Africa-Press – South-Africa. Local real estate groups believe the United States’ proposed 30% tariff on South Africa could benefit the country’s property market in the long run.

However, this will depend on South Africa’s ability to significantly strengthen its trade relationships with countries other than the United States.

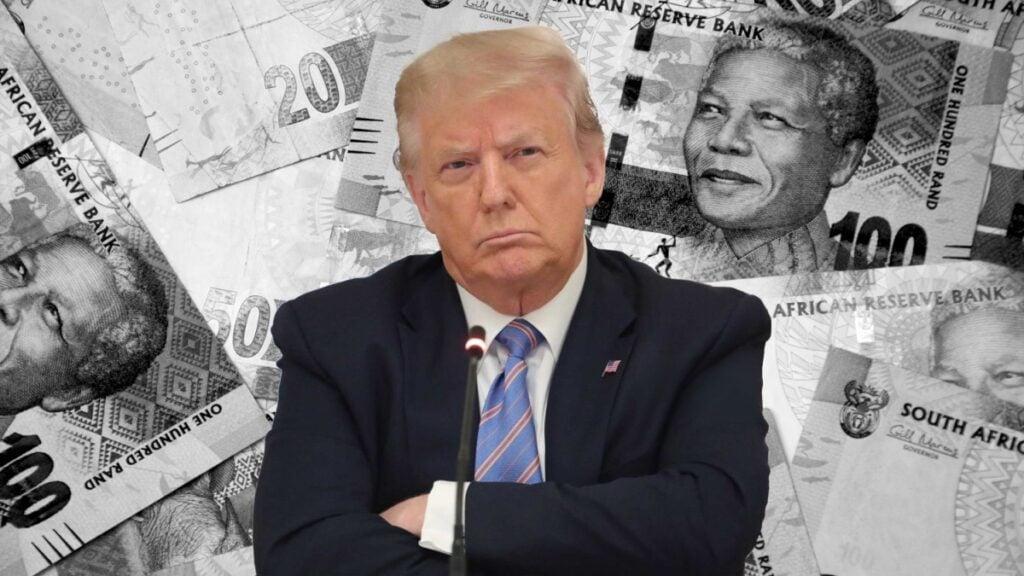

On 7 July 2025, US President Donald Trump made his long-awaited announcement regarding the tariffs he plans to impose on imports to the United States following his ‘Liberation Day’ speech earlier this year.

The US President informed South African President Cyril Ramaphosa that, from 1 August 2025, a 30% tariff will apply to all products from South Africa.

While Ramaphosa has reassured South Africans that the Trump administration may lower the planned 30% tariff on goods, this has not yet been confirmed.

Several economists have already warned of the devastating impact these tariffs will have on South Africa’s economy, considering the United States is South Africa’s second-largest trading partner.

However, FIRZT Realty Group CEO Denese Zaslansky said that while the tariffs’ immediate impact is expected to be negative, they could be a “long-term blessing in disguise” for South African property.

She explained that the expected economic slowdown and employment uncertainty resulting from the tariffs would initially lower demand for residential and commercial properties.

However, she believes this impact will be temporary, at most, as many local companies have started to prepare for higher tariffs over the past few months.

She said these businesses have already been actively seeking out and finding alternative markets for their products and services worldwide.

“This could accelerate South Africa’s long-term drive to diversify its export markets, cement new trading relationships with other countries and permanently reduce reliance on the US,” she said.

Chas Everitt International CEO Berry Everitt said many South African exporters are already leveraging agreements like the African Continental Free Trade Area (AfCFTA) to bolster intra-African trade and reduce dependency on the US market.

In addition, he pointed out that South Africa’s membership in the BRICS+ trade group may also help local exporters find large new markets to offset the US trade they lose.

One positive sign is that China, South Africa’s largest trading partner, announced last month that it would remove all tariffs on imports from the 53 African nations with which it has diplomatic relations.

This move will make South African products cheaper and more attractive to Chinese consumers.

Everitt warned that the local real estate sector is expected to feel the effects of the tariff decision for at least a few months while businesses adapt.

“There could be job losses in the export-driven industries, and the banks are likely to be more cautious about approving home loans,” Everitt said.

“This will slow demand for both residential and commercial properties and cause many investors and developers to press pause on new projects.

However, he pointed out that this also means property price growth will stabilise for a period and create opportunities for those with a positive view of South Africa’s longer-term future.

“What is more, we believe many buyers will soon find the real estate market one of the better places to invest as stock markets around the world become more volatile in response to the shifting US tariff scenario,” he argued.

There’s a catch

South Africa’s ability to avoid or overcome Trump’s tariffs relies on strengthening its trade relationships with other countries and diversifying its export markets.

The country must also stabilise its relationship with the United States and implement more business-friendly policies locally.

NWU Business School Professor Raymond Parsons explained that the aggressive US tariff policy creates a fragmented world trading system, which further exacerbates economic uncertainty, disrupts supply chains, and hampers economic activity.

However, while there is a great deal of fear psychology about what this means going forward, South Africa is not without remedies.

“As a small open economy, it remains essential that bilateral negotiations must continue to stabilise and consolidate future US-SA investment and trade relations,” he said.

“And collaboration between government and the private sector must continue to accelerate the

steady identification of alternative markets, for which South Africa must remain globally competitive.”

Therefore, Parsons argued it is essential for South Africa to speedily implement growth-friendly policies that build economic buffers and reduce costs for doing business.

This will enable South Africa to successfully deal with any global setbacks, including aggressive tariff policies, and build its economy.

This echoes recommendations made by Investec Wealth and Investment’s Osagyefo Mazwai earlier this year.

Mazwai argued that South Africa has several competitive advantages it can lean into to avoid the worst effects of US President Trump’s tariffs on imports into the world’s largest economy.

Mazwai suggested the following actions that South Africa could take to ensure its products remain competitive globally –

Decrease prices to offset the impact of tariffs and remain competitive. This will result in reduced margins for South African companies.

Introduce subsidies for negatively impacted industries. This is unlikely, given South Africa’s poor financial health.

Access new markets where prevailing export prices are acceptable and competitive, particularly in Asia and the Middle East.

Mazwai also said that South African companies could, relatively easily, circumvent tariffs on their products by rerouting goods through Mexico, Canada, and other countries that have more favourable trade terms with the United States.

For More News And Analysis About South-Africa Follow Africa-Press