Africa-Press – South-Africa. The South African Reserve Bank could lower its inflation target as soon as its policy meeting at the end of this month, according to Citigroup.

“We recently wrote that the SARB would likely drop the inflation target in the third quarter” to 3% — with a possible 1% plus-or-minus tolerance band — from its current 4.5% goal, said Gina Schoeman, the bank’s economist for South Africa.

“We believe there is a reasonable chance” of this happening at the upcoming meeting.

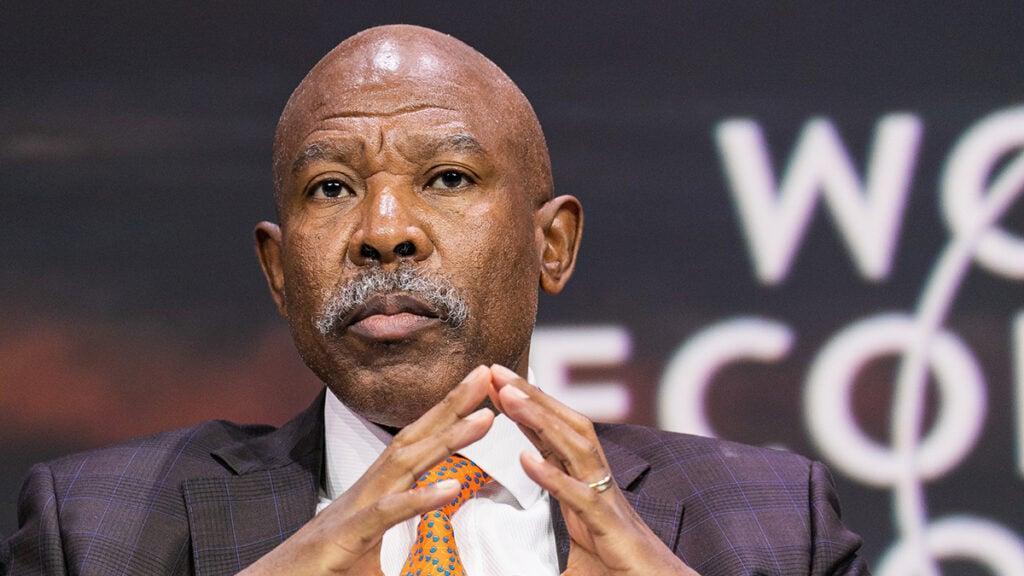

SARB Governor Lesetja Kganyago said on July 1 that a long-running review of the 3% to 6% inflation goal would be finalised “very soon,” with the country’s current tame price pressures presenting an opportunity to move.

He added that shifting to a lower target would be more effective if it were backed by Finance Minister Enoch Godongwana, who said on Tuesday that “such decisions should not be taken in haste” and that he has the final say on the matter.

Still, Citigroup cited several reasons why the central bank might forge ahead in adjusting a framework that hasn’t been changed since it was introduced 25 years ago, including low inflation expectations and research that highlights the benefits of aiming for a 3% goal.

The central bank has repeatedly advocated for a 3% goal and since 2020 has worked to keep inflation close to the 4.5% midpoint of its target range.

SARB studies show big benefits for public finances if it aims for a lower inflation target and moving now – with price pressures forecast to remain low — would give the Treasury time to work that shift into its analysis for a mid-term budget review in October, Schoeman said.

It would be easier for the target to be adjusted between May and September, while price growth still remains in the 3% region, she added.

For More News And Analysis About South-Africa Follow Africa-Press