Africa-Press – Namibia. SOUTH African consumer finances took another hit today as the South African Reserve Bank’s (SARB) monetary policy committee meeting hiked the repurchase rate by 50 basis points to 7,75%.

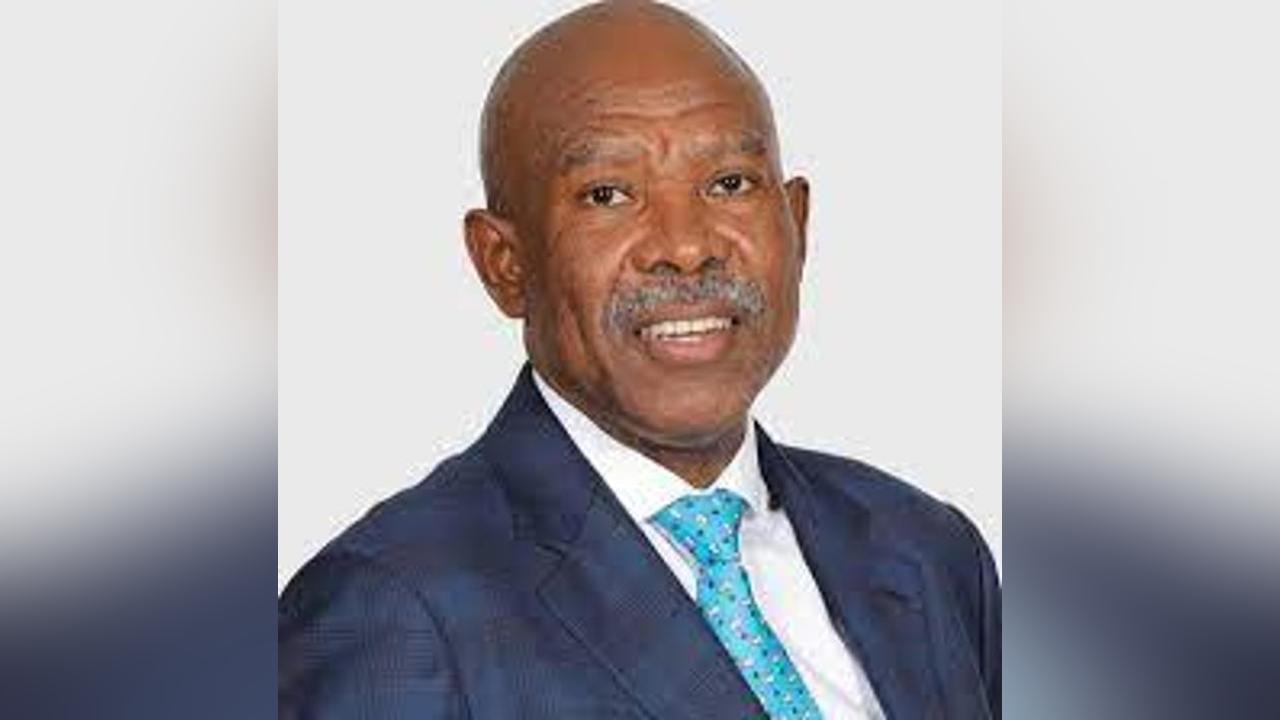

This was announced by SARB governor Lesetja Kganyago yesterday, pushing the repo rate up from 7,25%.

Namibia is still behind at 7%.

This means the prime lending rate in South Africa will increase from 10,75% to 11,25%.

The announcement made by the governor was unexpected as it was widely predicted by analysts and economists that the bank would hike the rate by 25 basis points.

The central bank has been on an aggressive trend of hiking the rate in a bid to help curb inflation, which saw the previous eight meetings of the committee voting for an increase.

Inflation, however, is still higher than the bank’s target range, as the economy has been impacted heavily by the rolling power cuts imposed on the country by ailing state-owned power utility Eskom.

“As we enter the second quarter of 2023, sticky inflation, sluggish growth and now elevated financial stability risks mark the global economy. Despite somewhat better growth outcomes in the first months of the year, we see no material easing of difficult global economic conditions,” Kganyago said during his announcement yesterday.

“With inflation and policy rates remaining higher for longer, and new weaknesses emerging in financial institutions, we expect global financial markets to remain volatile,” he said.

Economists in September last year, when the prime lending rate was increased to 9%, said the increase spelt doom for consumers in the country.

That paints a gloomy picture as the rate now sits at 11%.

Hayley Parry, money coach and facilitator at 1Life’s Truth About Money, said: “It’s been a rough week to be South African, and I’m afraid the hits keep coming.”

The impact on consumers is that the cost of servicing their debt is going to go up, and this is going to hit cash-strapped consumers hard.

“If you haven’t yet, now is the time to really get your financial affairs in order. In this kind of environment, it becomes critical that we manage the money we do have better.

“This may mean taking a ‘financial health’ day to get on top of your budget, cut out unnecessary expenditure, audit your debit orders and get your finances fighting fit,” she urged.

“This means ensuring that you have an emergency fund in place, you’re paying off as much debt as possible, and taking proactive steps to manage your cash flow as inflation pushes prices up across the board,” Parry said.

For More News And Analysis About Namibia Follow Africa-Press