Africa-Press – Nigeria. Nigerian single-point financial service and payment solution provider, Aella App, is working with Amazon Web Services, Inc. (AWS) to empower unbanked Nigerians through quick access to credit and other financial services using Amazon Rekognition for identity verification.

Amazon Rekognition, is a fully managed computer vision service that enables developers to analyze images and videos for a variety of uses, including face identification and verification, media intelligence, custom industrial automation, and workplace safety.

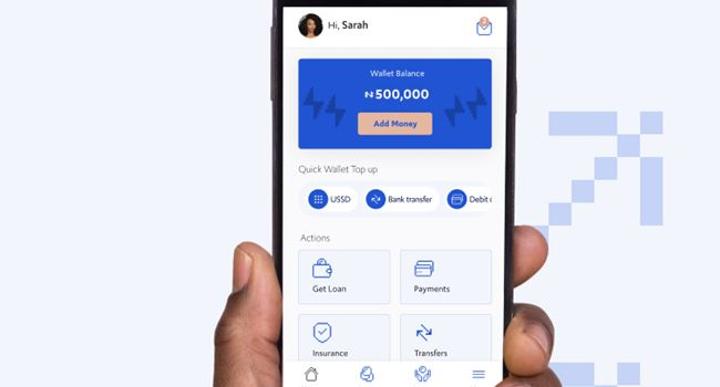

With the lack of application programming interface (API) infrastructure that allows the real-time verification of government identifications in Nigeria, Aella App is about to change the fintech ecosystem by taking advantage of cutting-edge AI technologies and using biometric identity verification on its mobile application, improving the accuracy of facial verification by over 40 per cent.

On the collaboration with Amazon Web, the CEO of Aella App, Akin Jones said:

“With only 38 per cent of Nigerians who have no form of identification, we realised that a vast majority of the population were being left out of financial services, taking away their financial independence and leaving them on the fringe of building bankable credit ratings.

“Our job as a fintech organisation is to come up with more creative ways to bring more people into the ecosystem, reinforcing our commitment to provide products that democratise financial services, ultimately alleviating poverty and driving economic growth in the country.”

Vice President, Amazon Machine Learning Solutions Lab, Amazon Web Services, Michelle Lee, reaffirmed AWS’s commitment to developing technology that could help tackle some of the world’s hardest problems.

“We are impressed by Aella’s dedication to driving financial independence for the under-banked. With the fintech ecosystem in Nigeria accounting for 1.25 per cent of retail banking revenues, it is clear that there is an opportunity to continue democratising financial service access for all.

“We are proud to work with Aella as they strive to ensure everyone, from individuals to small business owners, are not left without financial support.”

Opinions