Africa-Press – Namibia. NAMIBIAN commercial banks have extended housing loans worth just more than N$42 billion, but not everyone is paying. The Ministry of Justice is now proposing leniency in regulations so that borrowers do not lose their homes.

A host of proposals include that the law allows individuals in a financial fix to apply for a six-month payment holiday on their mortgages, or to have their loan period readjusted.

According to a discussion paper prepared by the ministry, several people have been losing their primary homes, sometimes due to unforeseen circumstances affecting their finances.

This should not always lead to individuals losing their homes, the paper said. The ministry said it intends to “propose legislative and administrative reforms regarding primary homes being sold in execution of judgements”.

It has been on the ministry’s agenda since 2014 to explore other options to avert the sale of primary homes. According to the ministry, these options should be available as soon as it “becomes apparent that the debtor is unable to pay the debt”.

“The courts must be empowered by the law to grant other alternative orders, such as rescheduling the debt repayment period, or authorising ‘payment holidays’ as forms of relief enabling the debtor to secure other sources of income,” the paper reads.

These proposals were made at the first of many public consultations in Windhoek this week. Present at the consultations were representatives from commercial banks, legal practitioners, and homeowners.

The affordability of mortgages is not the only issue, said the ministry. Sometimes homeowners do not know what the procedures are when the execution stage of their homes has been reached.

The ministry also said there is too little time for defaulters to secure assistance to defend themselves in court. Many defaulters do not have the financial and legal resources to defend their cases, it said.

A proposal to attend to this is to amend the Legal Aid Act to enable the automatic granting of legal aid where the defendant is potentially at risk of losing a primary home. The ministry also wants a reserve price to be set for all properties sold in execution, which is not at municipal value.

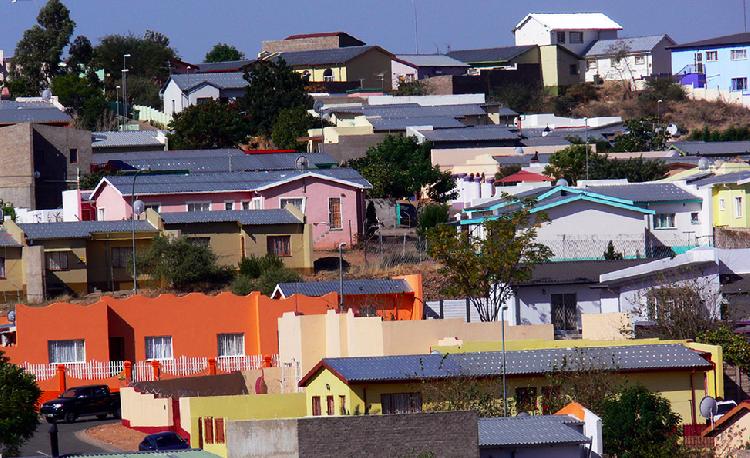

Justice minister Yvonne Dausab this week said that members of the National Assembly as representatives of the Namibian public have raised concerns about the fact that they have not found additional safeguards or ways in which to deal with issues regarding the repossession of primary homes. She said the issue specifically affects vulnerable communities. Dausab said ignorance on the part of homeowners contribute to the problem.

“We must make sure and must know that the rights of all interested parties must be protected and promoted, but the state has a duty to protect and promote the human rights of all citizens – especially the most vulnerable in our society, and an opportunity is presenting itself to rectify injustices,” she said.

Deputy chief legislative drafter Freed Zenda said the time within which to secure assistance to defend defaulters’ cases is limited. “This is one of the reasons why debtors take no action when they are being issued with court documents,” he said.

He also identified ignorance and a lack of understanding of legal processes as problematic. “The proposal was that some of the property owners are ignorant about the legal process set,” Zenda said.

A High Court judgement suggests that the execution process under Rule 108 be served on people who may assist debtors financially, he said. According to the ministry, an aspect of judicial control was introduced through Rule 108 of the 2014 High Court rules in an effort to mitigate the impact.

The object was to investigate the reasons for non-payment and the possibility of less drastic measures to deal with defaulters. The ministry intends to retable the bills that in part address this issue during the course of the first or second session of the National Assembly, it said.

The list of proposals includes the setting of a minimum reserve price and a need to establish whether banks should be allowed to buy up defaulters’ homes and sell them after five years is not open for abuse.

According to the Bank of Namibia’s data, commercial banks owned houses to the tune of N$214 million at the end of October last year, although the historic cost was N$136 million.

By keeping these homes, the banks have already made a profit of N$78 million. The ministry said it would soon announce the details of the next consultation. The list of the proposals is available from the ministry.

For More News And Analysis About Namibia Follow Africa-Press