Africa-Press – South-Sudan. The South Sudan Revenue Authority (SSRA) has announced a record surge in national revenue collections, reaching an unprecedented 130 billion South Sudanese Pounds (SSP) per month — a milestone attributed to the country’s digital transformation.

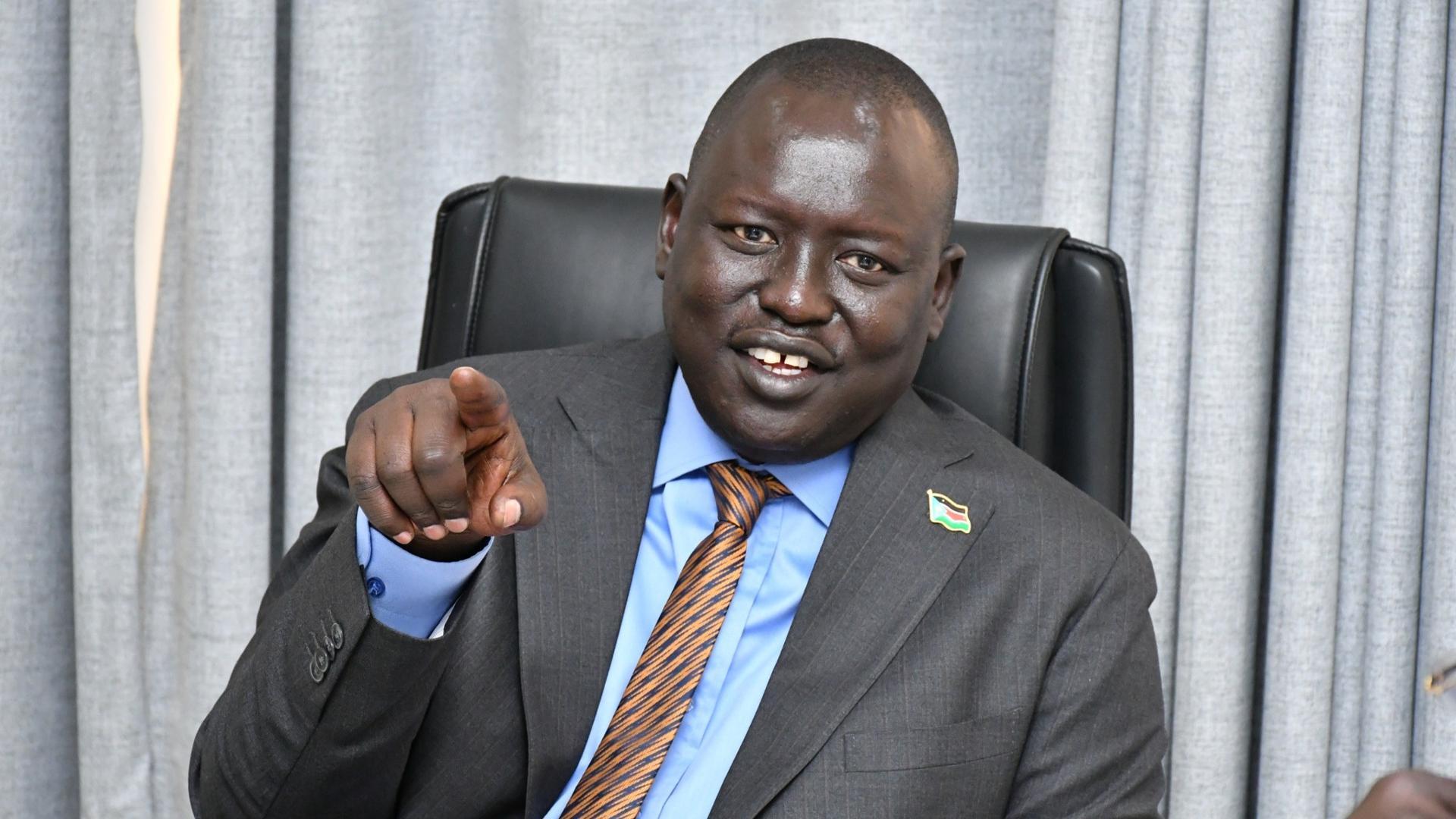

“As of October 2026, monthly revenues have reached an average of 130 billion SSP — representing an unprecedented increase that underscores the effectiveness of digitisation, disciplined governance, and data-driven fiscal management,” said SSRA Commissioner General Simon Akuei Deng in a statement on Tuesday.

According to Deng, in 2020, the authority collected an average of just 3 billion SSP per month, a figure that, while promising, fell far short of meeting national obligations such as salaries, infrastructure development, and essential public services.

“Through strong collaboration between the Ministry of Information, Communication Technology (ICT) and the SSRA — a sweeping digital transformation has reshaped the national revenue landscape,” he added.

The turning point, Deng noted, came in 2021, when the Ministry of ICT launched a nationwide digitalisation and e-government programme across ministries, departments, and agencies. This reform included the introduction of e-Government cargo tracking systems, which have significantly improved visibility and accountability in South Sudan’s cross-border trade operations.

He revealed that the system also helped expose irregular practices involving UN contractors. In May 2024, SSRA tracking data uncovered that TriStar Company, contracted by the UN to import fuel for humanitarian operations, had diverted consignments for private sale to local petrol stations.

“While the UN acknowledged this misconduct and committed to investigating, no formal update has since been shared,” Deng said. “The SSRA reiterates its call for transparency and partnership to uphold integrity in trade operations.”

He further explained that the digital cargo tracking systems — implemented at no direct cost to the Government — are financed through minimal, industry-standard levies that ensure sustainable and efficient oversight of imports and exports.

“The transformation achieved in public revenue management and governance through digitalisation demonstrates the power of innovation, accountability, and institutional collaboration,” Deng said.

He concluded that the SSRA remains committed to promoting fiscal transparency and accountability, driving digital innovation across all revenue streams, and strengthening South Sudan’s non-oil revenue base to support long-term economic stability.

Over the past two years, SSRA reported steady growth in non-oil revenue collections, though the progress has been uneven and often below projected targets. In March 2025, the SSRA announced gross collections of SSP 132.6 billion, while by October 2025, monthly revenues reportedly averaged SSP 130 billion, attributed to digital reforms and improved tax administration.

Earlier in the 2024–2025 fiscal period, revenues rose from SSP 187.4 billion to SSP 388.9 billion between July 2024 and January 2025, yet this remained about 52 percent below the estimated target of SSP 559.5 billion.

Despite such headline figures, fiscal experts note that persistent inflation, currency depreciation, and gaps in public financial management have continued to undermine the impact of these gains on government salaries, service delivery, and economic stability.

For More News And Analysis About South-Sudan Follow Africa-Press