Africa-Press – South-Africa. Growing geopolitical upheaval and global policy uncertainty are among the biggest risks facing South Africa’s financial industry, the South African Reserve Bank says.

The nation is vulnerable to spillover effects from trade-related tensions and international conflicts because of the limited extent to which it can mitigate against them, the SARB said in its biannual Financial Stability Review on Thursday.

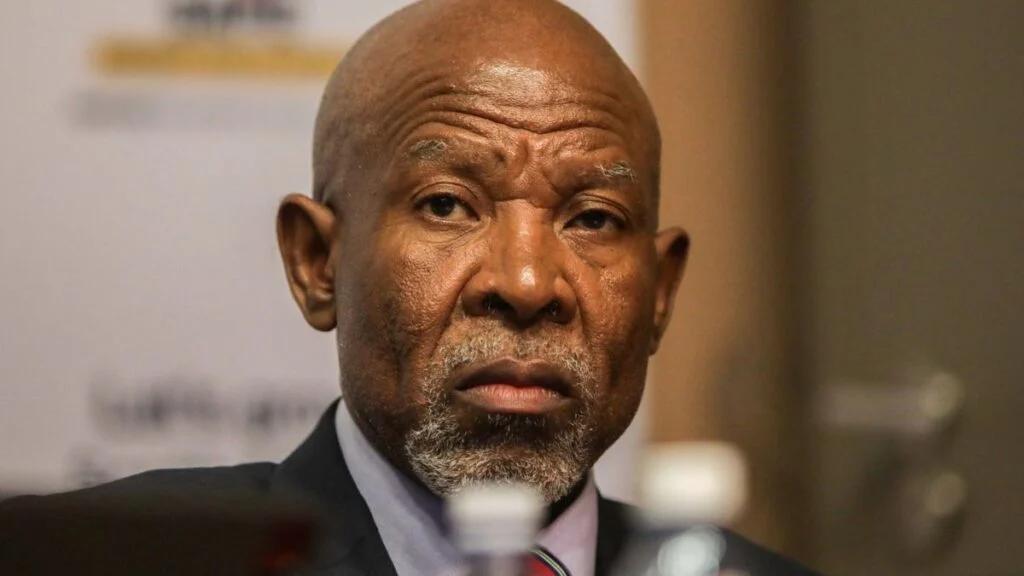

“Globally, we are witnessing a significant disruption of the international trade system,” Governor Lesetja Kganyago said in a briefing in Johannesburg.

“We are also seeing intensifying global conflicts, with the war in Ukraine ongoing and conflict escalating in the Middle East.”

The US this year imposed tariffs on everything from steel to autos.

Meanwhile, Israel launched a surprise attack on Iran last week and the Islamic Republic retaliated with waves of ballistic missiles and drones, raising fears of a wider regional conflict and disruptions to flows of oil and consumer goods.

The uncertainty caused by these events has led central banks to refrain from cutting interest rates, while investors have shifted away from riskier financial assets.

In the first five months of this year, foreign investors sold R111 billion of South African equities, while their share of government bonds declined to 24.5% from 24.6% between December and May.

Heightened market turmoil may lead to rapid capital outflows, the central bank warned.

A material selloff in rand-denominated government bonds may raise state borrowing costs and undermine fiscal sustainability, it said.

South Africa’s debt-to-gross domestic product ratio is forecast to peak at 77.4% in the year through March and it spends 22 cents of every rand collected in revenue on servicing its loans.

So far, South Africa’s financial system is demonstrating “a high degree of resilience” in response to the global shocks, Kganyago said. “The one thing that is certain is that uncertainty is here.”

The central bank concluded the country’s first-ever climate risk stress test of systemically important South African banks.

It found that Absa, Capitec, FirstRand, Investec, Nedbank and Standard Bank are reasonably well positioned to assess the dangers.

“Some challenges remain, specifically around data gaps and modeling capabilities,” it said.

According to the report, participant banks categorized 32% of their total credit exposure as climate sensitive by the end of 2023.

The risk of South Africa remaining on the Financial Action Task Force’s dirty-money list has reduced significantly since November.

South Africa’s credit-to-GDP gap has been negative since the fourth quarter of 2020, implying that loan extension hasn’t been excessive over this period and therefore isn’t considered a vulnerability from a financial-stability perspective.

For More News And Analysis About South-Africa Follow Africa-Press