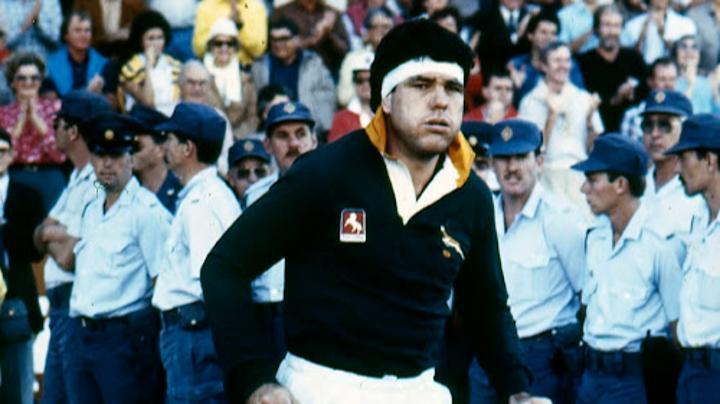

Africa-Press – South-Africa. The Paarl magistrate’s court has fined former Springbok rugby player Schalk Burger Sr and his company Welbedacht Wines for failing to submit VAT, pay-as-you-earn (PAYE) and income tax returns.

The court fined the company R6,000 on each count of failing to submit a VAT201 return for February 2023 and a monthly employer declaration return for March 2023.

Burger, 69, was convicted on 14 counts, which included failure to submit a VAT201 return for February 2023, a monthly employer declaration (EMP201) return for March 2023 and IT12 income tax returns for the period 2011 to 2022.

He was fined R6,000 or 12 months’ imprisonment on each count, of which R2,000 or four months’ imprisonment was suspended for five years.

“This amounts to a payable fine of R56,000, or 112 months’ imprisonment and a further R28,000 or 56 months’ imprisonment suspended for five years on specific conditions,” National Prosecuting Authority spokesperson Eric Ntabazalila said.

Burger successfully requested the court to grant him a deferred fine and was ordered to pay the R56,000 in instalments of R6,000 per month and a final payment of R8,000.

The accused entered into a plea and sentence agreement with the state. The court confirmed the agreement and convicted and sentenced him accordingly.

According to the agreement, Burger admitted that Welbedacht Wines was registered for VAT and PAYE at the Paarl office of the South African Revenue Services. Burger failed to submit the returns on behalf of the company.

In addition, Burger, in his personal capacity, was registered for income tax at the Paarl Sars office.

“Following his successful registration for e-filing in 2011, he failed to submit his IT12 income tax returns for the tax years of 2011 to 2022. This was despite Sars’ best efforts to encourage all taxpayers to submit their income tax returns.”

It was only after the institution of a prosecution and his being summoned to appear in court that he submitted all outstanding returns relating to himself and his company, and both are currently tax compliant.

“The accused’s son, Christiaan Francois Burger, was on July 21 also convicted and sentenced on 12 counts of failing to submit his IT12 personal income tax returns for the 2011 to 2022 period.”

The 40-year-old was sentenced to a fine of R48,000 or 96 months’ imprisonment, and a further R24,000 or 48 months’ imprisonment, suspended for five years on conditions.

The NPA said the sentence sent a strong message of deterrence.

“With the filing season for income tax currently under way, this is a clear message that failure by persons and juristic persons to file their Income Tax returns will not be tolerated. It is a serious offence that impacts negatively on the fiscus,” he said.

For More News And Analysis About South-Africa Follow Africa-Press