Africa-Press – South-Africa. South Africa’s government has R707.8 billion in contingent liabilities, which include guarantees given to state-owned enterprises (SOEs) such as Transnet and Eskom.

The National Treasury has gone to great lengths in recent years to limit the growth of these liabilities, which pose a hidden threat to the country’s precarious financial position.

One of the reasons behind the significant rise in the South African government’s debt has been the state’s support for SOEs, particularly Eskom, over the past decade.

The government has guaranteed an increasing amount of the debt of these SOEs and, in some cases, moved the debt onto its balance sheet.

Coupled with increased government spending and a stagnant economy, this has resulted in the state’s debt burden surging from 26% of GDP in 2008 to over 77% in 2025.

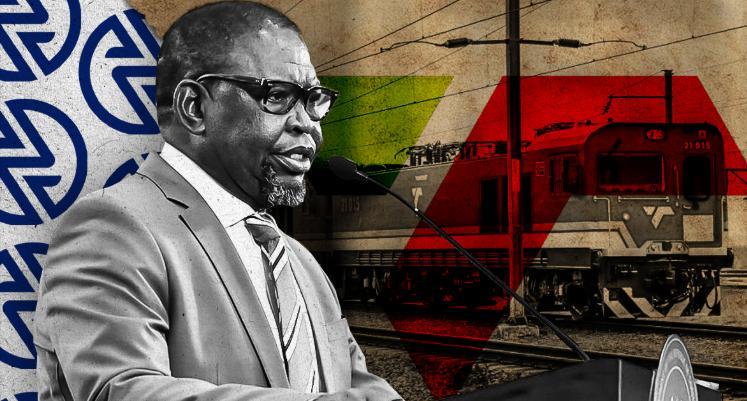

Since being appointed as Finance Minister in 2021, Enoch Godongwana has taken a “tough love” stance towards supporting SOEs.

Godongwana was instrumental behind Eskom’s debt relief package, spread over three years, with the government taking on over R200 billion of the utility’s debt.

However, he has taken a hard stance on support for other SOEs, tying debt relief packages and government guarantees to reform, turnaround plans, and improved performance.

This has seen some, such as the SABC and the Post Office, not receive any support as these SOEs remain on a downward trajectory.

Godongwana’s approach has seen the state’s contingent liabilities decline from 19% of GDP in 2020/21 to 15.7% in the current financial year.

The National Treasury said this trend reflects greater scrutiny of guarantees and stronger surveillance of SOEs and their turnaround strategies.

These contingent liabilities are still substantial, and its guarantee portfolio now sits at R707.8 billion, with hundreds of billions given to Transnet over the past two financial years.

Transnet remains the largest dependent on government guarantees, with the government issuing R145.8 billion in additional guarantees to the utility.

These guarantees are to address funding shortfalls, liquidity pressures, and debt redemptions over the next five years.

This will bring total guarantees to Transnet to R196.3 billion as the utility continues to implement its turnaround programme.

Thus, despite the improvement, the National Treasury says contingent liabilities remain a significant risk to South Africa’s financial stability and health.

To reduce the risk to the government, the National Treasury is working to crowd-in private sector financing for infrastructure projects.

Zero to hero

The good news for the South African government is that the performance of SOEs are improving, particularly at Eskom and Transnet.

These two monopolies have dominated their respective sectors for decades, with no competition allowed.

However, this is all set to change as the government has made substantial progress in reforming these sectors to create a competitive electricity market and increase private participation in the logistics sector.

This is vital for South Africa, with the country’s reliance on two companies set to be cut and the private sector expected to invest heavily in infrastructure.

The reforms in South Africa’s electricity sector are a clear example of this dynamic, with private companies investing billions of rands after deregulation occurred.

Symmetry chief investment strategist Izak Odendaal explained that breaking the stranglehold of these companies on the local economy is key to encouraging private sector investment.

Odendaal said the reform of these sectors will result in more opportunities for the private sector in areas of the economy that have historically been dominated by the state.

South African corporates are estimated to be sitting on over R1.8 trillion in cash on their balance sheets, which is sitting idle in money market funds or call accounts rather than being deployed in the economy.

Much of this has to do with these companies waiting for better opportunities to invest than in a stagnant economy, as well as the need for greater confidence about South Africa’s future and policy direction.

This remains the biggest bright spot in the South African story – after decades of the state controlling the commanding heights of the economy through the likes of Eskom and Transnet, it is letting go, even if reluctantly.

Space is opening for the private sector to step in and do what it does best, Odendaal said. However, this does not mean it should do everything.

It remains to be seen whether the South African government can step up and do what governments theoretically do best, namely, provide public goods like safety and security.

Things surely can’t get any worse, but the upcoming inquiry into SAPS will be an important marker, Odendaal said.

For More News And Analysis About South-Africa Follow Africa-Press