Africa-Press – Namibia. AT the end of the month, when government workers receive their payslips, a small line towards the bottom of the document connects everyone – from cleaning staff to senior government officials – to the richest companies in the world.

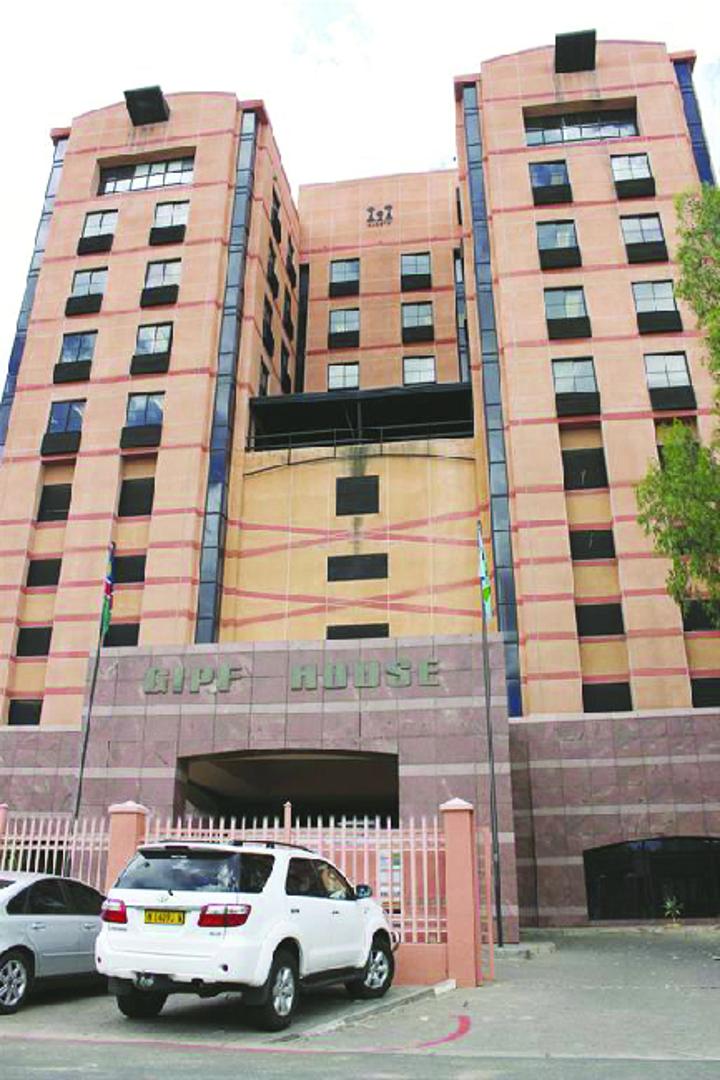

These monthly deductions are towards the Government Institutions Pension Fund (GIPF), the largest investment fund in the country, valued at N$136,2 billion, with shares in over 700 companies all over the world.

Those shares, in turn, mean that everyone who contributes to the fund owns a tiny part of automakers, diamond mines, casinos, movie makers, and even Silicon Valley.

The fund’s seemingly simple mission is to take monthly retirement contributions from workers, invest them wisely, and pay out pensions upon workers’ retirement. The government’s 101 000 employees each pay 8% of their salary, and the government matches that with an amount equal to 16% of their salary.

“The money contributed needs to be invested wisely to be able to pay out the promised benefits to these members and their dependants upon retirement,” says PSG Namibia’s former head of research, Eloise du Plessis.

“That is the only responsibility of the GIPF.” If the fund were to deposit all contributions into a bank account, and then pay them out later, it could run out of money. MANAGING RISKS

The fund’s managers have to consider various risks, such as inflation. An individual who starts working at the age 25 would pay a lot more for a loaf of bread in 35 years when she retires than now.

The population’s age is another factor to consider. Currently, Namibia has more young people than pensioners, but in the future these young people will retire and would need to be paid pensions.

There are additional concerns, such as the global economy and possible financial crises, such as the one in 2008. In order to manage risks, the fund invests in different ways. It buys government bonds, among others. The treasury is legally required to repay this money with interest.

Some of the fund’s money is invested in giant, global corporations, which is also seen as a safe investment, like government bonds. This means the GIPF owns shares in companies like Toyota, Google, and Microsoft.

Of course, companies that seem ‘safe’ today may not be in the same position tomorrow. The fund has sold its N$3,5 million shares in Nokia, which once looked positive, for example.

Now it has shifted money to newer companies, like Zoom, betting on office workers continuing to video conference after the Covid-19 pandemic ends. The pension fund’s biggest shareholding is a N$3,2 billion stake in South Africa’s Naspers Limited, which owns MultiChoice and News24.

Its money is, however, spread around the world, from Air Canada to De Beers to Samsung. More than 50 companies and individuals manage the fund’s investments, including Namibians, but also managers in Dubai, South Africa, the United Kingdom, and the United States.

They’re paid a percentage of the money they manage, which adds up fast. Their payouts totalled N$1,2 billion in the last two years alone. THE BRAND Since the fund was founded in 1989, its assets have grown larger than the national budget.

For the last three years, the value has been averaging to at least 70% of what the country produces in total. That kind of money draws attention. Last year, former prime minister and defence minister Nahas Angula said he knew there was corruption at the fund during his time in office.

Investment decisions for GPIF and all other pension schemes are overseen by the Namibia Financial Institutions Supervisory Authority (Namfisa) to prevent meddling.

Some argue that the fund’s money could be better spent by meeting the country’s immediate needs, and not necessarily the future needs of retirees. Windhoek mayor Job Amupanda believes the fund should finance housing developments.

“GIPF is an instrument in the hands of the elites, operating like missionaries operated in telling our people to wait for imaginary rewards in heaven while suffering on earth,” he said earlier this year.

“The point remains that our people must access housing now, directly from their pension – not when they turn 60 years old.” Despite its massive pockets, the GIPF has invested not more than N$2 billion into housing, one of the country’s biggest problems.

Namibia’s current housing backlog amounts to over 100 000 houses, while almost one million people live in informal settlements. The GIPF has invested in housing, as well as in farms in the Zambezi region, and Grove Mall in Windhoek.

Other local investments included textbook publishing, solar power, hospitals, and countless residential flats and commercial apartments. The fund also has a stake in civil servants’ microlending friend Letshego Namibia.

These investments form part of what the fund calls its ‘development investment policy’, but not all investments bear fruit. SCANDALS AND CONFLICTS The GIPF’s reputation is still stained by the millions it has lost in the Development Capital Portfolio scandal around 2010.

This scandal, in which over N$600 million of civil servants’ money was invested in questionable deals, led to the ousting of former GIPF chief executive officer Primus Hango.

The government’s reliance on the fund to buy its bonds essentially makes the GPIF a major lender to the treasury. That situation is reinforced by requirements for the fund to invest a major portion of its money locally, and bonds are one of the most readily available local investments.

Then there’s conflicts of interest. Ninety One Asset Management (previously known as Investec Namibia ) has the largest slice of the GIPF pie in Namibia, valued at N$15,3 billion.

Much of that came when James Hatuikulipi was Investec’s managing director, who is currently in prison in connection with the Fishrot corruption scandal.

Former minister of finance Calle Schlettwein pushed for an investigation into alleged favouritism between Investec Asset Management Namibia and trustees at the GIPF after the arrest of two of the investment entity’s bosses.

BIG COG Because the GIPF is making payments to current retirees, it is not allowed to invest all of its money. The fund has a legal obligation to keep enough cash to make pension payouts.

It also has a huge role to play in directing Namibia’s economy, says Trophy Shapange, managing director of Hangala Capital, which has received a commitment to manage about N$500 million for the fund.

“GIPF, being the biggest pension fund in the country, has an upper hand in directing and shaping our economy. The GIPF alone has about N$54,9 billion at its disposal, which is almost equal to our national budget for local investments,” he says.

“SME development and infrastructure are vital and more urgent to grow the economy. The GIPF has done quite well, but more needs to be done. They must engage the government to ensure funds are diverted to social impact projects without compromising the fund’s reserves and assets.”

Du Plessis says while it’s true that the GIPF has been instrumental in moving the Namibian economy, she fears the fund would struggle to maintain a high return on local investments.

“There are only so many investment opportunities, and the GIPF is forced to invest in Namibian government bonds and cash. The returns on these investments are lower than in other assets,” she says.

“I would not force GIPF money into risky investments and jeopardise the financial soundness of the fund. The current and future portfolio of alternative managers should be chosen based on skill, expertise, and a solid investment pipeline, not political pet projects,” she says.

Email: [email protected]: @Lasarus_A * This article was produced by The Namibian’s investigative unit. Email news tips from your secure email to [email protected]

SO, WHERE’S THE MONEY? Below is a list of the fund’s notable investments and their value at the end of March 2021: IN NAMIBIA Capricorn Group Limited N$1,7 billion

FirstRand Namibia (FNB) N$972 million Namibia Breweries N$928 million Oryx Properties Limited N$291 million Standard Bank Namibia N$23 million Letshego Namibia N$25 millon

Stimulus Investment Limited N$77 million SOUTH AFRICA Mediclinic International N$33 million Shoprite Holdings N$298 million Old Mutual Limited N$182 million

Sanlam Limited N$328 million Anglo American (De Beers’ parent company) N$1,1 billion Nedbank Group Limited N$223 million Absa Group N$253 million British American Tobacco N$1 billion

MTN Group Limited N$620 million Naspers Group Limited (DSTV) N$3,2 billion Mr Price Group Limited N$146 million The Spar Group N$152 million Vodacom Group Limited N$174 million

Pick n Pay Stores Limited N$44 million GLOBALLY Rio Tinto Plc N$18 million Amazon Inc N$244 million EBay Inc N$9,7 million Bank of America N$149 million

Microsoft Corporation N$134 million Walmart Inc N$11 million Barclays Plc N$15 million Rothschild & Co N$3,5 million Rakuten Inc N$3,1 million Sony Corp Inc N$34 million

Toyota Industries and Toyota Motor Corp N$32 million Porsche Automobile Holdings N$12 million Heineken Holdings NV and Heineken NV N$40,4 million Samsung Electronics Co Limited N$280 million Air Canada N$14 million Alphabet Inc (Google) N$322 million Zoom Video Communications Inc N$29 million Shopify Inc N$83 million

For More News And Analysis About Namibia Follow Africa-Press