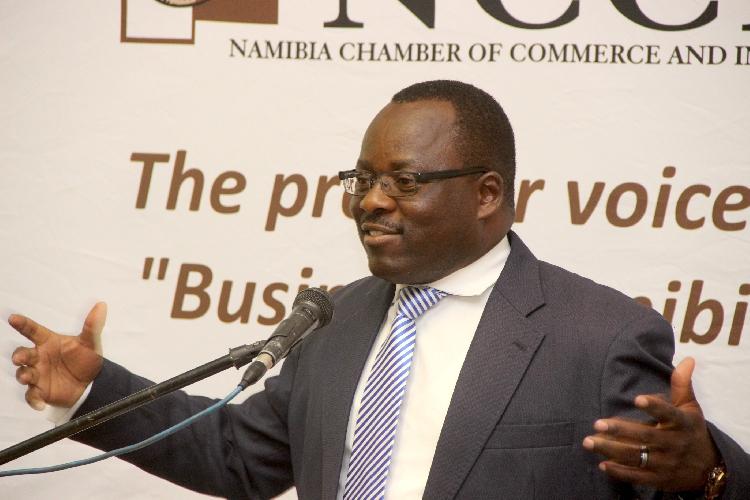

Africa-Press – Namibia. NAMIBIA Asset Management chief executive officer Tarah Shaanika has called for the government and the financial sector to create affordable and reasonable financial packages for small and medium enterprises (SMEs).

He yesterday in conversation with Desert Radio 95.3 FM bemoaned the lack of financial literacy among Namibians, and said it has kept many from participating in potentially lucrative opportunities, including the stock market. Shaanika said some businesses are not listed on the stock exchange and are missing the opportunity to raise capital for their operations.

“Therefore, the Namibia Stock Exchange (NSX) is quite liquid. You do not have a lot of shares being traded on a regular basis. But businesses need to understand they can also use the stock exchange to raise capital. That is where we come in – with the assets from the public we can then invest in these businesses when they list,” he said.

He said money could be used to grow such businesses, but as asset managers they need to do a lot more to educate Namibians on the opportunities the stock exchange could create for those who want to raise capital.

“Even businesses can make use of Namibia Asset Management to raise capital, but we only manage listed assets,” Shaanika said. LACK OF AWARENESS He said there is a lack of awareness of the various options individuals have in terms of saving and investing money.

“We need to intensify awareness campaigns. People think you need a lot of money to invest, but in our business we have created some vehicles in which investors who don’t have a lot of money can invest,” he said.

ON OFFER Namibia Asset Management is currently running six unit trust funds which allow Namibians to put away a small amount of money as an investment to grow a portfolio of their own.

Shaanika said these six funds look at those who are risk averse and want to protect their capital as much as possible. “With risks there are higher returns. Our fund is on different levels, giving Namibians an opportunity to have a wide range of options,” he said.

FOREIGN INVESTORS He said he does not think the domestic economy favours foreign investors at the expense of locals. Facilitating investments depends on various factors, such as capital to invest, well-polished ideas, and skills, he said.

In most cases, foreign investors may seem successful in certain areas because they have skills and experience. “Local investors may not have the same experience, but I think local investors have access to investment opportunities. It is just how you package your business, how you build your business model.

“Is it easy for you to attract capital in your business? That is probably the biggest challenge businesses in Namibia are facing as far as investing in the local economy is concerned,” he said.

Shaanika said the lack of skills and capital are major stumbling blocks for investments – especially local investments. Access to markets is, however, sometimes the result of bureaucracy, which hampers business, he said.

“You find that people have beautiful ideas they want to implement, but cannot attract capital. Maybe they can attract skills, but the bureaucracy you must endure to start a business in Namibia needs to be improved,” he said.

For More News And Analysis About Namibia Follow Africa-Press