

The FMO is thus continuing to push for a complete write-off of the debts “and for just compensation for the effects of the scandal”, – including the dramatic reduction in foreign investment and aid. When the true scale of the illicit loans became known, in April 2016, all 14 donors who used to give at least some of their aid as direct budget support suspended all further disbursement. Budget support has never resumed.

A study by the Public Integrity Centre (CIP) showed that, between 2016 and 2019, the “hidden debts” had cost Mozambique around 11 billion dollars, and this figure could rise to 16 billion, if Mozambique is obliged to continue repaying the debts.

For the FMO, the Credit Suisse admission of guilt is just a first step towards a full solution, involving the complete cancellation of the debts.

Denise Namburete, Executive Director of N’weti, one of the members of the FMO, remarked that the fine of 475 million dollars “is a drop in the ocean compared to the damage the hidden debts have inflicted on Mozambique”.

“The people of Mozambique had no say over and received no benefit from the loans”, she said. “We welcome the cancellation of 200 million of the two billion dollar debt, but all the hidden debts must be cancelled. We need justice for Mozambican people.”

Tim Jones, Head of Policy at Jubilee Debt Campaign in Britain said: “A 475 million dollar fine is small beer for a bank as large as Credit Suisse, while the failure to take virtually any action against VTB is baffling”.

“These fines do little to prevent a similar case happening again”, he warned. “We urgently need new rules in the UK and US to make the details of all loans to governments publicly available.”

Unlike Credit Suisse, VTB, a bank largely owned by Vladimir Putin’s government, did not even admit guilt, and even threatened to continue pursuing Mozambique through the British court for repayment of the loan.

VTB agreed to pay over six million dollars to settle its dispute with the SEC. In an arrogant statement given to the Portuguese news agency Lusa, VTB said it hoped to reach an “amicable solution” with Mozambique, but said nothing about cancelling the debt.

For More News And Analysis About Mozambique Follow Africa-Press