Africa-Press – South-Africa. In African countries, where economies are frequently susceptible to both internal inefficiencies and external shocks, preserving a healthy general government balance may support long-term development objectives and unlock a multitude of economic advantages.

A high general government balance can be a reliable sign of sound fiscal management and sound economic management, particularly when it shows a steady surplus or small deficit.

A large government balance has several immediate benefits, one of which is that it reduces or eliminates the need for borrowing.

Consequently, there will eventually be less public debt and interest payments.

Lower debt levels in African nations allow them to devote more of their budgets to infrastructure, healthcare, and education rather than utilizing national resources to pay back debt.

A government’s responsible financial management is communicated to investors and credit rating agencies via a robust fiscal balance.

As a result, the nation’s credit rating rises and the perceived risk of investing falls.

For many African countries seeking to issue sovereign bonds or draw in foreign direct investment (FDI), a sound government balance can lead to more numerous and reasonably priced capital inflows.

Furthermore, one of the most glaring advantages of a high general government balance is the fact that a government does not need to rely on excessive borrowing or printing money to cover its costs, and as a result, inflationary pressure is reduced.

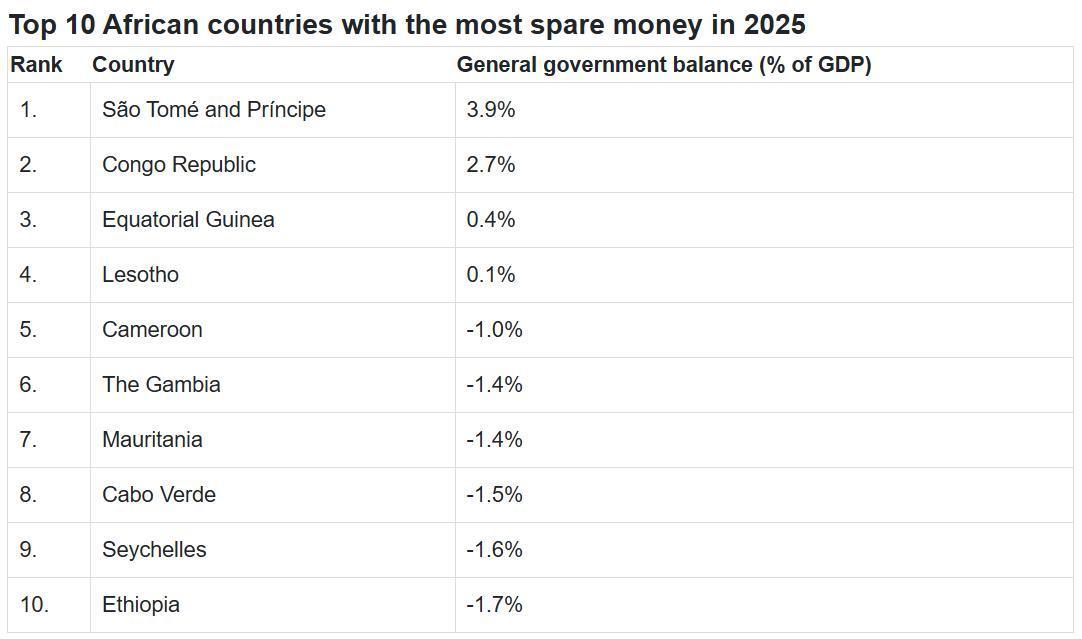

With that said, here are the 10 African countries with the highest general government balance in 2025, as a percentage of its GDP, according to the Africa Pulse report by the World Bank.

For More News And Analysis About South-Africa Follow Africa-Press