Africa-Press – South-Africa. While economists anticipate a hold or an interest rate cut in July, they have not ruled out the South African Reserve Bank (SARB) changing tack in response to global market uncertainty down the line.

This could be exacerbated by the Reserve Bank chasing a lower inflation target by the end of the year, which would tilt the scales further towards hikes should inflation not match.

However, Aluma Capital chief economist, Frederick Mitchell, warned that a hiking path could push South Africa’s economy further into the doldrums and hurt the country’s longer-term economic growth.

The Reserve Bank is in the unenviable position of having to navigate a particularly sensitive time.

South Africa’s headline inflation rate has surprised on the downside and remained outside the 3% to 6% range set by the SARB.

This has given the Reserve Bank’s Monetary Policy Committee (MPC) impetus to vote in favour of rate cuts totalling 100 basis points since September 2024.

These cuts have come even in the face of growing global uncertainty pushed by the United States’ unpredictable trade and tariff war, along with rapid geopolitical shifts and conflicts resulting in knee-jerk market reactions.

Mitchell said that, in this context, South Africa is walking a tightrope and faces a heavily constrained path.

While the country enjoyed a modest trade surplus with the US, totalling R37 billion, this was largely thanks to trade enabled by the African Growth and Opportunity Act (AGOA).

The future of South Africa’s participation in the Act is hanging by a thread, and the benefits of the Act are likely to be wiped out by the looming imposition of a 30% tariff on local exports to the US on 1 August.

On that point, Mitchell noted that the incoming tariff hike risks sending affected industries into an even deeper crisis.

“As detailed in recent trade briefs, the automotive sector has already suffered an 82% decline in exports to the US in the first half of 2025 due to existing tariffs,” he said.

“A further escalation, especially with a potential additional 10% tariff targeting BRICS countries opposing US policies, could lead to factory closures and significant job losses.”

The Reserve Bank has little room to act

In the context of instability and rising inflation, Mitchell said that conventional wisdom would suggest that raising interest rates could curb this.

However, in the current economic environment—where inflation is subdued, but economic growth is threatened—tightening monetary policy could be disastrous.

Mitchell said this is especially true if the underlying trade issues are not resolved.

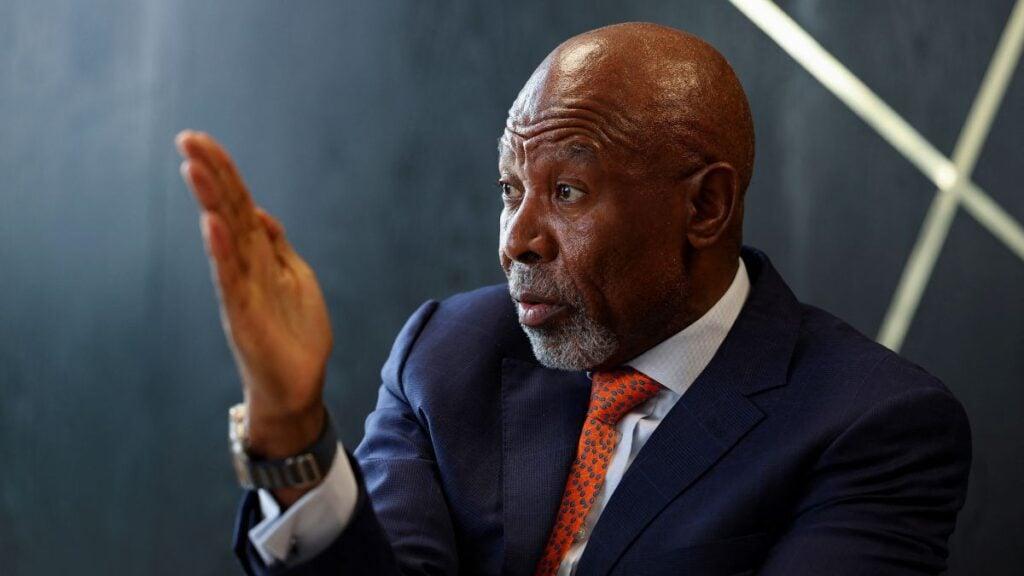

“As SARB Governor Lesetja Kganyago has noted, inflation is expected to stay within the target range, but global trade war uncertainties loom large.”

“Increasing interest rates in such a fragile environment risk stifling growth further, especially as global economic slowdown cues stemming from China’s potential slowdown and trade tensions compound the problem.”

The economist noted that South Africa’s economy is highly reliant on exports and sensitive to external shocks, so a restrictive monetary stance could deepen recessionary pressures without equipping the economy to withstand the imminent trade disruptions.

Mitchell said that, while efforts to curb inflation are vital, the scope for interest rate hikes in response to global trade tensions and tariffs is limited.

He said that it would be better for the country if stability was found through fiscal prudence rather than reactionary over-tightening of monetary policy to inflation.

“The health of South Africa’s economy hinges on resilient trade relations and sound fiscal management rather than aggressive rate hikes amid uncertain international conditions,” he said.

However, the pressure on interest rates isn’t just coming from outside South Africa.

They will soon have to contend with a lower inflation target being set at a time when inflation is likely to be ticking higher.

Economists and analysts anticipate a new inflation target to be set before the end of the year, likely at around 3%.

It usually takes around two years for a new target to be reached, and the Reserve Bank itself has warned of a “short term pain, long term gain” type of impact on households.

That is to say, households could expect to see interest rates held or even hiked as the macroeconomics settle toward the target. This means no relief from rate cuts.

Over the long term, however, this would prevent prices from increasing as rapidly as consumers have seen with the target at the 4.5% mid-point of the SARB’s range.

In the immediate term, the SARB’s MPC will meet at the end of the month to determine its next policy move.

Economists are split between another 25 basis point cut in rates—like the final in the cycle—or a hold, as they committee waits to see what economic shocks lie ahead.

For More News And Analysis About South-Africa Follow Africa-Press