Africa-Press – South-Africa. South African influencers are now firmly in the sights of the South African Revenue Service (SARS), and they are advised to get their tax affairs in order.

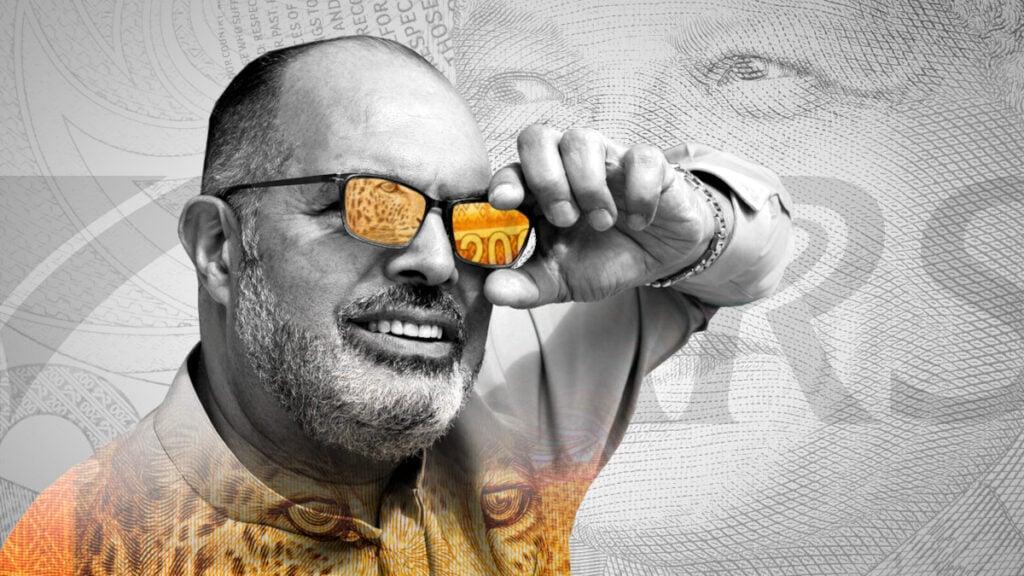

This was the warning from Mohau Lebese, managing partner at Accountants on Point, who explained that people who earn money by leveraging large social media followings must treat these earnings like any other form of income.

“Influencers are people who make money out of having a lot of followers on the various social media channels on which they post content. This is content aimed at earning revenue,” said Lebese.

“And SARS has urged these influencers to get their tax affairs in order, include this extra source of income, or watch out for the penalties.”

According to Lebese, many influencers fall short because they do not realise that even non-cash benefits must be declared.

“Unfortunately, yes, you have to,” he said when asked whether something as simple as a free meal offered to an influencer should be declared.

“Most of these influencers don’t have that information or education because they will be mainly like people who started from home doing funny videos and gained a lot of followers.”

“But on the other hand, they don’t have any tax knowledge. So yes, SARS needs you to declare these very kind benefits.”

Lebese explained that sponsorships, brand deals, free trips, meals, etc., all form part of your gross income and must be declared in your annual income.” Lebese added that the distinction comes down to whether there is a contractual obligation.

For example, if someone receives a gadget, unboxes it, and talks about it without any contractual requirement to promote the brand, that may not count as taxable income.

However, if the item is given as part of an agreement to promote the product, then SARS views it as income. Lebese also noted that it’s not easy to distinguish between the two.

For example, in industries like journalism and broadcasting, where free products or experiences are common, the situation can get more complex.

SARS is gearing up

“If you visit a restaurant and write a review about it, or if you stay at a luxury lodge in Botswana and share your experiences on the travel page of a newsite, any benefits you receive in exchange for your review will count as part of your gross income.”

“For example, if there is an arrangement between you, the newsite, and the owner of the travel lodge that allows you to stay there free of charge in return for your review, that income will still be considered taxable,” Lebese explained.

For independent contractors, this needs to be included directly in their income declarations.

For full-time employees, employers may classify such perks as fringe benefits and include them on the payroll.

Despite the rules being clear in law, Lebese admitted that compliance is low. “There is a lot of miseducation or lack of knowledge thereof,” he said.

“A lot of these benefits are just looked at as gifts, with people saying, ‘But then gifts, you can’t declare a gift.’ Some of them say that, you know. So, a lot of these are not declared.”

This under-declaration is not going unnoticed. Lebese warned that SARS is already investing in technology to track down undeclared income.

“SARS is upgrading their systems, AI and all. At some point, what they will do is have information from these big companies, which push marketing budgets through content, gifts, and so on.

Once they declare, what will SARS do? They will try to match this and track, especially for the people who are earning big. And that’s where the problem will come.”

He added that SARS already has systems in place to track this kind of information and that influencers who continue ignoring their obligations may soon face penalties.

“Please note, systems are already in place to actually track this,” Lebese cautioned.

For More News And Analysis About South-Africa Follow Africa-Press