Malcolm Libera

Africa-Press – South-Africa. South Africa is missing out on a once-in-a-generation opportunity in gold and other metals by driving investment away through hostile policy choices and regulatory instability.

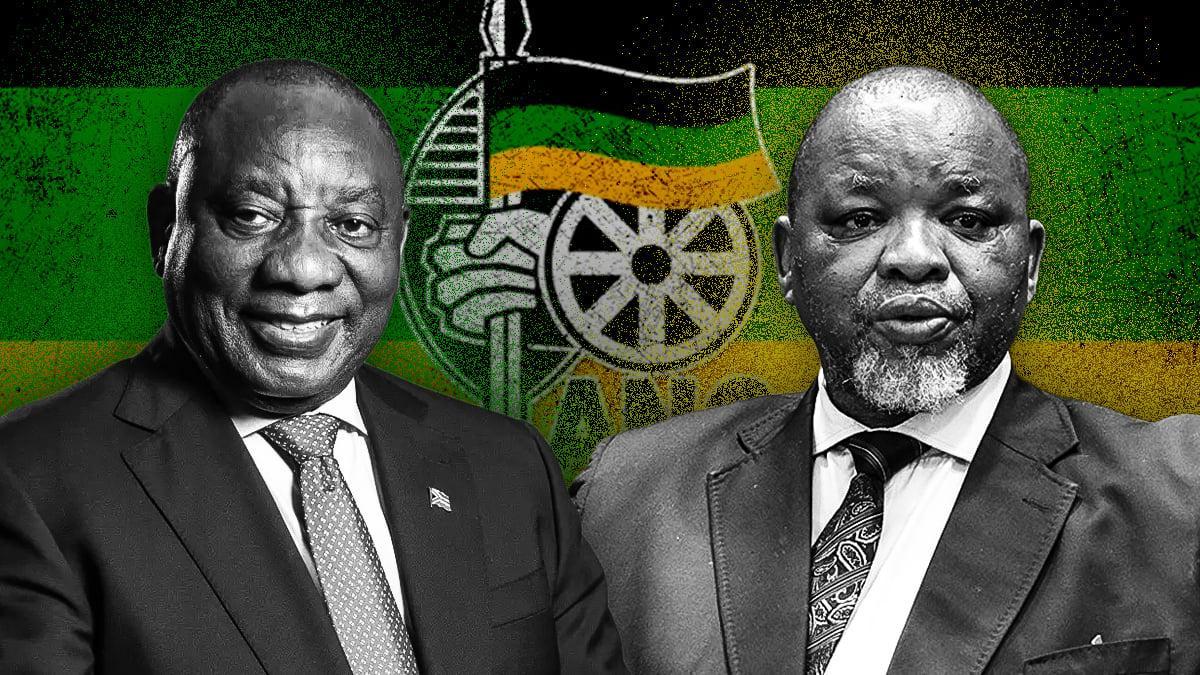

The country’s mining industry, under Mineral and Petroleum Resources Minister Gwede Mantashe, is effectively chasing the world’s most important mining capital out of its borders.

This is the feedback from mining analyst at Modern Corporate Solutions, Peter Major, who explained why this is the case in an interview with BizNews.

The surge in gold and other metal prices should have triggered a global rush into new and previously marginal mining projects, much like the boom South Africa experienced in the 1970s.

Because of this, Major explained that when prices rise and demand surges, investment naturally follows.

“That’s where capitalism comes in, and that’s what we saw in the ’70s, when South Africa was starting mines left and right because the gold price went up, and it made a lot of deposits that were marginal.”

However, he said South Africa has positioned itself as a high-risk, low-reward destination just as global capital is hunting for new opportunities.

“We’ve got more gold than any single country on the planet, and it’s known, but it’s going to take money. And money is capitalistic. It’s not socialist money that investors are putting out. It needs to see that you can get a return,” Major said.

According to Major, the country’s regulatory framework has become a significant deterrent.

He described the Mineral and Petroleum Resources Development Act (MPRDA) as a disaster that has been repeatedly amended “not for the better”.

“Our MPRDA has probably been changed four or five times, and every time we hear they’re going to redo it, we build up this false optimism—and it’s even worse. Gwede just doubles down,” he said.

He compared South Africa’s approach with countries like Zambia and the Democratic Republic of Congo, which scrapped bad policies and started again.

“They threw out the bombs, burned all those bad regulations and policies, and started afresh. Now tens of billions of dollars are going into those countries.”

“They didn’t fix their infrastructure or get cheap electricity—they just changed their policies.”

South Africa is watching capital, jobs, and growth pass by

Mining analyst at Modern Corporate Solutions, Peter Major

Major believes South Africa is missing out on the junior and mid-tier miners that typically drive exploration, job creation and new listings.

“We had 62 listed gold entities when I was getting into asset management in the early ’90s. I don’t think we’ve got 62 listed mining companies in South Africa now. And that’s tragic,” he said.

In his view, the current gold price boom should have delivered “five or ten listings a month”, but instead the country is falling further behind as new projects list elsewhere.

He is particularly critical of the government’s attitude toward investors, saying mixed messages and reluctant reforms scare capital away.

Referring to Mantashe’s quiet removal of a BEE requirement for prospecting rights, Major said it was done “reluctantly and in secret”.

“We don’t want to come in here if the minister has to reluctantly take it out in secret,” he said. “Just be bold. Change the legislation appropriately.”

Major argued that South Africa’s leaders may believe things are fine because of a stronger rand and high commodity prices, but that view is dangerously complacent.

“Maybe there’s a view from where they’re sitting that everything’s just fine, thank you,” he said. “But the less this government does, the better. Try doing nothing for a bit.”

In his assessment, Mantashe’s hard-line stance has worn thin with the global mining industry.

“He got the benefit of the doubt as well, but I’ve seen people increasingly challenge him on almost everything because he’s got his heels dug in,” Major said.

While not abusive, industry players are openly frustrated by what he sees as ideological resistance to capitalism.

Despite this, Major said global investors are still circling South Africa—not because of government policy, but in spite of it.

According to Major, the tragedy is that South Africa could be leading this global mining resurgence.

“It’s in the politicians’ hands. They can do it. Instead, we’ve got this horrendous investment environment that prevents money from coming in and building mines,” he said.

In his view, unless policy direction changes, the country will continue to watch capital, jobs and growth flow north and overseas while its own mineral wealth remains locked in the ground.

Source: businesstech

For More News And Analysis About South-Africa Follow Africa-Press