Africa-Press – South-Africa. Healthcare was the best-performing asset class in South Africa at the end of 2023, followed closely by industrial shares and the financial index. Globally, US equities dominated, generating a return of over 26% last year.

This was revealed in the 2023 Alexforbes Manager Watch Annual Survey, where the country’s largest asset managers were listed and investment trends outlined.

The Alexforbes survey of retirement fund investment managers showcases the performance of institutional fund managers in South Africa. It ranks the largest and best asset managers and gives other information, including their respective BBBEE ratings.

The Alexforbes Manager Watch has tracked the retirement fund investment management industry since the dawn of democracy in South Africa. The survey provides a key reference point to all South African retirement funding industry stakeholders.

Alexforbes said South African equities experienced a downward trend for most of 2023, undergoing a notable resurgence in the final quarter with a gain of 10.62% in US dollar terms to end the year 1.94% higher.

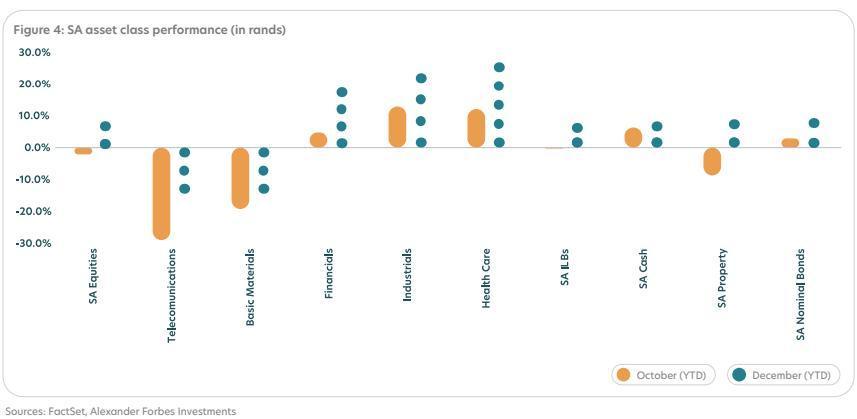

Returns in rands fared slightly better, registering at 9.25% for the year, providing a favourable outcome for most local investors. Local bonds closely trailed, delivering a robust return of 9.7% for the year, outperforming the Stefi Index that tracks money market performance, which posted a return of 7.8%.

In a noteworthy turn of events, local property emerged as the top-performing major asset class, yielding a return of 10.15% for the year. On the other end, South Africa’s telecommunications sector and basic materials performed poorly despite recovering slightly towards the end of the year and were the only two classes to generate negative returns.

Both of those asset classes posted negative returns of around 15% in 2023. The performance of South African asset classes can be seen in the graph below.

Globally, US equities outperformed all other major asset classes, returning 26.29% in 2023.

For most of the year, performance was driven by the ‘Magnificent Seven’ tech and AI stocks, contributing approximately 80% to the index returns. The Magnificent Seven includes companies such as Apple, Microsoft, Alphabet (Google), Amazon, Meta, Nvidia, and Tesla.

European equities also posted strong returns for the year. The index ended at 20.66% for the year, while UK equities lagged due to higher exposure to underperforming energy stocks and sterling strength, concluding the year at 12.48%

For most of the year, emerging market equities battled headwinds associated with the issues surrounding China. Despite these hurdles, the index achieved a double-digit return of 10.2% for the year. Chinese equities, on the other hand, are down -11.04% for the year.

The economy has faced numerous economic challenges that have filtered into the markets and continued to drive sentiment towards Chinese stocks to very low levels.

Positive momentum prevailed in the fixed-income markets, characterised by a more accommodative stance on interest rates. The World Government Bond Index showed that government bonds demonstrated resilience, returning 5.19% for the year.

The shift from the third to the fourth quarter witnessed a significant decline in the US 10-year Treasury yield, dropping from 4.57% to 3.87%. A similar trend was observed in the UK 10-year gilt and German 10-year Bund yields.

The performance of global asset classes is shown in the graph below.

For More News And Analysis About South-Africa Follow Africa-Press