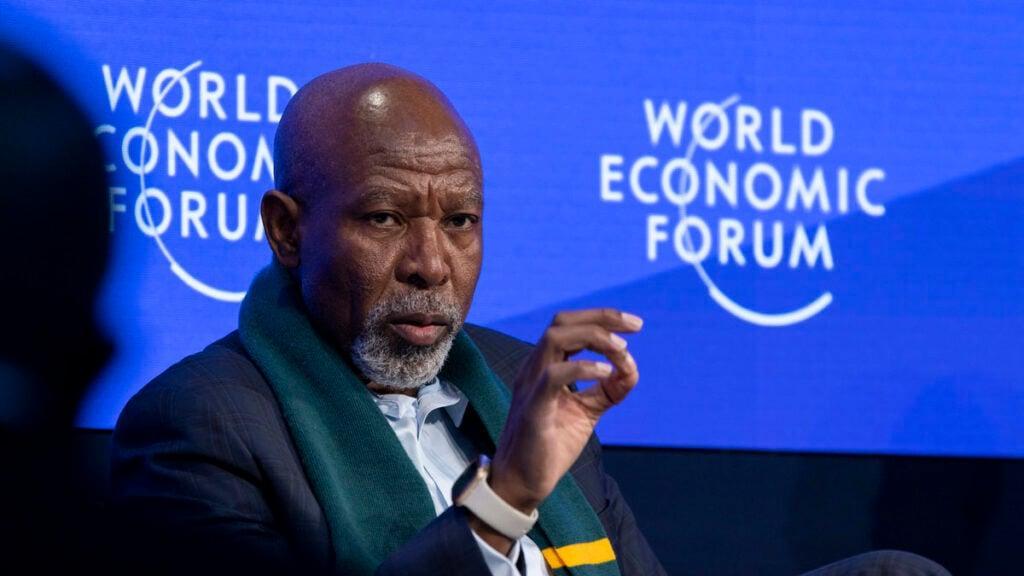

Africa-Press – South-Africa. A review of South Africa’s inflation target by the National Treasury and the nation’s central bank is close to completion, Governor Lesetja Kganyago said.

“It should be very soon that it’s finalised,” Kganyago said in an interview with Bloomberg Television on Tuesday on the sidelines of a European Central Bank forum in Sintra, Portugal.

“Our teams have been working very hard. They are fine-tuning the final details, and they’ll make their recommendations to the minister and the governor.”

South Africa’s inflation rate was steady at 2.8% in May and has been hovering near or below the floor of the Reserve Bank’s 3%-to-6% target range for eight consecutive months, creating “opportunistic disinflation” that will help policymakers to anchor price expectations at a lower level, he said.

The central bank’s inflation target, which was adopted in 2000 and hasn’t been reviewed since, is currently under review by teams from the SARB and Treasury.

Once it’s completed, the recommendations will be presented to Kganyago and Finance Minister Enoch Godongwana.

“We have impressed on the team — there is an opportunity right now of using opportunistic inflation and that the sooner we finalize that the better,” Kganyago said, adding that while the central bank could go it alone in aiming at a lower target, such a shift would be much more effective if it had political buy-in.

“These things always work because you have mobilised the whole of government and society around the target,” the governor said.

“And this particular minister is a big advocate of central bank independence, is a big advocate of prudent macro-economic management, and it’s very important that he is on board.”

Policymakers will deliver their next rate decision on July 31. They cut the benchmark gauge by 25 basis points to 7.25% at their last meeting in May and some analysts see them easing again at the end of this month.

Kganyago said he was comfortable with the trajectory of South African inflation, but the outlook remains clouded by uncertainty stemming from geopolitical tensions, including US President Donald Trump’s trade war.

These risks warrant the central bank’s current policy stance, which he characterised as still restrictive while being fairly close to a neutral setting that neither heats nor cools the economy.

For More News And Analysis About South-Africa Follow Africa-Press