Africa-Press – South-Africa. Inflation in South Africa may be subdued, but the emerging conflict between Iran and Israel could cause the South African Reserve Bank (SARB) to be cautious over further interest rate cuts.

The latest data from Stats SA showed that inflation tracked sideways in May, remaining unchanged at 2.8% despite rising meat prices.

Reza Hendrickse, Portfolio Manager at PPS Investments, said the persistent subdued inflation underscores the Monetary Policy Committee’s (MPC’s) decision to lower the repo rate in May.

The MPC has cut interest rates by a cumulative 100 basis points since September 2024, with average inflation now believed to be firmly in the target range of 3% to 6%.

At its last meeting, the Reserve Bank indicated that there was room for more cuts in 2025, with most economists pencilling in another 25 basis point cut, some as soon as July.

Hendrickse said that inflation is expected to remain subdued going forward. Last month, the SARB revised its forecast for 2025 and 2026 to 3.2% and 4.2%, below the 4.5% target.

A major contributor to disinflation has been the lower oil price, coupled with a stronger rand. However, both of these tailwinds are under threat due to the escalations between Israel and Iran.

The exchanges of attacks between the two countries have led to a weakening of the rand and a higher oil price, given Iran’s large oil reserves.

“This is a prime example of why the SARB tends to be relatively hawkish with an eye on external factors which could suddenly impact domestic inflation and impact the rates outlook,” said Hendrickse.

Although inflation remains subdued across most global economies, the outlook for the global economy and financial markets is characterised by massive uncertainty and volatility.

This is still primarily driven by global trade tensions after the US announced massive tariffs in April, which could be a significant negative for economic growth and inflation.

“The South African economic recovery could therefore remain elusive, with domestic improvements potentially being offset by the deterioration in the global economy,” added Hendrickse.

Major uncertainty

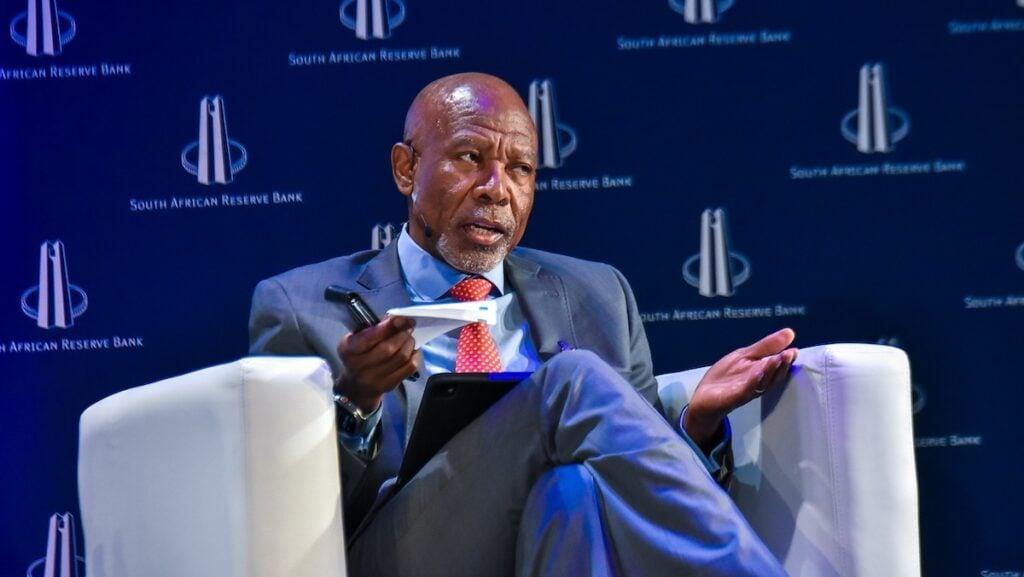

Sanisha Packirisamy – Chief Economist at Momentum Investments

Sanisha Packirisamy, Chief Economist at Momentum Investments, shared similar concerns over the recent escalation in the Middle East.

Oil prices spiked by over 10% after Israel launched airstrikes on Iran’s nuclear and military facilities and Iran’s subsequent response.

Most economists’ worries lie in the potential disruption in the Strait of Hormuz, a vital corridor for global oil supply.

Although oil prices have started to stabilise, risks are to the upside, and ongoing tensions could increase inflation, limiting central banks’ ability to lower interest rates in 2025.

This is especially the case given the backdrop of a protectionist environment marked by higher trade and tariff barriers.

Looking at financial assets, equity markets saw initial declines, but later recovered as hopes of a de-escalation grew.

This was primarily in response to the United States, which is a key ally of Israel, reaffirming its defensive rather than offensive position.

Safe-haven assets, such as gold, US treasuries and the US dollar, gained traction amid the uncertainty.

“Historically, geopolitical shocks tend to have fleeting market impacts unless they significantly impair economic growth or trigger stagflation,” said Packirisamy.

Iran’s oil exports currently remain unaffected, with its domestic markets being the primary target of the Israeli attacks.

OPEC’s spare capacity can also mitigate global oil supply concerns, as it could match any shortfall from Iran.

“However, prolonged conflict or a blockade of the Strait could drive oil prices significantly higher, threatening global economic stability,” said Packirisamy.

“That said, blocking the Strait would prevent their own shipments from getting out and could trigger retaliation from other exporters.”

The economist added that diplomatic efforts, especially from the USA, will be essential, given that a de-escalation and a lower risk of a broader regional conflict are crucial for market normalisation.

Source: businesstech

For More News And Analysis About South-Africa Follow Africa-Press