Africa-Press – South-Africa. Petrol prices are set for another cut in September as oil prices continue to come under pressure and the rand strengthens against the US dollar.

This will add to the relief petrol users received at the beginning of August, when petrol prices were cut by 28 cents per litre.

However, diesel motorists are set to experience further pain, as supply remains tight as refineries in the northern hemisphere struggle to catch up with demand.

The Central Energy Fund (CEF) tracks fluctuations in the price of international oil products and the rand-dollar exchange rate to forecast potential changes to the price of fuel in South Africa.

Its latest data indicates the following changes to the price of petrol and diesel for September –

Petrol 93 – decrease of 10 cents per litre

Petrol 95 – decrease of 5 cents per litre

Diesel 0.05% – increase of 12 cents per litre

Diesel 0.005% – increase of 10 cents per litre

These prices are set to decline over the coming weeks, barring any major disruptions to global oil supply or geopolitical shocks.

Oil fell to its lowest price in more than two months as US President Donald Trump announced that he plans to meet with his Russian counterpart to bring the war in Ukraine to an end.

Any peace settlement is expected to increase the availability of Russian oil in global markets, pushing down prices.

Kremlin foreign policy aide Yuri Ushakov told reporters Russia and the US had agreed on a venue for the meeting, which would be disclosed later, Bloomberg reported.

This has driven oil prices to move lower in August following three consecutive monthly gains, with the Organisation for Petroleum Exporting Countries (OPEC) set to increase supply from its member states.

OPEC has been steadily unwinding the production caps placed on some of its member states to ensure they can retain market share.

These factors have been compounded by fears of slowing global economic growth, which will weigh on oil demand, due to Trump’s tariffs.

On the other hand, the rand has held its own despite elevated global uncertainty and a misfiring local economy.

This is mostly explained by the weakening of the US dollar rather than a fundamentally stronger rand, as investors increasingly look outside American assets to safeguard their wealth.

Investors are increasingly concerned about the United States’ financial health, with the country’s debt burden reaching record levels and its government running record deficits outside of wartime.

So far in 2025, investors have shied away from investing in the traditional safe haven of US Treasury bonds, looking to Europe, Japan, and Switzerland for enhanced stability.

This is largely a result of the increased uncertainty created by US President Donald Trump’s imposition of tariffs on the country’s trading partners and increased scepticism of the financial health of the US government.

The United States continues to run record deficits out of wartime, increasing its debt load to over $36 trillion, and resulting in it spending more on servicing its debt than on its renowned military.

As a result, emerging market currencies, such as the rand, will likely strengthen against the dollar over a sustained period for the first time in a decade.

Coupled with a potential commodity boom, the rand could strengthen significantly, helping to contain inflation and attract investment.

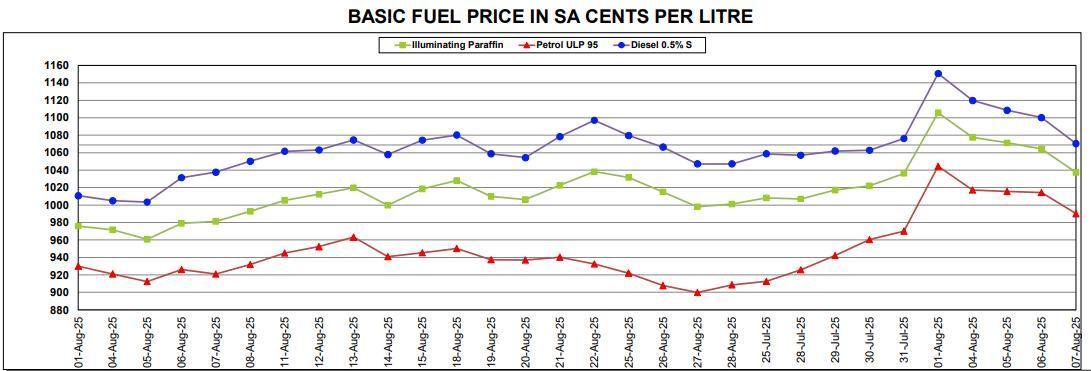

The graph below, courtesy of the CEF, shows the basic fuel prices of petrol, diesel, and paraffin in South African cents per litre.

For More News And Analysis About South-Africa Follow Africa-Press