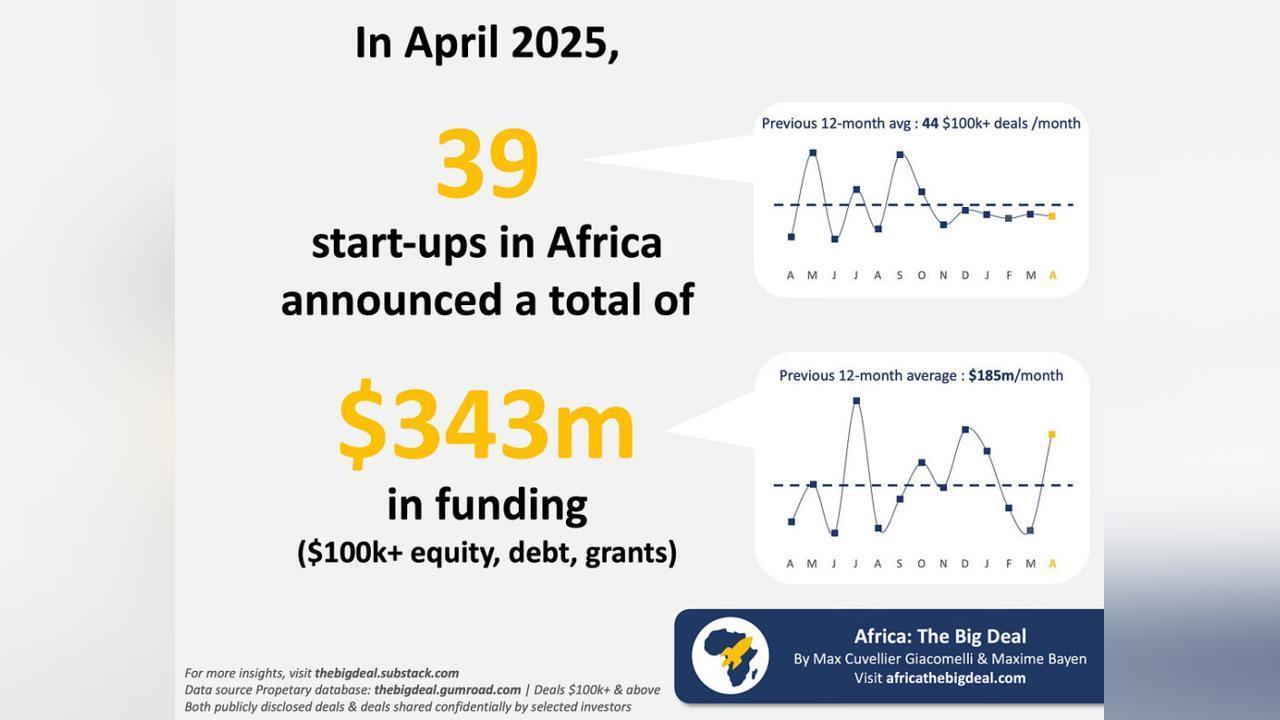

Africa-Press – Tanzania. In April 2025, African start-ups secured $343 million through deals exceeding $100,000 (excluding exits), spanning 39 companies. This marks not only a strong recovery from a sluggish March but also the second-highest April performance on record, trailing only the funding surge of April 2022. Compared to April 2024, the growth is remarkable funding has increased by 4.5 times. It’s a clear indication that while investors remain cautious, their confidence in the continent’s potential is steadily returning.

April’s funding figures were lifted by several major deals. South African healthtech company hearX secured $100 million through a merger with U.S.-based Eargo marking 2025’s first mega deal and signaling strong intent to reshape the hearing health sector globally. In Egypt, Islamic fintech platform Bokra raised $59 million via a sukuk issuance, an impressive leap from its $4.6 million pre-seed round just a year ago. Meanwhile, South African payments startup Stitch closed a $55 million round from existing investors as it intensifies efforts to offer comprehensive payment solutions across Africa.

On the exit side, at least four were recorded—three involving fintechs: Egypt’s ADVA was acquired by UAE-based Maseera; Nigerian fintech Bankly was bought by investment firm C-One Ventures; and South Africa’s Peach Payments acquired PayDunya to fuel expansion.

With a strong April performance, year-to-date figures are also promising startups raised $803 million across 163 deals from January to April 2025 (excluding exits), a 43% increase over the $563 million recorded during the same period in 2024. More ventures are securing funding too, up from 147 last year to 163 this year. Notably, at least 225 distinct investors have participated in $100k+ deals so far in 2025.

This momentum is exactly what we want to see in the ecosystem not just an increase in funding, but a broader, more diverse range of investments. It signals that this isn’t just a short-term bounce but the early stages of a more stable recovery. While it’s still early, and a few strong months don’t define a year, if this pace continues, 2025 could shape up to be a great year. Furthermore, since early 2024, VC funds focused on Africa have closed over $1.3 billion, including Janngo Capital (with a gender focus), Airnergize Capital, Verod-Kepple Africa Ventures, Saviu’s Fund II (focused on Francophone Africa), and LoftyInc Capital, among others. As we’ve said before, it’s a marathon, not a sprint—but for now, it’s a great time to be in the race.

For More News And Analysis About Tanzania Follow Africa-Press