Africa-Press – South-Africa. Renowned economist Roelof Botha says that the prime lending rate should be 1.25% lower than it currently is, which would mean an extra savings of R1,388 per month from the current rate.

Both said the latest Altron FinTech Household Resilience Index shows that, despite immense pressures, South Africans continue to display extraordinary staying power.

Reflecting on the second-quarter data, Botha said the figures show a level of improvement and confirm that as South Africans, it seems as though we’re trying our best to get by—and we actually are getting by.

Botha argued that if one had to choose a single word to describe South Africans in 2025, it would be resilience.

However, the index reflected a year-on-year improvement of 2.3%, which looks nice on paper, but the picture becomes more complex when explored in detail.

Botha noted that while many households are coping, a significant number are drawing on pension savings to stay afloat.

“There’s a lot of activity on the pension fund side, but unfortunately, these are people dipping into their pension funds,” he says.

He warned that these withdrawals are capped, taxed, and ultimately risky for long-term financial security.

While these withdrawals help in emergencies, they have artificially boosted parts of the index.

“These pension fund withdrawals have made a difference, but they’re not sustainable in the long term,” he stressed.

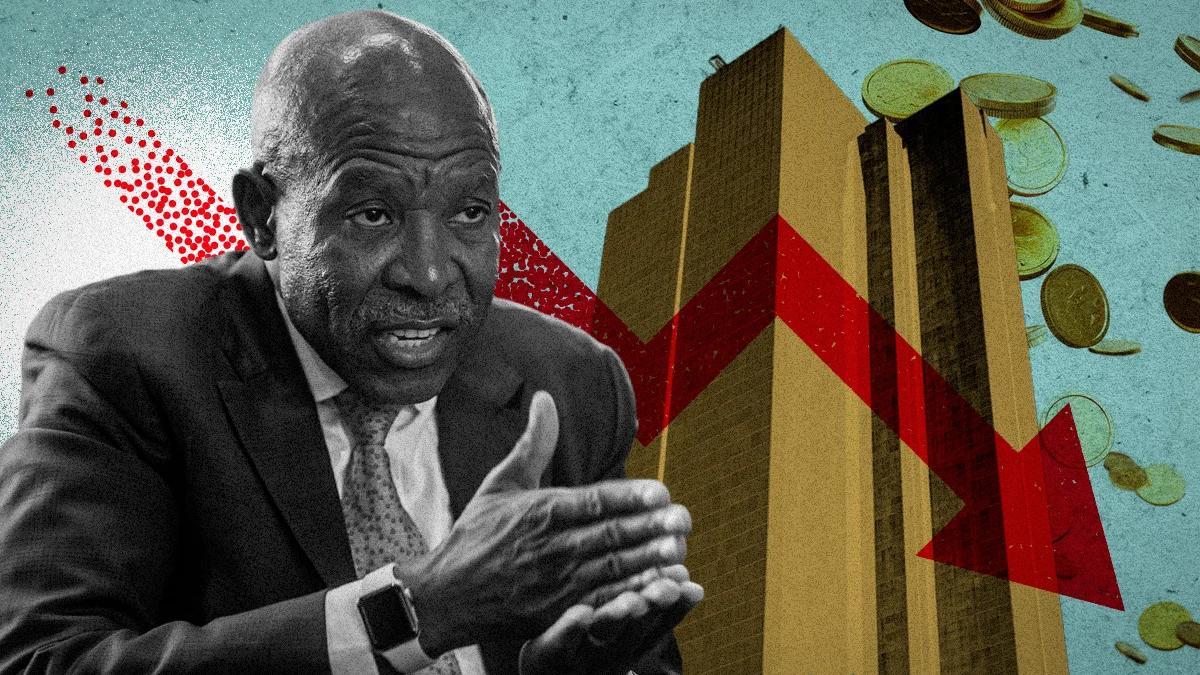

Turning to interest rates, Botha reaffirmed a long-held concern that South Africa’s borrowing costs remain unnecessarily high.

In November, the South African Reserve Bank (SARB) reduced the repo rate by 25 basis points, which provides some additional financial relief for homeowners and prospective buyers.

This decision, announced after the Monetary Policy Committee (MPC) meeting, brings the repo rate to 6.75% and the prime lending rate to 10.25%. The decision was unanimous.

While grateful for the recent cuts, Botha said the reduction is far from sufficient. “We’ve had a reduction of 150 basis points in the prime rate, and we are very grateful for that,” he noted.

South Africa urgently needs deeper interest rate cuts

Economist, Dr Roelof Botha.

However, he argued the current prime lending rate of 10.25% remains elevated, particularly when compared to inflation. “Prime 10.25 minus CPI 3.6 gives you a 6.8% real prime rate,” he explained.

Botha contrasted this with the period under former Reserve Bank governor Gill Marcus, whom he described as “the best governor of the Reserve Bank we’ve ever had.”

During her tenure, the real prime rate averaged 3.4% and the economy grew steadily at 2% to 3% per year.

In his view, monetary policy took a harmful turn after 2015. “There has been a profound shift in emphasis and the approach of the Reserve Bank has changed dramatically for the worse,” he argued.

He disputed the Reserve Bank’s claim that higher interest rates brought inflation under control.

“They are claiming credit for lower inflation, which is absolute nonsense. Our inflation came down because of a reduction in the oil price and a reduction in global freight shipping charges,” Botha said.

He noted that these costs spiked by 400% and 700% respectively after the pandemic before coming back down.

Botha stressed that South Africa urgently needs deeper interest rate cuts to support households and stimulate growth.

“We are sitting with this dilemma that we need deep interest rate cuts and our prime overdraft rate should be 9% or lower,” he said.

He added that many economists agree, and that ongoing research continues to reveal the economic damage caused by an overly restrictive monetary stance.

Despite these challenges, Botha repeatedly returns to one theme: resilience. South Africans continue to navigate adversity with determination..

However, he warned that they deserve a more supportive interest-rate environment to match their efforts.

Data from ooba Home Loans shows that a 125-basis-point reduction to a prime lending rate of 9% translates to extra monthly savings of R819 on a R1 million bond and R1,638 on a R2 million bond.

The latest oobarometer report highlighted that the average home price in South Africa has climbed to R1,695,257.

This means a 1.25% drop in interest rates would bring notable relief to homeowners over the last year.

For the average South African home priced at R1.695 million, the monthly repayment decreases by R1,388, providing much-needed relief to households.

While uncertainties remain, the combination of lower rates, easing inflation, and renewed confidence will benefit the property market and prospective buyers.

For More News And Analysis About South-Africa Follow Africa-Press