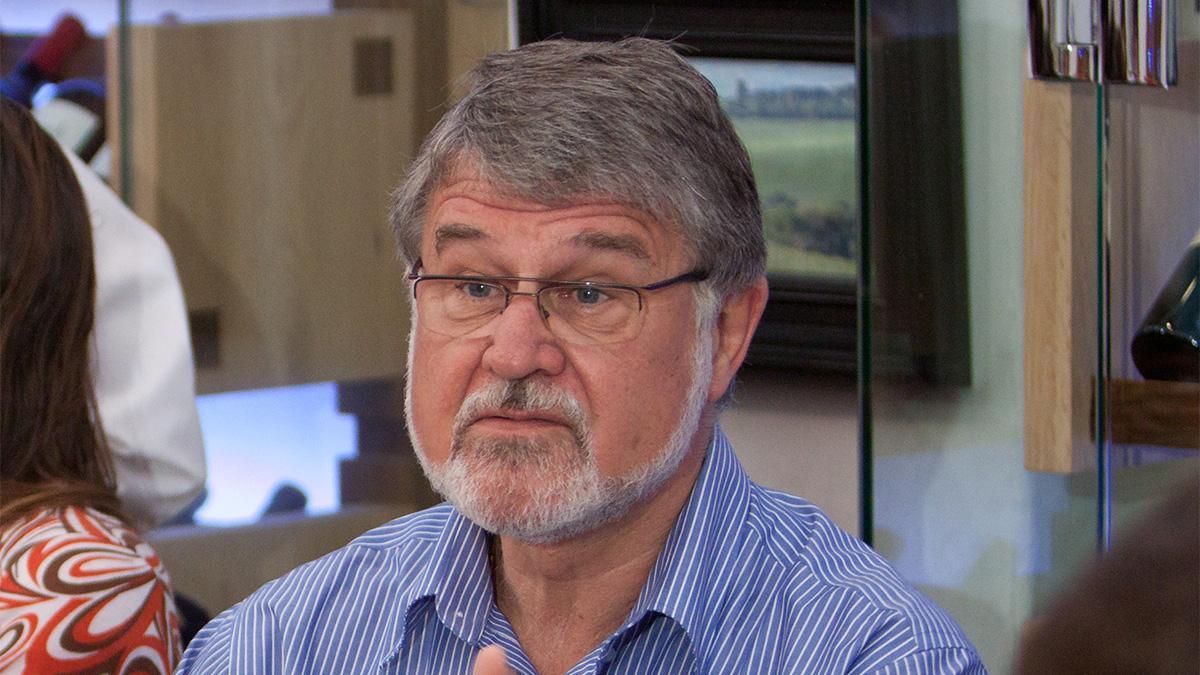

Africa-Press – South-Africa. South African billionaire Jannie Mouton looks set to acquire JSE-listed Curro for R7.2 billion, with more details on the possible deal given to shareholders.

Shareholders will vote on the deal at a general meeting scheduled for 31 October, which, if approved, will see Curro delisted in early December.

Mouton is one South Africa’s richest men and founded the PSG Group, which would go into support many successful businesses, including Capitec, PSG Financial Services and Curro.

Curro Holdings is South Africa’s largest independent school network with over 70,000 students.

Mouton plans to acquire Curro via the Jannie Mouton Foundation, a Public Benefit Organisation (PBO). The trust already owns around 3.0% of Curro.

The trust’s aim is to position Curro as an ever-evolving independent education institution that uses its funds to build more schools, expand facilities and offer bursaries.

South Africa has opportunities to build and operate more schools and enhance quality educational outcomes nationwide.

If the transaction proceeds, the Curro business will continue to grow independently, with the current management on board. Curro will also become a registered PBO and de-list from the JSE.

The trust plans to accelerate Curro’s growth by reinvesting its potential returns and surpluses, which will scale its offerings via new builds, expansions and the acquisition of new schools

As per the offer, Mouton plans to offer existing shareholders a small cash consideration, with existing shareholders instead given Capitec and PSG Financial Services shares.

The offer works out to around R13 per share, and includes:

A cash Consideration of R0.85837 per Scheme Share (which will comprise approximately 6.6% of the Scheme Consideration)

Capitec Shares in the ratio of 0.00284 Capitec Shares per Scheme Share (which will comprise approximately 79.7% of the Scheme Consideration);

PSG Financial Services Shares in the ratio of 0.07617 PSG Financial Services Shares per Scheme Share (which will comprise approximately 13.7% of the Scheme Consideration).

“For the foundation, acquiring Curro represents a game-changing R7.2 billion donation in quality education—quite possibly the largest philanthropic contribution South Africa has ever seen,” said Mouton.

“Over time, this will open the door for thousands more children to attend Curro schools through bursaries, broadening access to excellent education.”

“At the same time, Curro shareholders stand to benefit from a 60% premium on the current market price, ensuring that both education and investors gain from this bold initiative.”

More details come in

Curro has now published a new circular to shareholders, which gives further details on the potential sale ahead of a vote on the deal at the end of the month.

A General Meeting will be held at 14h00 on Friday, 31 October 2025, to vote on the offer.

If shareholders approve the deal, shareholders’ entitlement to the consideration shares will see a workaround.

Should the shareholders’ consideration shares, i.e. the Capitec and PSG Financial Services shares, work out to a fraction, the fraction will be rounded down to the nearest whole number.

Shareholders will then receive a cash consideration for the remaining fraction of the consideration share.

The remaining fractions of consideration shares will be bundled and sold to the market on behalf of the scheme participants to fund the cash payments.

Trading in Curro scheme shares on the JSE is expected to be suspended from the commencement of trade on about 26 November 2026.

Curro’s listing on the JSE will then be terminated from 2 December 2025, with the company going private. Further details can be found in the circular below:

For More News And Analysis About South-Africa Follow Africa-Press