Africa-Press – Mozambique. Mozambique has been late in paying long-term, local currency (LC) commercial debt in 2023, owing to administrative shortcomings and liquidity flow mismatches.

As a result, we previously lowered the LC ratings on Mozambique to ‘SD’ in June 2023, before raising them to ‘CCC+’.

The government is implementing measures to avoid late payments and progress on fiscal consolidation is ongoing, but risks of further payment delays remain possible, in our view, stemming from potentially higher costs associated with wage reforms, elevated spending to address weather-related shocks, and risks of fiscal slippage in the run-up to 2024 elections.

We therefore affirmed our foreign and local currency ratings on Mozambique at ‘CCC+/C’, indicating that we continue to view the government’s ability to service commercial debt as weak until revenue from gas projects starts arriving. The outlook is stable.

Rating Action

On Oct. 20, 2023, S&P Global Ratings affirmed its long- and short-term local currency (LC) and foreign currency (FC) ‘CCC+/C’ sovereign credit ratings on Mozambique. The outlook is stable. At the same time, we affirmed our ‘CCC+’ transfer and convertibility assessment on the sovereign.

Outlook

The stable outlook reflects the balance between the still-lingering administrative shortcomings in Mozambique’s debt management and ongoing liquidity pressures against the more favorable medium-term growth prospects–driven by several major liquefied natural gas (LNG) projects–and the government’s fiscal consolidation plans that are supported by policies under an IMF program.

Downside scenario

We could lower the LC ratings over the next 12 months if we assess that further delays on LC debt payments constitute a selective default (SD) according to S&P Global Ratings’ Definitions. We could also lower the LC and FC ratings if we assess that additional economic or external shocks, or further delays to the large gas projects, are likely to make the government less willing or able to service its commercial debt obligations in a timely manner.

Upside scenario

We could raise the ratings if we were to expect government revenue to increase materially, perhaps due to a sharp rise in gas production, reducing the risk of further delayed payments to creditors or a distressed restructuring of Mozambique’s 2031 Eurobond.

Rationale

S&P Global Ratings expects Mozambique’s fiscal headroom to remain weak until production starts at large LNG megaprojects, weighing on its ability to make timely payments on domestic obligations. The government is undertaking reforms to lower its wage bill and implementing measures to improve treasury management and functioning of local debt markets, but we think fully resolving the payment delays will likely take time.

Without stated grace periods as per S&P Global Ratings’ Definitions, which we understand is the case with Mozambique’s LC debt, we will lower the ratings to ‘SD’ if payments come more than five business days after the due date. From February-May 2023, the sovereign repaid LC long-term debt on average nine days late; in some instances, payments were up to three weeks late (for more information, see “Mozambique LC Ratings Temporarily Lowered To ‘SD’ On Delayed Payments; ‘CCC+’ FC Ratings Affirmed,” published June 20, 2023, on RatingsDirect).

Institutional and economic profile: Near-term public financial management challenges are significant, but long-term economic potential is large, underpinned by the planned sizable LNG projects

Institutional strength and capacity remain weak, underpinning our expectation that further debt payment delays are possible. This is seen in a weak track record in debt repayment with restructurings in 2016 and 2017, which we considered tantamount to defaults (for more information, see “Republic of Mozambique Foreign Currency Sovereign Ratings Lowered To ‘SD/D’ On Announced Debt Exchange Offer Results,” published April 1, 2016; and “Mozambique Foreign Currency Ratings Lowered To ‘SD/D’ On Missed Payment,” published Jan. 18, 2017), and late payments on LC debt in 2023.

The Ministry of Economy and Finance is implementing public debt management reforms through streamlining and improving cash management across and within departments, consolidation of cash balances, and increasing communication and engagement with local market participants. Also guiding overall policy is a $456 million IMF Extended Credit Facility program, which aims to support an economic recovery and reduce public debt and financing vulnerabilities.

Gains from these efforts will be gradual and risks of fiscal slippage through the current election cycle are high, in our view. Mozambique held municipal elections in October 2023 and is set to hold general elections in October 2024. We expect the government’s ability to significantly reduce public wages, and spending more broadly, as limited during this period, given high unemployment, particularly among the youth, and weak socioeconomic conditions outside of large cities. The risks of unrest and insurgency could also remain prevalent due to persistent social pressures.

While policy continuity is likely, remaining centered on reducing debt vulnerabilities, succession within the ruling Frente de Libertacao de Mocambique (Frelimo) is unclear. Filipe Nyusi was reelected as party president at the September 2022 congress, and it appears unlikely that constitutional changes will happen that would enable him to serve a third term. Frelimo has yet to appoint a 2024 presidential candidate.

In the long term, Mozambique’s fiscal and economic prospects could improve substantially on major gas export potential. The country’s natural gas reserves are large, estimated at 160 trillion cubic feet, and production started in November 2022 from the Coral South floating LNG (FLNG) platform, which has capacity of 3.4 million tons per year.

More significant economic prospects hinge on the $20 billion Area 1 project led by TotalEnergies SE, which we expect could restart in first-quarter 2024. The project has capacity of 13.1 million tons per year, but the project has been under force majeure following Islamist insurgency attacks in April 2021. We understand the security situation has improved markedly over the past year, assisted by Rwandan and Southern African Development Community military support, while economic activity in the city of Palma (near the Area 1 gas field) has improved as the population returns. We think the project could be finalized in late 2027 and production start in 2028. An investment decision remains delayed on Exxon Mobil Corp.’s $30 billion gas project in Area 4 fields (next to Area 1 fields) because of security concerns in Cabo Delgado. We do not expect a decision before TotalEnergies resumes Area 1 activity because ExxonMobil is looking to draw synergies from that project in terms of security and onshore infrastructure. This will be the largest project, with an estimated production capacity of 15.2 million tons per year.

We forecast economic growth at 4.8% in 2023, increasing to an average of 5.5% in 2024-2026. Growth will be fueled by higher consumption, as significantly lower inflation improves consumers’ purchasing power; and large foreign direct investment into the TotalEnergies Area 1 project. Growth will also receive support as Eni SpA’s Coral South platform in Area 4 reaches full capacity and will also benefit from coal, heavy sands, and aluminum production.

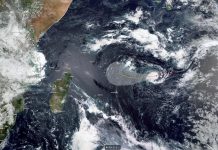

We view Mozambique’s susceptibility to climate change risk as high, and increasingly erratic weather poses continued economic risks. The country’s north has experienced damage from multiple cyclones since 2019. Most recently, Mozambique was hit by a large cyclone in late February and early March 2023. The country’s south also experienced flooding in that time. Agriculture is the largest contributor to GDP, at just under 25% of GDP.

Flexibility and performance profile: Debt service capacity to remain weak on sizable public and external debt.

Mozambique’s fiscal and public debt position will remain key rating weaknesses until the government starts benefiting from potential revenue from the large gas projects in 2028. The general government fiscal deficit has narrowed in the past two years as extraordinary pandemic-related spending has moderated, but liquidity challenges became acute in 2023 due to fiscal slippages and spending related to weather shocks. Public sector wage reforms began in fourth-quarter 2022 but cost overruns in implementing the reforms have already been sizable. The government had forecast public sector wages to amount to about 52% of government revenue in 2023, but preliminary data shows wages amounting to close to 67% of revenue in January-August 2023. These pressures have resulted in substantial drawdowns of general government liquid assets, to approximately 12.4% of GDP currently from 23.7% of GDP at end-2022.

We forecast the general government deficit to narrow only marginally in 2023 to 4.5% of GDP from 4.6% in 2022, then gradually decrease to 3.6% by 2026. The government expects a significantly narrower deficit of 0.9% of GDP in 2023 and fiscal surpluses averaging 1.4% through 2026 on rising revenue from FLNG and significant expenditure restraint. We think some consolidation will happen through 2026 but more significant improvement in fiscal metrics will only materialize once TotalEnergies’ gas project begins production, which is beyond our forecast horizon.

In our view, delays to payments on domestic debt could persist, given constrained fiscal headroom and elevated local bond redemptions. We estimate LC principal bond redemptions in 2023 and 2024 at about Mozambique metical (MZN) 20.1 billion ($310 million; 1.7% of GDP) per year, and for this to rise significantly to an average of MZN36.4 billion ($530 million; 2.2% of GDP) in 2025 and 2026. Total domestic debt accounted for 23% of GDP at end-June 2023, of which short-term treasury bills outstanding are estimated at MZN70.5 billion ($1.1 billion; 5.4% of GDP).

We expect external commercial debt servicing costs, which are currently low, to rise. The government has started repaying the coupon on its 2031 Eurobond, which stands at 5% ($47 million per year) and will rise to 9% ($81 million per year) from 2024-2028, thereafter decreasing as the bond starts amortizing. Amortization will amount to $225 million per year from 2028-2031.

Mozambique’s increasing access to concessional financing sources could provide some relief from 2024 onwards. The signing of the three-year IMF program in May 2022 was followed by a return of multilateral funding on concessional terms from other institutions–the government anticipates it will receive $300 million in budget financing from the World Bank in 2024. This could reduce the government’s reliance on more costly domestic markets to finance its deficit.

The government also plans to reduce the share of domestic financing to 45% by 2026, by making increasing use of concessional external financing while lengthening the maturity profile of domestic debt (which stands at just over six years) and lowering debt servicing costs. It has had some success after issuing 10-year local government securities in July and September 2023 at lower yield to maturities than existing five-year bonds. Nevertheless, the domestic market will remain a key source of financing, which we forecast will raise interest servicing costs to 13.2% of general government revenue in 2026 from 10.6% in 2022.

We believe banks’ appetite and ability to purchase government securities will gradually improve again after the sharp increase in reserve requirements in January and May 2023 reduced banks’ liquidity. Banks remain highly exposed to the government, with total exposure to government typically constituting over 20% of banking sector assets.

Contingent liabilities are large as government guarantees totaled 10% of GDP ($1.8 billion) at end-2022, but risks of these crystalizing on the government’s balance sheet have decreased. Most of the guaranteed debt has been extended to national oil and gas company Empresa Nacional de Hidrocarbonetos (ENH). ENH’s assets and liabilities have been placed in special purpose vehicles, with the company’s share of revenue from LNG projects being ringfenced for repayment of its debts. We understand that the Coral South FLNG and TotalEnergies’ Area 1 projects have long-term purchase agreements with gas buyers, which will assist in revenue generation for ENH to repay its loans.

We also include the $1.2 billion external commercial loans contracted by the Mozambique Asset Management Co. and Proindicus in our calculation of general government debt, while the government considers them contingent liabilities. The government and UBS have reportedly reached an out-of-court settlement for a loan that Credit Suisse made to Mozambique in 2013 (UBS acquired Credit Suisse in March 2023). This could reduce the general government’s debt stock, although details of the agreement are not available. Still, our debt service cost forecasts are not likely to change as the government has not paid these loans for multiple years. The remaining loans are subject to litigation in international courts and were reported to be guaranteed by the government. Without access to the guarantee documentation, we are unable to opine on whether these loans constitute financial obligations of the Mozambican government under our ratings methodology, and consequently whether the guarantor’s failure to honor payment under the purported guarantees constitutes a default on its financial obligations.

External imbalances will moderate temporarily in 2023, but will rise sharply in 2024-2026 as import requirements for the LNG megaprojects increase. The current account deficit is forecast to narrow to 13.3% of GDP in 2023 from 34.2% in 2022, but we forecast it will then average 34.2% through 2026. The large narrowing of the deficit in 2023 is propelled by receding imports following the completion of the Coral South Floating LNG project in 2022, increasing LNG exports from the project as production ramps up; and lower supply of dollars by the Bank of Mozambique (BoM; Mozambique’s central bank) to meet imported fuel requirements. Foreign exchange reserve levels therefore improved to $3.2 billion at end-June 2023 from $2.8 billion at end-2022.

From 2024, the large current account deficit will be mostly funded by foreign direct investment to develop the large gas projects along with concessional government financing. After two years of currency stability, we anticipate the exchange rate to begin depreciating from 2024 as current account deficits widen materially. Exchange rate stability since early 2021 reflects a relatively stable supply of foreign currency in the interbank market. However, a deteriorating external position would likely lead to the exchange rate weakening.

The BoM operates a managed float regime but has significantly cut its interventions since 2021. We understand that the BoM sold $120 million in 2021 but has refrained from intervening over 2022 and 2023. Furthermore, it has stopped supplying hard currency for fuel imports, significantly reducing foreign currency availability for the economy.

The BoM could begin loosening policy in 2024 following a substantial reduction in inflation in recent months. Inflation moderated to 4.6% in September 2023 from a peak of 13% in August 2022 after the BoM increased its policy rate by 400 basis points since July 2021 and raised the mandatory reserve requirements twice in 2023 (to 39% and 39.5% from 10.5% and 11.5% for liabilities in local and foreign currencies, respectively, to absorb excess liquidity in the system). At the latest monetary policy committee held in September 2023, the monetary policy interest rate stayed at 17.25% as the committee noted risks to inflation remaining on the upside.

Mozambique’s benchmark interest rate remains one of the highest in sub-Saharan Africa, limiting credit access among domestic borrowers. We think the tight monetary policy stance might face challenges due to fiscal dominance and the adverse risks that heightened real interest rates could pose for the government’s debt servicing costs. Credit to the private sector in Mozambique is forecast to stand at 24.3% of GDP at end-2023, much below the sub-Saharan average of 38%. Nonperforming loans stood at 10.4% of total loans in March 2023, up from 9% at end-2022.

The banking sector is dominated by well-managed South African and Portuguese banks and is well capitalized to weather tight credit conditions. Therefore, we think contingent liabilities from the banking sector are limited.

For More News And Analysis About Mozambique Follow Africa-Press