Africa-Press – Namibia. ALTHOUGH 60% of all industries included in the GDP calculation have not recovered to fourth quarter 2019 pre-pandemic levels, Namibia’s economy is reportedly on track to perform better than it did in the last two years.

ALTHOUGH 60% of all industries included in the GDP calculation have not recovered to fourth quarter 2019 pre-pandemic levels, Namibia’s economy is reportedly on track to perform better than it did in the last two years.

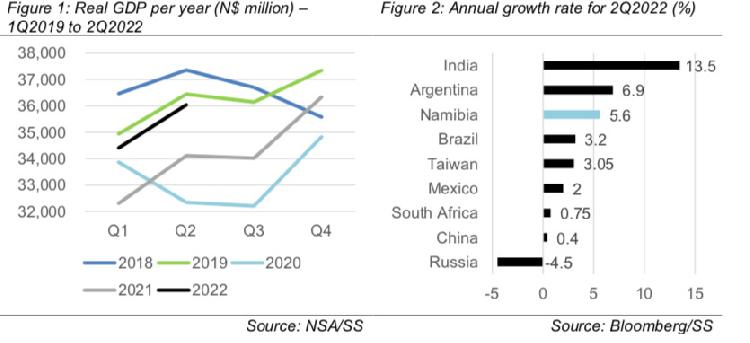

According to analysts at Simonis Storm, the latest GDP figures show economic growth of 5,6% in the second quarter of 2022, which ranks fairly high compared to second quarter figures from emerging markets.

Simonis says the growth is primarily supported by mining, which rose 29%, financial services, which went up 16%, transport, which rose 11% and health services, which shot up 10%.

“The latest growth rates are far above the 2 – 3% range supporting our 2,5% annual growth forecast for 2022. Hence, growth is likely to overshoot consensus forecasts averaging 2,8%,” said economist Theo Klein in a review released on Wednesday.

“At the start of the year, we identified mining, agriculture, ICT, transport, tourism (hotels and restaurants) and financial services as economic growth drivers in 2022.

“To date, only three of these sectors – agriculture, mining and ICT – have recovered to above fourth quarter 2019 economic levels,” the analyst said.

Private consumption rose by 8,4% quarter-on-quarter (q/q) in the second quarter of 2022, marginally lower than the 9,2% q/q recorded in the first quarter of 2022, while government spending decreased by 15,7% q/q in the second quarter of 2022, following a rise of 6,9% q/q in the first quarter of 2022, said Simonis.

Namibia’s key exports are diamonds, copper and uranium, which are still priced at short-term highs, but this has not supported the trade balance, with Namibia recording an average trade deficit of N$3,5 billion a month from January to July, said Simonis.

“Inflation is one of the biggest risks to local economic growth as private consumption expenditure accounted for 80,0% and 83,3% of GDP in the first and second quarter of 2022, respectively.”

MONETARY POLICY

South Africa and Namibia hiked respective repo rates by 250bps and 175bps year-to-date, but the repo rate is still below official inflation rates, indicating that monetary policy is accommodative in both countries.

“We see the repo rates between South Africa and Namibia equalised at 7% by the end of this year, with the prime rate at 10,50% in South Africa and 10,75% in Namibia.

“We also see a 50bps hike in the first quarter of 2023 in South Africa and Namibia, followed by a 25bps cut in the third and fourth quarter of 2023, to bring the repo rates back to 7,00% by end of the fourth quarter of 2023,” said Simonis.

INFLATION

During the first two months of the third quarter of 2022, inflation averaged 7,1% in Namibia compared to 5,7% in all months of the second quarter of 2022 and 4,5% in the first quarter of 2022.

“Goods inflation remains the main driver of local inflation, with services inflation only averaging 2,9% year to date (YTD) compared to 7,6% average goods inflation YTD,” said Simonis, adding that during the first two months of the third quarter of 2022, transport, food, alcohol and housing and utilities were the main contributors to inflation rates.

Meanwhile, all major commodity prices are in retreat, except the energy market. Metals and industrial commodity prices declined by 20,5% since their peak in March 2022, with global food prices down by 11,9% and energy prices up by 3,6% by the end of July 2022.

Although commodity prices have declined since their March 2022 highs, increased local mining production still fetched fairly elevated prices, which would support improved export earnings and tax revenues from the sector.

Manufacturers face higher input costs and consumer spending is coming in lower in most advanced economies, which weigh on business sentiment for the immediate outlook.

A decline in factory orders and manufacturing activity should support a moderation in commodity prices until the end of this year, lowering Namibia’s export potential.

National occupancy rates and foreign arrivals continue to improve, having more than doubled during the first two months of the third quarter of 2022, compared to the same period last year.

Namibia enjoys a business operating environment free of any Covid regulations and restrictions, which would not only benefit the local tourism sector, but businesses in general as well. With the improved tourist inflows, other sectors are also likely to see improved operations given the wide value chain in tourism.

Marketing activities of livestock products increased by double digits for all categories in the first two months of the third quarter of 2022, compared to the same period last year.

“Crop production is expected to weigh on the agricultural sector in 2022, due to sporadic rainfall not benefiting all areas equally as some areas had late rainfall and others had excessive rainfall causing crop damage,” said Simonis.

Email: [email protected]

According to analysts at Simonis Storm, the latest GDP figures show economic growth of 5,6% in the second quarter of 2022, which ranks fairly high compared to second quarter figures from emerging markets.

Simonis says the growth is primarily supported by mining, which rose 29%, financial services, which went up 16%, transport, which rose 11% and health services, which shot up 10%.

“The latest growth rates are far above the 2 – 3% range supporting our 2,5% annual growth forecast for 2022. Hence, growth is likely to overshoot consensus forecasts averaging 2,8%,” said economist Theo Klein in a review released on Wednesday.

“At the start of the year, we identified mining, agriculture, ICT, transport, tourism (hotels and restaurants) and financial services as economic growth drivers in 2022.

“To date, only three of these sectors – agriculture, mining and ICT – have recovered to above fourth quarter 2019 economic levels,” the analyst said.

Private consumption rose by 8,4% quarter-on-quarter (q/q) in the second quarter of 2022, marginally lower than the 9,2% q/q recorded in the first quarter of 2022, while government spending decreased by 15,7% q/q in the second quarter of 2022, following a rise of 6,9% q/q in the first quarter of 2022, said Simonis.

Namibia’s key exports are diamonds, copper and uranium, which are still priced at short-term highs, but this has not supported the trade balance, with Namibia recording an average trade deficit of N$3,5 billion a month from January to July, said Simonis.

“Inflation is one of the biggest risks to local economic growth as private consumption expenditure accounted for 80,0% and 83,3% of GDP in the first and second quarter of 2022, respectively.”

MONETARY POLICY

South Africa and Namibia hiked respective repo rates by 250bps and 175bps year-to-date, but the repo rate is still below official inflation rates, indicating that monetary policy is accommodative in both countries.

“We see the repo rates between South Africa and Namibia equalised at 7% by the end of this year, with the prime rate at 10,50% in South Africa and 10,75% in Namibia.

“We also see a 50bps hike in the first quarter of 2023 in South Africa and Namibia, followed by a 25bps cut in the third and fourth quarter of 2023, to bring the repo rates back to 7,00% by end of the fourth quarter of 2023,” said Simonis.

INFLATION

During the first two months of the third quarter of 2022, inflation averaged 7,1% in Namibia compared to 5,7% in all months of the second quarter of 2022 and 4,5% in the first quarter of 2022.

“Goods inflation remains the main driver of local inflation, with services inflation only averaging 2,9% year to date (YTD) compared to 7,6% average goods inflation YTD,” said Simonis, adding that during the first two months of the third quarter of 2022, transport, food, alcohol and housing and utilities were the main contributors to inflation rates.

Meanwhile, all major commodity prices are in retreat, except the energy market. Metals and industrial commodity prices declined by 20,5% since their peak in March 2022, with global food prices down by 11,9% and energy prices up by 3,6% by the end of July 2022.

Although commodity prices have declined since their March 2022 highs, increased local mining production still fetched fairly elevated prices, which would support improved export earnings and tax revenues from the sector.

Manufacturers face higher input costs and consumer spending is coming in lower in most advanced economies, which weigh on business sentiment for the immediate outlook.

A decline in factory orders and manufacturing activity should support a moderation in commodity prices until the end of this year, lowering Namibia’s export potential.

National occupancy rates and foreign arrivals continue to improve, having more than doubled during the first two months of the third quarter of 2022, compared to the same period last year.

Namibia enjoys a business operating environment free of any Covid regulations and restrictions, which would not only benefit the local tourism sector, but businesses in general as well. With the improved tourist inflows, other sectors are also likely to see improved operations given the wide value chain in tourism.

Marketing activities of livestock products increased by double digits for all categories in the first two months of the third quarter of 2022, compared to the same period last year.

“Crop production is expected to weigh on the agricultural sector in 2022, due to sporadic rainfall not benefiting all areas equally as some areas had late rainfall and others had excessive rainfall causing crop damage,” said Simonis.

For More News And Analysis About Namibia Follow Africa-Press