Africa-Press – Rwanda. Banque Populaire du Rwanda (BPR) returned to its birthplace in Kayonza District on Friday, 18, July, where clients from Kayonza, Rwamagana, Ngoma, and parts of Gatsibo gathered to reflect on the bank’s half-century journey, assess the present, and deliberate on future cooperation.

The event, held as part of BPR’s 50th anniversary celebrations, comes at a pivotal time for the institution, which is undergoing internal transformation under the Kenya-based KCB Group. The engagement also served to reaffirm the bank’s longstanding presence in the region and renew its commitment to community-led financial inclusion.

Speaking at the event, BPR Chief Executive Officer Patience Mutesi recalled the bank’s humble beginnings. “It is remarkable that BPR now has the capacity to disburse Rwf 40 billion in loans—20% of our capital. And to think it all started here in Kayonza—that’s why we value this region,” she said.

She further announced new loan products, including unsecured personal loans of up to Rwf 50 million, and a specialised lending facility for women entrepreneurs of up to Rwf 100 million, determined by account performance.

The discussion, however, was not without concern. Several clients highlighted ongoing challenges, particularly delays in loan disbursement.

Frank Kadugara, an agricultural entrepreneur, welcomed the bank’s support but emphasised the need for more efficient delivery, especially under the CDAT programme, where loans are offered at an 8% interest rate.

“These delays affect our operations. I work with 20 clients daily, each delivering 20 tonnes. When funds are not available on time, business is disrupted. Making this facility more accessible would not only support farmers but would also help reduce food costs,” he said.

Another client, Elade Bayingana, shared his experience, starting as a bus conductor and now owning a fleet of vehicles and running hospitality ventures. He attributed his growth to a Rwf 5 million loan from BPR but raised concerns about bottlenecks in accessing larger loans.

“Branch managers approve our proposals, but once the file reaches Kigali, the process slows. A Rwf 450 million loan took six months to process—this hampers business continuity,” he said.

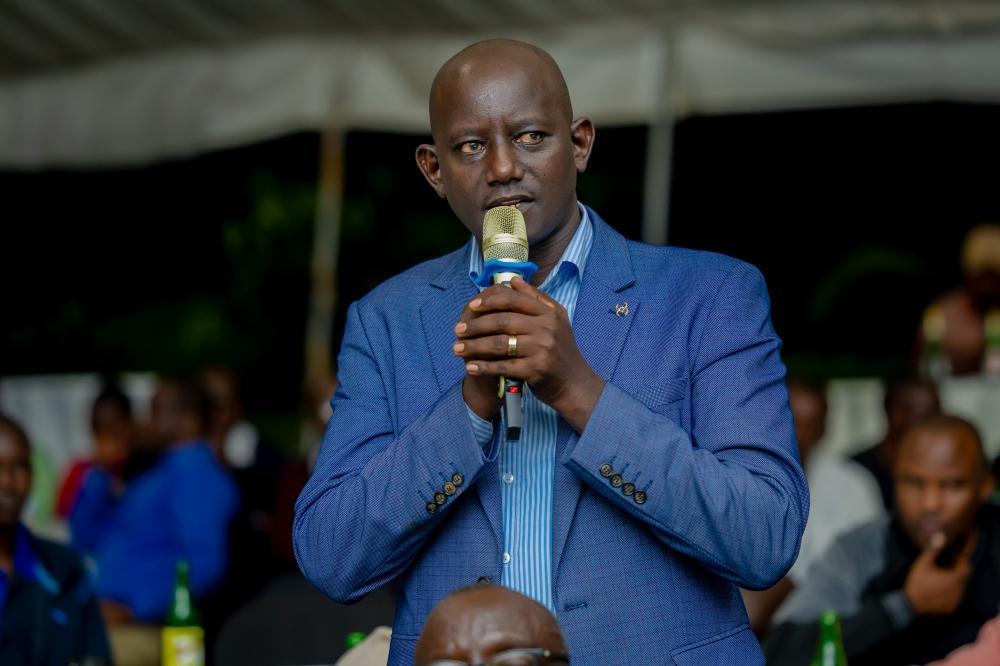

In response, BPR’s Director of Commercial Banking, Shema Mugisha, acknowledged the challenges. “We have undergone internal reforms, and we understand that this may have caused some delays. We are now in a stronger position to provide timely service and remain fully committed to improving access to finance. We regret any inconvenience caused,” he said.

He added that the bank is aligned with broader local development goals. “We will continue working with stakeholders in Kayonza to support the district’s development initiatives,” Mugisha affirmed.

On agricultural finance, he reiterated that under the CDAT programme, 90% of the loan is issued at the subsidised 8% interest rate, with the remaining 10% covered by the client. He noted that when efficiently directed, such financing would “provide a significant boost to the agriculture sector, which remains the backbone of the district’s economy.”

Kayonza District Mayor, John Bosco Nyemazi, pointed to the district’s untapped potential in hospitality, particularly in areas near Akagera National Park.

“Our towns, including Kabarondo and Mukarange, still lack essential infrastructure. We are arranging meetings with banks and the private sector to improve access to finance. Investing in these areas will not only uplift lives but also transform the city’s landscape,” the mayor said.

Private Sector Federation Chairperson Richard Bashana also stressed the district’s strategic location as a trade corridor between the Northern and Central routes.

“Our town is expanding rapidly. We need funding to develop our industrial park and construct commercial complexes,” he said.

From neighbouring Rwamagana, trader Ezra Nshimiyimana praised BPR for swiftly approving his Rwf 75 million loan in just 10 days. Support, he said, had been denied by other financial institutions. However, he urged the bank to consider translating loan documents into Kinyarwanda.

“Most contracts are in English. Providing them in Kinyarwanda would help boost customer confidence and comprehension,” he said.

This dialogue, bank officials noted, marks only the beginning of a broader phase of engagement, as the institution continues to reshape its services while reaffirming its founding purpose: building financial inclusion from the ground up.

For More News And Analysis About Rwanda Follow Africa-Press