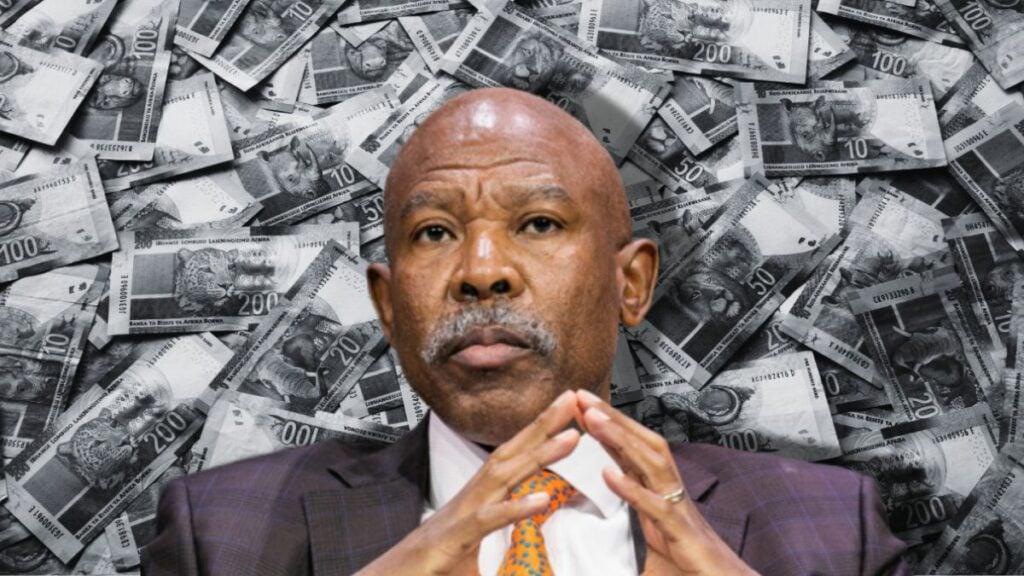

Africa-Press – South-Africa. Reserve Bank Governor Lesetja Kganyago warned that the United States’ tariff policies carry significant risks for South Africa.

One of the most pressing threats is the US Federal Reserve’s response to these tariffs, which could lead to increased borrowing costs globally.

The governor’s concerns arise in light of US President Donald Trump’s confirmation that South African goods imported to the United States will be subject to a 30% tariff starting from August 1, 2025.

This is expected to severely hamper South Africa’s economic growth, as the United States is the country’s second-largest trading partner after China.

As a small, open economy, South Africa is heavily reliant on exports to drive its economic growth, particularly in terms of commodities, of which the United States is a significant consumer.

Kganyago said he is concerned about the risks US tariffs pose for the global economy, especially if other countries retaliate with their own tariffs.

This was already seen earlier this year, when China retaliated against Trump’s first tariff announcement in April.

The two countries entered into a trade war, during which tariffs on each other’s goods rose to as high as 145%.

While the countries have since reached a deal that saw significantly lower tariffs, Kganyago warned that further trade wars could have a severe impact on the global economy.

Furthermore, rising global tensions would likely lead to significant volatility in financial markets and commodity prices, which would directly impact South Africa’s economy.

Another often overlooked potential impact of tariffs is their effect on the United States’ monetary policy.

During the Covid-19 pandemic, central banks worldwide loosened monetary policy by cutting interest rates to assist struggling households.

However, the post-pandemic economic boom led to a significant rise in inflation, prompting central bankers to tighten monetary policy.

The South African Reserve Bank’s Monetary Policy Committee (MPC) hiked interest rates by a cumulative 475 basis points during its latest hiking cycle, pushing rates to 15-year highs.

This was done in an attempt to bring the country’s high, sticky inflation down and within the Reserve Bank’s target range of 3% to 6%.

These efforts paid off, as inflation steadily fell after reaching a peak of 7.8% in July 2022 and finally breaching the SARB’s target range in June 2023.

In 2024, inflation reached its lowest point in years, allowing the MPC to cut interest rates in September.

Other countries’ central banks followed a similar pattern amid lower inflation and in an attempt to boost economic growth, with lower rates projected worldwide.

However, the United States’ new tariff plans now pose a significant risk to this outlook.

Interest rate warning

United States President Donald Trump

In a recent interview with 702, Kganyago explained that central banks around the world have been loosening monetary policy in response to slowing inflation.

However, since the imposition of the United States’ tariff policy, the US central bank, the Federal Reserve, has decided to slow down its easing and has stopped adjusting its rates.

This is because the tariffs introduced significant uncertainty and risks to the United States’ inflation outlook.

Under the new tariff regime, US consumers will likely pay far higher prices for goods imported from other countries, presenting inflationary risks.

Therefore, in light of these risks, the Federal Reserve’s Federal Open Market Committee (FOMC) has kept interest rates unchanged at every meeting in 2025 so far.

This has far-reaching implications for countries worldwide, as the United States has the largest and most important financial market in the world.

Because of this, if the United States stops lowering rates or even raises them, borrowing money will become more expensive for countries and companies worldwide, as global interest rates often follow the US’s lead.

For South Africa, this could mean that the MPC votes to keep interest rates higher for longer, intensifying the pressure on local households and businesses.

For More News And Analysis About South-Africa Follow Africa-Press