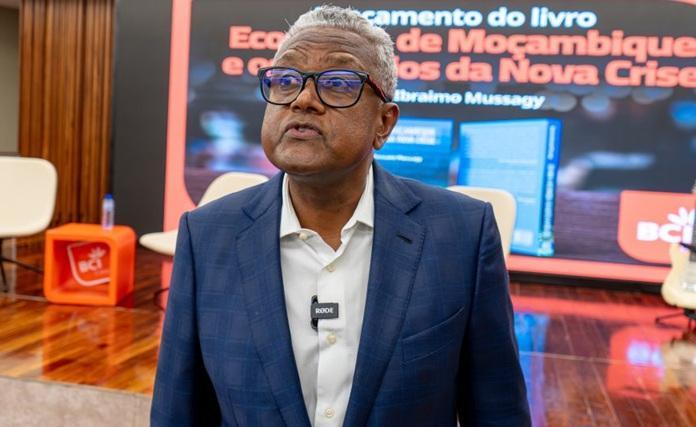

Africa-Press – Mozambique. Omar Mithá, economist and Chairman of the Board of Directors of BNI, delivered one of the most incisive speeches during the launch of the second edition of Economia de Moçambique e os Desafios da Nova Crise (‘The Economy of Mozambique and the Challenges of the New Crisis’) by Ibraimo Mussagy. For Mithá, the book’s contribution is particularly relevant at a time when the Mozambican economy faces deep vulnerabilities and an urgent need to strengthen credibility, competitiveness and institutional trust to attract sustainable financing.

The context: a book launch turned economic diagnosis

Omar Mithá’s intervention took place at the public ceremony presenting the book, attended by academics, economists, public managers and government officials. The event quickly became a forum for assessing the economic situation, and it was in this setting that the BNI Chairman framed his concerns about the country’s trajectory.

Mithá openly praised Ibraimo Mussagy’s contribution, stating that the book arrives at a moment when “we must look at the economy without illusions, with rigour and based on evidence.” He said the work offers a clear diagnosis of accumulating vulnerabilities and highlights the urgency of structural reforms.

Crisis shaped by internal and external shocks

Omar Mithá began by emphasising that current problems are not merely cyclical, nor the result of a single shock. The crisis the country faces is the outcome of a combination of internal factors — inconsistent policies, currency fragility, low productivity — and external ones — pandemics, climate shocks and international volatility.

“We are facing internal and external shocks that affect the economy — from adverse weather and Covid, to macroeconomic management and exchange rate policy. All of this impacts prices, inflation, income and may cause recession.”

This perspective directly dialogues with Mussagy’s book, which analyses the interaction between structural and cyclical factors in the formation of the new economic crisis.

The economy cannot finance itself without credibility

The most incisive point in Mithá’s intervention was his assertion that Mozambique critically depends on the credibility and trust of markets to finance its development.

“The country can only finance itself if it is credible, competitive and able to attract external savings. And in a world with strong competition, capital goes where there is trust.”

Here, the economist reinforces one of the central arguments in Mussagy’s work: economic stability is not built solely on political will, but with strong institutions, fiscal coherence and regulatory predictability.

A book that demands intellectual honesty

Mithá highlighted that Mussagy’s work “forces reflection,” valuing the fact that the author directly confronts sensitive issues such as poverty, informality, currency fragility, public debt, structural inequality, SME vulnerability and dependence on primary exports.

For the BNI Chairman, the merit of the work lies in not softening the diagnosis. The book, he said, “shows the country as it is, not as we would like it to be,” enabling decision-makers, academics and businesspeople to work on real problems rather than artificial perceptions.

Currency instability and systemic vulnerability

The economist further explored the theme of currency instability, stating that it reflects broader weaknesses in the economic model. The Mozambican economy is highly dependent on essential imports, meaning any pressure on foreign exchange results in increased domestic prices.

This phenomenon, Mithá argues, compromises business competitiveness, cost predictability and the security of productive investments.

Ibraimo’s Mussagy’s book elaborates precisely on this vicious circle, showing how instability, debt and low productivity mutually reinforce each other.

Public debt: the silent risk

Another convergence point between Mithá and the book is the growing risk of public debt. The economist considers the trajectory of internal and external debt one of the main factors of the country’s vulnerability — because it reduces fiscal space, raises financing costs and limits the State’s capacity to implement policies supporting the productive sector.

The book discusses this issue exhaustively, presenting it as a critical obstacle to economic sustainability.

Paths to a stronger future

In concluding his intervention, Omar Mithá stated that the country needs to see the current crisis as a turning point. Structural reforms, fiscal discipline, greater economic diversification and strengthened governance are conditions for regaining confidence and attracting capital.

For the economist, Mussagy’s book is a relevant intellectual contribution to start — or deepen — that debate.

By contextualising the country’s economic fragilities and directly linking them to the structural themes analysed in Ibraimo Mussagy’s book, Omar Mithá reinforces a central message: Mozambique will only be able to finance its development if it restores credibility, strengthens institutions and adopts reforms that promote competitiveness and trust. The warning is simultaneously a diagnosis and an agenda for the future.