Africa-Press – South-Africa. JOHANNESBURG – AngloGold Ashanti, the world’s third-biggest gold producer, recorded its highest cash flow since 2011 and returned bumper dividends during the six months ended December 2020 on the gold price rally.

AngloGold Ashanti posted a 485 percent year-on-year surge in cash flow to $743 million in 2020, from $127m in 2019, excluding proceeds from the sale of its South African assets helped by the gold price.

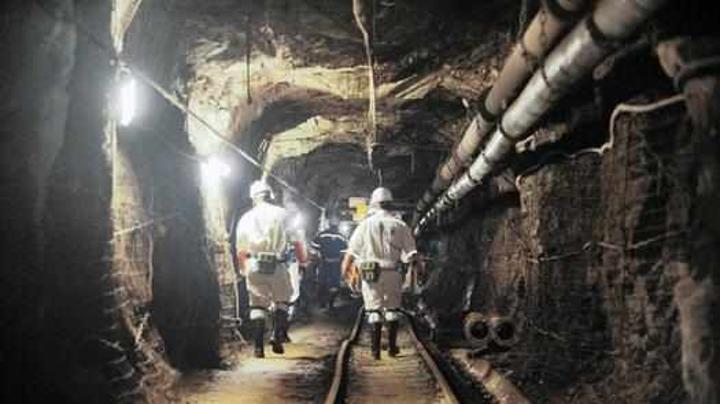

AngloGold Ashanti sold its remaining South African assets Mponeng, the deepest mine in the world, Mine Waste Solutions, and the West Rand Mine to Harmony Gold Mining as part of an effort to rationalise group operations.

Interim chief executive Christine Ramon said after several years of rationalising the portfolio the group had a clear and credible path to disciplined, high-return growth.

“We’ve built a solid balance sheet, which allows us to continue self-funding our capital investment while rewarding shareholders,” Ramon said.

AngloGold Ashanti declared a full-year dividend of R7.05 per share, compared to a dividend of R1.65 in 2019.

The company lifted its production guidance, saying it aimed to grow annual output from last year’s 3.05 million ounces to between 3.2 million ounces and 3.6 million ounces by 2025.

This growth was expected mainly to include the ramp-up of the Obuasi mine in Ghana, and incremental improvements from existing assets in the next two years.

“Beyond that, it will include the addition of new production from Colombia, assuming that plans for investment are approved by the board of the company later this year,” said the group.

[email protected]

BUSINESS REPORT