Africa-Press – South-Africa. The National Treasury projects strong revenue growth for South Africa over the next three years, and while hikes in official tax rates seem increasingly unlikely, the state may need to rely on bracket creep to meet these targets.

A stronger, more capacitated, and increasingly efficient South African Revenue Service (SARS) will also play a large role in helping the Treasury meet its revenue projections.

The Bureau for Economic Research’s Lisette IJssel de Schepper said in the firm’s latest Weekly Review that the Medium-Term Budget Policy Statement (MTBPS) presented a positive but fair narrative for South Africa’s future fiscal dynamics.

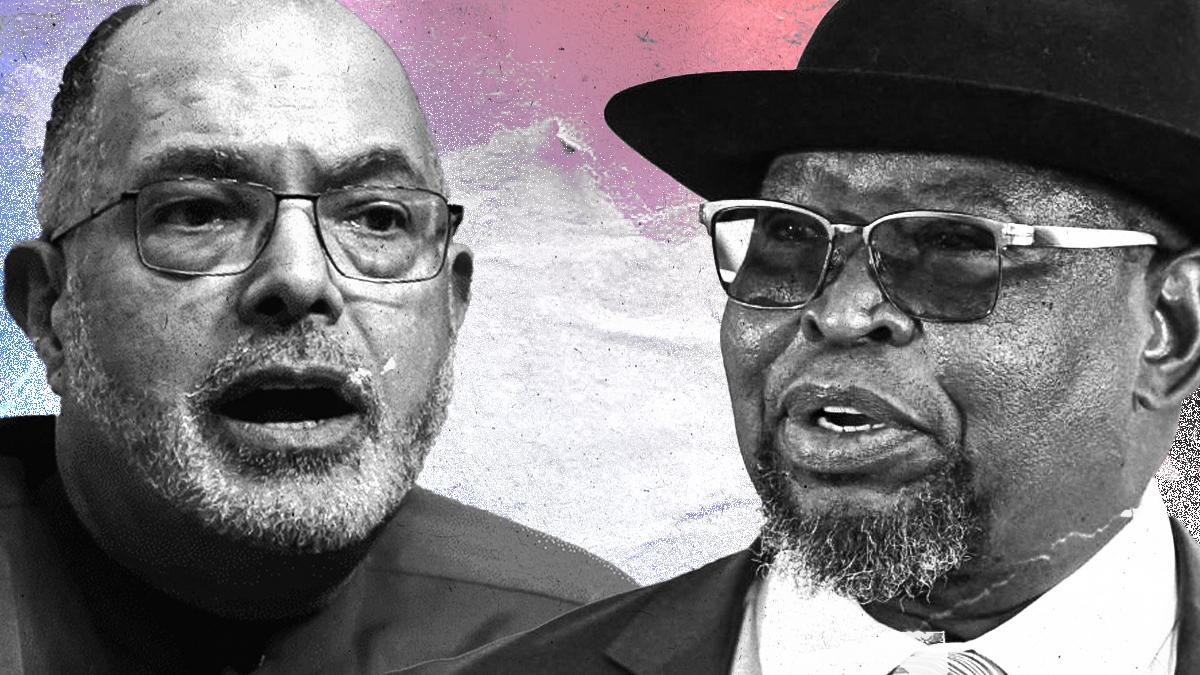

The MTBPS, which Finance Minister Enoch Godongwana presented on 12 October, showed that South Africa is on track to deliver a larger-than-expected primary budget surplus for the 2025/26 fiscal year.

This was aided by better-than-expected revenue performance in 2025/26, due to higher net value-added tax (VAT) collections and taxes on corporate income and profits.

These factors provided the state with a welcome revenue boost, with gross tax revenue R19.7 billion higher than projected in the May 2025 Budget.

On the back of 2025/26’s strong revenue growth, the Treasury said tax collections are expected to remain buoyant over the medium term.

Revenue is projected to increase from R2 trillion in 2025/26 to R2.4 trillion in 2028/29. This will see the tax-to-GDP ratio increase from 25.7% to 26.4%.

IJssel de Schepper said that while these revenue forecasts seem fair, they will likely require more personal income tax (PIT) bracket creep to materialise.

Bracket creep happens when the Treasury does not adjust South Africa’s PIT brackets for inflation, which increases PIT revenue without explicitly raising the tax rate.

The Treasury has used this “hidden” tax to boost its PIT revenue for the past three fiscal years, without needing to increase the tax rate South Africans pay.

In the 2025/26 fiscal year, no inflationary adjustment to tax brackets and rebates added around R15.5 billion to the government’s tax take.

Raising revenue

In the MTBPS, the Treasury also conceded that, despite better-than-expected revenue performance in 2025/26, gross revenue collection is projected to fall short of 2025 Budget estimates by R15.7 billion in 2026/27 and 2027/28.

It explained that this is, in part, because lower inflation results in a downward revision to the estimates for tax base growth over the period.

This lower inflation rate is expected to result from the lower inflation target also announced in the MTBPS, which will see South Africa’s target go from a range of 3% to 6%, with a focus on the midpoint, to 3%.

In addition, the Treasury said improved tax revenues will require more sustainable economic growth and further gains in tax compliance and administration.

The Treasury attributed its improved revenue performance in 2025/26 to several factors, including a 7.8% jump in domestic VAT collections and slower growth in VAT refunds due to stronger enforcement and weaker economic activity.

Corporate and dividend tax collections also boosted revenue, as they benefited from strong collections in the trade, electricity and finance sectors, as well as large one-off dividend tax collections in mining and retail.

Prior to the MTBPS, many economists expected this corporate tax windfall, as a commodity boom during the year, particularly gold and platinum, boosted mining profits.

Another significant factor that boosted revenue collection in 2025/26 was a more efficient taxman, with SARS having been allocated an additional R4 billion in the May 2025 Budget. This was intended to increase debt collection by R20 billion to R50 billion per year.

While SARS data for the first six months of the year shows that it is not yet on track to meet these targets, the taxman has obtained additional skills to address complex cases, which should improve collections for the rest of the year.

For More News And Analysis About South-Africa Follow Africa-Press