Africa-Press – South-Africa. Investec’s worst-case scenario projects the rand could tank to R21.40 by the end of 2024 and sink even further to R21.90 by the end of 2025.

According to Investec chief economist Annabel Bishop, emerging market currencies, including the rand, have historically strengthened during US interest rate cut cycles.

However, despite the expectations of a rate-cut cycle in the US, ongoing delays have caused the domestic currency to weaken.

Last week, the rand remained around R19.00/USD as the US saw a week of data that didn’t convince financial markets that the US would begin cutting its interest rates in Q4 2024.

This has affected the rand and other factors, such as the actions of the other two big players.

Bishop said a potential escalation of the Middle East conflict could have a “strong effect” on limiting growth. Escalations could also raise oil prices and inflation, triggering tighter monetary policy from central banks and increasing the risk of no relief this year.

Domestically, risk aversion is high ahead of the May 29th elections.

While this was attributed to the rand’s weakness last week, economists quickly pointed out that it was not a significant factor.

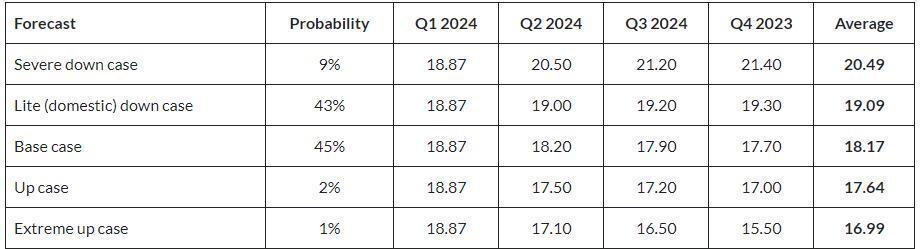

Investec’s base case scenario predicts that the rand will be valued at R18.20/USD in the second quarter of this year and will average R18.17/USD in 2024.

This forecast is based on a scenario where South Africa’s economic growth is modest but expected to increase to 2% over five years, supported by domestic policy measures.

However, growth is still limited by load-shedding and freight constraints. The forecast also assumes that the rand will stabilise and strengthen somewhat.

Inflation will be affected by weather patterns, which could lead to food price inflation.

Moreover, some expropriation will occur without compensation, but it will not negatively impact the economy, and the conflicts in Russia/Ukraine and the Middle East will continue without worsening.

In the best-case scenario, the South African rand is predicted to have an average exchange rate of R16.99/USD for the year.

This scenario assumes that the country’s economy will initially experience a growth rate of between 3% to 5% and then 5% to 7% thereafter.

It also assumes that South Africa will have good governance, growth-oriented reforms, and the elimination of any structural constraints.

In this scenario, there will be no nationalisation or expropriation without compensation, and South Africa will have only been on the greylist for 18 months.

However, Investec’s severe down case for the rand this year predicts the currency will average R20.40/USD.

In this scenario, there is a prolonged global recession and financial crisis, with inadequate domestic and international support.

The situation also assumes very high inflation, adverse weather conditions, and severe weakening of the rand.

Furthermore, it is assumed that the government borrows from a broader range of sources and falls deeper into a debt trap.

Additionally, there is severe load-shedding and civil and political unrest. The scenario also assumes that South Africa is blacklisted and the Russian-Ukraine war expands into neighbouring NATO countries.

Below is an overview of Investec’s forecasts for the rand/dollar exchange rate in 2024.

For More News And Analysis About South-Africa Follow Africa-Press