Africa-Press – Namibia. THE First National Bank (FNB) of Namibia says it was unaware that the Fishrot accused may have acquired properties through illegal schemes and vowed to protect its rights.

“The law protects those who are vigilant and not those who sleep on their rights,” FNB said in court papers filed in the Windhoek High Court on Monday this week.

Namibia’s biggest commercial bank believes that it has a right to demand that it’s interests are protected, if the assets are sold in future by the state. The case is set to be heard on 27 January.

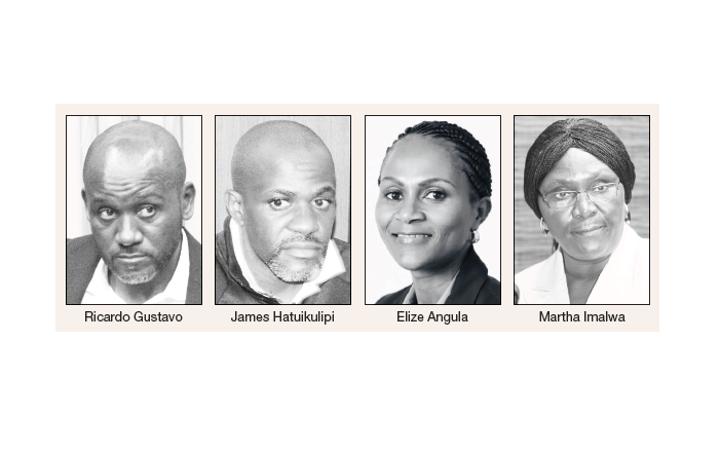

The battle between FNB and the prosecutor general, Martha Imalwa, revolves around assets worth N$5,3 million belonging to former Fishcor board chairperson James Hatuikulipi and former Investec manager Ricardo Gustavo. Those assets were bought through FNB.

Other defendants are Tamson Hatuikulipi, former fisheries minister Bernhard Esau, former justice minister Sacky Shanghala and Pius Mwatelulo. The bank said they do not want to obtain or release the confiscated assets.

“FNB simply seeks a variation of the order to clarify its rights and interests,” FNB said.

Imalwa obtained a restraining order in November 2020, over a wide range of assets linked to six accused in the Fishrot case, their wives, 15 companies and close corporations in which they have an interest.

FNB fears the bank might lose out if there is no legal order to compel the state or the curator to include them in the sale of the assets if the suspects are found guilty.

“The purpose behind the application is to protect FNB’s interests in certain specified movable and immovable assets financed by it,” the bank said. Lawyer Elize Angula is representing FNB, while judge Orben Sibeya is presiding over the case.

“The bank had no reasons to suspect that the assets were purchased with the proceeds of unlawful activities. It is against this factual background that the next issue arises: is the application necessary to the bank’s interest?” FNB said.

FNB financed the assets worth N$5,3 million to some of the Fishrot-accused. The assets in question include three houses – one worth N$2,7 million belonging to Gustavo, and two houses – one worth N$987 000 and another N$613 000, all belonging to Hatuikulipi.

Other assets are three cars: a Range Rover with a remaining loan balance of N$520 000, a Mercedes-Benz (N$429 000) and a Toyota Hilux GD6 (N$88 000). The bank said in the event that it does not recover its funds through curators appointed by Imalwa, it will pursue other means to do so.

“An order varying the rule to declare that it shall not affect the bank’s interest in the specified asset, in the event of the sale of such asset, the proceeds would go first to settle the debts owed to the bank in respect thereof,” the bank said. FNB said several factors could leave them at the mercy of an ongoing and dragged-out criminal trial, with possible appeals.

Imalwa opposed FNB’s application last year, saying the bank failed to join the curator – who is a legal representative appointed by a court to manage the finances, property, or estate of another person unable to do so because of mental or physical incapacity.

She said FNB has failed to show that they had brought to the attention of the curator that the market value of the properties in which it has an interest, is depleting.

“FNB should have first approached the curator with regard to its interests in the said properties, before approaching this honourable court by means of this application to intervene for the purposes of requesting a variation of property order,” the PG said.

Contacted for comment, FNB spokesperson Elzita Beukes yesterday said they are not able to discuss publicly any decisions taken on private accounts of customers, nor any ongoing legal investigation.

She added that as part of the bank’s ongoing risk assessment, the bank reserves the right to terminate any contractual banking relationships where such relationships pose an unacceptable risk.

“Clients who have legitimate claims against the bank are aware of their rights and are encouraged to contact us directly at any time for details on any decisions taken,” she said. Imalwa’s mobile phone, and the office number were also unreachable when contacted by The Namibian yesterday.

For More News And Analysis About Namibia Follow Africa-Press