Africa-Press – Namibia. NGHIINOMENWA ERASTUS and LAZARUS AMUKESHETHE government is stuck in traditional methods of borrowing, even for this fiscal year, although there are innovative ways that could help it create a sustainable debt portfolio.

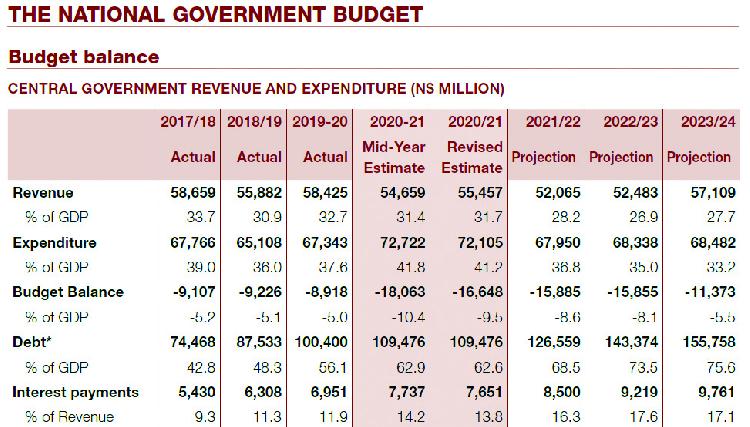

Experts at the International Monetary Fund and other international lenders have called for innovation in fiscal funding instruments, including introducing hybrid instruments.For Namibia, the Bank of Namibia, as a government borrowing agency through government securities, seems reluctant to go beyond the usual and bring to the market new securities that would help reduce the billion-dollar government interest rate bill.According to the central bank’s annual report from last year, the treasury is expected to spend about N$25,37 billion by the 2022/23 fiscal year just on servicing its debt, which is expected to be at about N$143,4 billion then.Despite this ballooning interest payment, the Bank of Namibia is not changing the type of assets and securities it advises the central government to use to lower the interest bill.The only innovation they seem to be stuck on is rolling over, switches and setting up a sinking fund.Instead, the central bank uses the same high-yielding securities that include treasury bills, inflation-linked bonds and fixed-rate bonds in the capital and money markets, as a result fuelling the interest bill.As part of domestic market development, the government added a similar new fixed-rate bond on the yield curve last year. By the end of March 2022, the government would have borrowed more than N$32,5 billion from internal and external sources to fund its budget deficit through the three types of interest-bearing government securities.Fixed-rate bonds constituted 86% of this amount, while 14% was denominated ininflation-linked bonds, coupled with other borrowings from continental and international lenders.In its defence, the central bank explained that sticking to the same securities as their 2015 assessment showed them that additional securities in the form of zero-coupon bonds were not viable. In line with the aspirations of the Namibia Financial Sector Strategy, the debt management team explored potential new instruments that could be rolled out in the domestic market. As far back as 2015, the viability of introducing various instruments including retail bonds, inflation-linked bonds and zero-coupon bonds, was assessed, the central bank said.“At the time, only inflation-linked bonds made economic sense and were practical to roll out as was successfully done during the FY2015/16,” the central bank responded.The bank also told The Namibian that their debt management team continues to review the available instruments in the market periodically and weigh that against investor demand for other instruments in the domestic market.The Namibian challenged the central bank to prove if there is no appetite for government securities that can reduce the country’s overall interest payment bill, such as a zero-coupon bond.This can be done through roadshows to potential investors, especially long-term investors.The central bank said it is customary during the crafting of the annual borrowing strategy for the debt management team to consult all active investors in the market to gauge their appetite for various government instruments.This is done “to determine their point of interest along the yield curve”, said the central bank.During these consultations, market participants also suggest the instruments they would like to be made available in the market. “To this end, the team has never received any expressions of interest for zero-coupon bonds from the domestic market,” revealed the central bank.The central bank also highlighted that it is not only about market appetite but also that the zero-coupon bonds are heavily discounted instruments.“The cash flow derived from these transactions (zero-coupon bond) is relatively lower in comparison to other instruments, while the debt levels increase by the principal amount only,” said the bank, adding that in the short-term, the discount factor on the zero-coupon bond is deeper than what you would pay on fixed-income bonds of the same maturity and volume. Thus, they are expensive to issue and simultaneously do not offer any unique value to the government as an issuer.In the same vein, the discounted price on zero-coupon bonds will have a pricing effect on the yields on other bonds, potentially resulting in higher debt costs for the government.Therefore, the central bank will continue to fund the budget deficit by issuing the same fixed-rate bonds and inflation-linked bonds, which could see the country’s interest bill to continue its upward trajectory, crowding out other sectors as government priorities fight for funding – given the constrained fiscal space.The central bank and treasury are finalising the FY2021/22 Borrowing Strategy, the update revealed.Last year, the traditional borrowing strategy was used to fund the N$16 billion budget deficit. Email: [email protected]