Abba Hamisu Sani

Africa-Press – Nigeria. The issue of Nigerian currency shortage is no longer a story as it causes more hardship among Citizens especially operators of small businesses.

Central Nigeria’s decision to redesign the Naira note and the short deadline provided for the swap is one of the present administration policies under President Buhari that generated more controversy among Politicians and business class.

The CBN initial deadline for the old Naira note as legal tender was January 31st 2023 but a few hours to the apex Bank extended the time with another ten days.

The extension also came with another challenge as the majority of the old notes were deposited in Commercial Banks despite the low circulation of the new Naira note.

Trading with Foreign Currency as an alternative

Nigeria shares a land border with four African Countries that include: Benin Republic , Cameroon, Chad, and Niger.

Residents of border communities in states like Sokoto, Zamfara, Katsina, Adamawa and Kwara have opted for the Chartered Financial Analyst (CFA) franc following the scarcity of the new naira notes across the country.

The residents, including traders and commercial drivers, are also rejecting the old naira notes, insisting that customers who do not have the new redesigned currency must pay for goods and services with CFAs.

The CFA franc is the legal tender in eight West African countries of Benin, Burkina Faso, Côte d’Ivoire, Guinea-Bissau, Mali, Niger, Senegal and Togo, which make up the West African Economic and Monetary Union, otherwise known as the Union Économique et Monétaire Ouest Africaine.

According to Punch news Paper Findings businessmen and traders in the Zurmi and Shinkafi local government areas of Zamfara State, which border the Niger Republic, prefer the franc to the naira.

The Paper revealed that traders in the two Areas had been selling their commodities in CFA due to fear that they might not get the new naira notes.

A cattle dealer, Musa Shehu, said he stopped receiving the Nigerian currency since the Central Bank of Nigeria announced the deadline for the swap of the N1,000, N500 and N200 notes.

“I have since stopped receiving the old naira notes because I don’t have an account and I can’t go to the bank.” The Cattle dealer stated.

Another trader who is a grain seller in Dada village in Zurmi Local Government, Muhammadu Isa, disclosed that he stopped selling grains in the Nigerian currency after the CBN’s policy on new naira notes was unveiled.

He said that he sold only to those who possessed CFAs to avoid losing money as ‘’my father did in 1983 when the naira notes were hurriedly changed by the same Major General Muhammadu Buhari regime.’’ The trader added.

Isa explained that his late father lost all his money when Buhari changed the national currency in 1983.

“You see, since our people and those from the Niger Republic are coming to buy the grains with the CFA, I see no reason why I should collect old naira notes. If anybody wants to buy grains from me, he must pay in CFA or forget it. I will not collect old naira notes because I don’t know what to do with them after the expiration of the deadline,” he noted.

Adamawa State is another Part of Nigeria that shares a border with Cameron, a Central African Country. Jafaru Hamman who is the Chairman of Mubi International Cattle Market in Adamawa State, lamented the scarcity of newly redesigned naira notes, adding that the difficulties in getting the currency had affected commerce at the border communities.

The problem, according to him, is that most traders in Mubi are accustomed to cash transactions and the cashless policy may take time to get mass support.

He, however, noted the volume of trade in foreign currency was minimal before the introduction of the new naira redesign policy.

He said as the deadline for the naira swap draws closer and the old currency is facing rejection, traders are faced with either accepting the CFA for their transactions or halting their business activities.

“The Traders are collecting the naira but since it became increasingly difficult to get new notes, they resorted to collecting CFA. The traders have also refused to accept the old notes. If they come to sell their cattle, if you give them the old notes they will reject it.” He said.

In Ipokia, a border town in Ogun state, traders were said to have been traveling to the Benin Republic to exchange the new currency with CFAs after selling their wares.

A youth leader in Ipokia, Deji Mawuntin, bemoaned the hardship the residents of Ihube, Ilara, Oja-Odan and others were going through to get the new notes.

He accused some bank workers of selling the new currencies to racketeers in the Benin Republic.

“The bankers are selling new naira notes to Beninese and Nigerians are going there to exchange it with CFAs. He decried In Kwara State, in Chikanda, a border town between Nigeria and the Benin Republic, a trader, Alhaji Bashir Mohammed, said he preferred taking CFA as new naira notes were not easily available.

“Since the change from old naira notes to new notes, there has been a shortage of the new notes, we are not getting the new notes, so it is easier to get the CFA than the naira notes, that is why we are accepting the CFA in exchange for our goods.” He said.

Another trader, Mrs Mariam Hassan, who trades in Garri, local rice, beans and yam flour, said that the traders in the border towns were accepting CFA in exchange for their goods.

Mariam who is based in Yashikira in the Baruten local government area of Kwara State said that the traders made more profits when they accepted CFA.

The situation continues in the border Communities even with extension of CBN deadline to 10th of February 2023 as the scarcity of both the new and old notes bite harder.

Experts Views on the matter

Johnson Chukwu is the Managing Director, Cowry Asset Management Limited. He described the move as the logical thing to do in face of the scarce availability of the new notes .

Instead of traders closing markets which will be more dangerous to the economy of the grass root people and the country’s at large ,it is better to use foreign currency to continue with businesses as a means of survival.

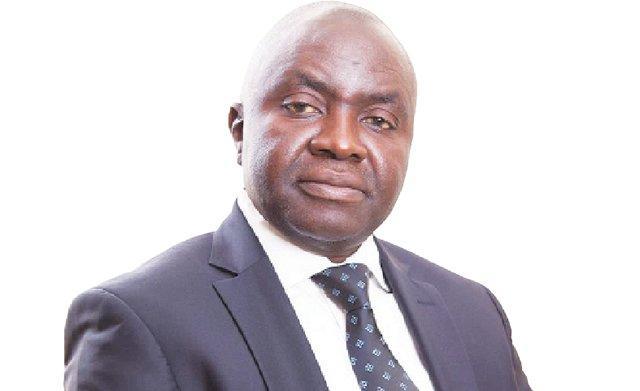

Dr. Muda Yusuf is a business analyst and Chief Executive Officer of the Centre for the Promotion of Private Enterprises. Henoted that , this was natural due to lack of enough new notes in circulation for the people to run their businesses particularly in border regions.

Dr. Muda Yusuf Chief Executive Officer Centre for the Promotion of Private Enterprises

The Expert added that border Communities have comparative advantage as they are familiar with dual currencies compared to other citizens that can only transact in a single legal tender.

For More News And Analysis About Nigeria Follow Africa-Press