Africa-Press – South-Africa. The Electricity Minister is now focusing on how the price of electricity can be lowered in South Africa, directing research on how the pricing structure can be changed and how energy generation costs can be brought down.

This comes after the minister said he believes that while load-shedding may not have come to an end permanently, the worst of it is passed.

While one crisis appears to have been solved, South Africa’s electricity prices are posing a new headache for the minister, as they have risen 1,000% in the past 20 years.

Apart from the immense strain this has placed on households, it has also complicated the Reserve Bank’s efforts to reduce interest rates and plans to move to a lower inflation target rate.

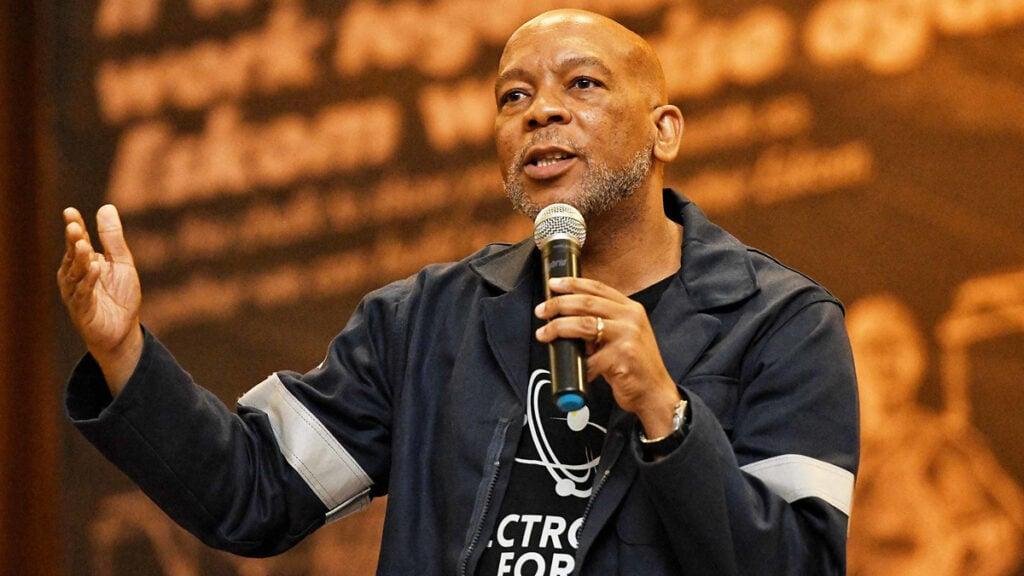

Electricity Minister Kgosientsho Ramokgopa has been calling for a new electricity pricing plan for nearly a year, and it has been the ministry’s main focus since the end of July 2024.

“Our electricity pricing plan needs to kick in, and that is the primary preoccupation of the ministry now, working with Eskom’s Distribution division and municipalities,” Ramokgopa said last year.

More engagements will also be held with South Africa’s energy regulator, Nersa, regarding ways to limit the increasing cost of electricity and expand access to affordable energy.

He said that industry players, including Eskom and municipalities, are committed to finding a solution to the rising cost of electricity in South Africa.

The head of the energy secretariat at the South African National Energy Development Institute (SANEDI), Professor Sampson Mamphweli, said the institute has been tasked with looking into the electricity pricing framework.

“We will look into the pricing framework and various other things that can be done to bring the cost of electricity down and expand the access to energy in South Africa,” he told Newzroom Afrika.

There are estimated to be between four to five million households that do not have access to electricity in South Africa, despite the government’s efforts at expanding access.

Mamphweli said there are some low-hanging fruit that can be achieved as part of this process to bring down the price of electricity.

Such fruits include reducing fixed charges or making them variable to be tied to the amount of electricity used as these fees are usually used to fund maintenance of transmission and distribution infrastructure.

This makes it logical that the more electricity a user consumes, the more they use the transmission and distribution infrastructure and, therefore, the more they should pay.

On the other hand, if one uses less electricity from the grid, they should pay less of a fee to fund its maintenance.

“We will be looking closely at the pricing framework at SANEDI, and the minister will make an announcement in terms of the particular areas where changes can be made,” Mamphweli said.

Private competition the long-term solution

Professor Sampson Mamphweli

While changes to the pricing structure may bring some relief to electricity users in South Africa, the only long-term solution appears to be increased competition in the energy sector.

Increased competition from private players, in particular, will push prices downwards and, coupled with new technologies coming online, the cost of generation will come down.

However, this does not mean that the pricing structure should not be changed, with increased private generation requiring changes to ensure the grid, which will remain state-owned, can be maintained and expanded.

The Organisation for Economic Co-operation and Development (OECD) explained in its recent economic survey on South Africa how the country can increase competition in the electricity sector to drive down prices.

It said that South Africa’s electricity sector is the second-least competitive of all OECD members and nearly all emerging markets.

A more competitive electricity sector will reduce South Africa’s reliance on a single provider, Eskom, enhancing resilience and bringing new technologies online.

Eskom’s current financial health limits its investment in new capacity and has contributed to its soaring cost of producing electricity, which is passed on to consumers.

This, in turn, ensures the country is still vulnerable to power outages and limits economic growth, as any pickup in activity will push demand significantly above supply.

The OECD said a fundamental restructuring of the entire electricity supply chain is needed to ensure long-term electricity security.

This includes establishing a competitive market, opening the distribution segment to include private operators and strengthening municipal financial and managerial capacity.

The electricity regulation component of the OECD’s Product Market Reform (PMR) indicator shows that South Africa’s electricity sector is more heavily regulated than nearly all OECD and emerging economies.

Eskom owns or operates most of the sector’s transmission and distribution segments and generates around 91% of the country’s electricity.

This current structure limits the entry of new players in all segments, providing preferential access for Eskom’s ageing fleet to the grid and limiting competition and energy security.

Third-party access is not yet fully established in both the transmission and distribution segments.

Access to the transmission grid is mainly limited to specific contracts procured by Eskom and the Electricity Ministry, with access granted based on availability and priority to Eskom generators.

In effect, Eskom has the power to set barriers for renewable energy investments and prioritise its own energy generation facilities, creating a major conflict of interest.

Slow progress has been made in reforming South Africa’s electricity market, with Eskom being unbundled into three separate entities.

The National Transmission Company of South Africa (NTCSA), operational since July 2024, was established as a wholly owned subsidiary of Eskom with an independent board, which is an important step towards full unbundling.

This separate entity is expected to ensure better and fairer access to the grid for all electricity generators.

A new fully independent transmission system operator (TSO), expected to replace the NTCSA, will manage the competitive market.

The Electricity Regulation Amendment Act, passed in August 2024, established the framework for a competitive regulatory environment.

This framework lays the foundation for creating a wholesale electricity market where energy can be bought and sold.

This will, in turn, facilitate a more flexible and efficient expansion of generation capacity, resulting in enhanced energy security.

For More News And Analysis About South-Africa Follow Africa-Press