Africa-Press – South-Africa. As the Monetary Policy Committee (MPC) gears up for its upcoming meeting this week, most economists and analysts expect the status quo to be held – and kept there until the end of the year.

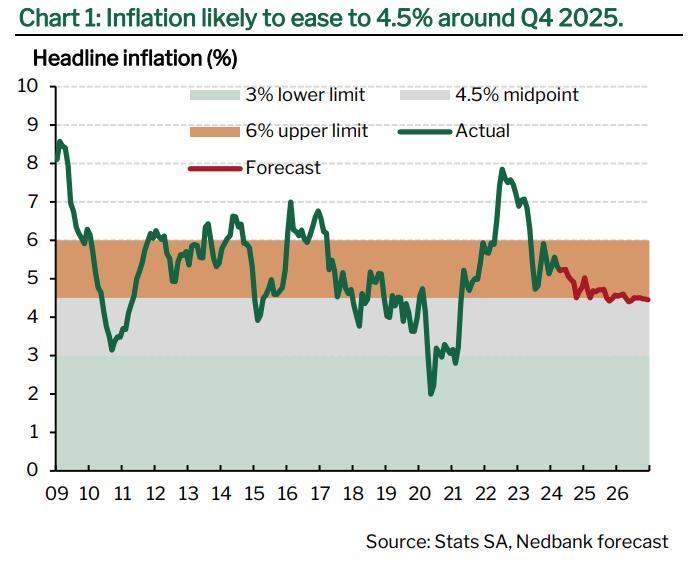

According to Arthur Kamp, Chief Economist at Sanlam Investments, despite cooling more than expected in April 2024, headline inflation is still sticking above the Reserve Bank’s 4.5% target and is taking longer to reach it.

“Given lingering inflation risk and uncertainty around the upcoming general election, the SARB is not expected to cut its repo rate this month,” he said.

This raises the question of when rate cuts will come and what needs to happen to get there.

Kamp said that there were three key elements that would lead to cuts, namely:

Rand stability

US rate cuts

Inflation hitting the SARB’s target

First, a sustained period of rand stability would go a long way towards anchoring actual inflation and inflation expectations at a suitably low level in South Africa’s small, open economy, Kamp said.

“Considering this, it will be important for the government to continue with economic reforms, while pursuing prudent monetary and fiscal policies, following the election,” he said.

Second, it would be helpful if the US Federal Reserve cut its policy interest rate significantly, he noted.

“The Fed matters since we benchmark off the US risk-free interest rate. US interest rate hiking cycles are typically associated with weaker currencies and higher interest rates amongst emerging market economies and vice versa.”

Third, and most importantly, domestic inflation must slow towards the mid-point of the Reserve Bank’s inflation target range.

“Ultimately, this is the most important thing, although implicitly, the Reserve Bank does take the weakness of the economy into account, considering the role the output gap plays in its modelling,” Kamp said, adding that it would also help if inflation expectations declined.

“On balance, however, the information at hand suggests interest rate should be cut significantly in response to slowing inflation as we head into 2025, once the Reserve Bank is confident it is on track to meet its inflation target sustainably.”

Other views

Expressing similar sentiments around rates, Nedbank economists also anticipate a hold on the repo rate this week, again citing sluggish progress towards the South African Reserve Bank’s 4.5% inflation target.

Additionally, the recent release of the Federal Open Market Committee (FOMC) meeting minutes last week has sparked concerns over stagnant inflation and monetary policy, subsequently impacting the South African rand.

“We expect the MPC to leave the repo rate unchanged at next week’s meeting as inflation’s progress towards the SARB’s 4.5% target remains slow,” they said.

Nedbank said that since March, there’s been mostly positive news. Inflation slightly improved in April to 5.2%. Factors like food and services saw moderation, offsetting fuel price increases. Global disinflation continued, with lower oil prices and better food outlook.

US inflation fell, but the Fed’s hawkish tone led to market concerns about prolonged tight monetary policy.

Additionally, despite some fluctuations, the rand held up well due to improved domestic conditions.

However, “although the stars are slowly aligning, the bar for a rate cut has not been cleared yet. Two months of inflation relief do not constitute a trend,” said Nedbank.

“The MPC would likely prefer more compelling evidence of consistent disinflation before shifting its stance. On this score, we still expect headline inflation’s descent to be frustratingly slow, stalling over the next two months before dipping below 5% in September and ending the year at 4.8%,” added the economists.

The recent Monetary Policy Review from the South African Reserve Bank (SARB) highlights that it currently sees the start of the local interest rate cut cycle well into 2025.

Yet, Nedbank said that risks remain, including the upcoming election and uncertain US interest rates. Hence, the repo rate is expected to stay at 8.25% for the next two meetings, with potential cuts of 25 bps in September and November, ending the year at 7.75%.

FOMC meeting minutes

The FOMC’s minutes revealed a hawkish stance, indicating a reluctance to initiate rate cuts amidst stagnant inflationary trends, while market reactions have been pronounced, with the rand weakening in response to the perceived delay in monetary easing.

This was outlined by chief economist at Investec, Annabel Bishop, in her FOMC minutes note, which she said “sees hawkish bent, in turn weakening the rand.”

Bishop said that the minutes of the committee’s May 1st meeting, which were released late last week, “prompted some rand weakness over FOMC concerns on the stickiness of inflation, with the rand previously strengthening over this month.”

The minutes reflected that members agreed there had been no significant advancement towards achieving the Committee’s inflation target of 2 percent in recent months.

“The lack of significant progress on inflation returning to target in the US (which has an implicit target of 2.0% y/y) was a dominant theme in the minutes, and has halted the rand’s recent progress towards R18.00/USD, with it weakening,” instead, said Bishop.

The chief economist explained that markets read the minutes as underlying a delay in the start of the rate cut cycle, instead of supporting one, with the minutes highlighting that “high interest rates may be having smaller effects than in the past.”

The minutes also outlined a “willingness to tighten policy further should risks to inflation materialise in a way that such an action became appropriate.”

Bishop noted that FOMC members’ concerns over inflation has knocked back the growing risk-taking in the markets which had seen the rand gain over the course of the month of May.

The Federal Reserve Bank in the US and the Reserve Bank in South Africa are both emphasising a commitment to bringing inflation back to their target levels. They plan to delay any reductions in interest rates as long as inflation remains persistently high.

SARB in particular has said that it will not cut the repo rate until CPI inflation has reached the midpoint of the target range 4.5% y/y, “and is expected to sustainably remain around this 4.5% y/y mark,” said Bishop.

For More News And Analysis About South-Africa Follow Africa-Press