Author: SYLIVESTER DOMASA

AfricaPress-Tanzania: Government has opposed a request from small-scale miners to remove or reduce royalty and clearance fee paid to the state, saying the payments are non-taxes and designed to improve efficiency and offer the public a share of the mining industry’s profits.

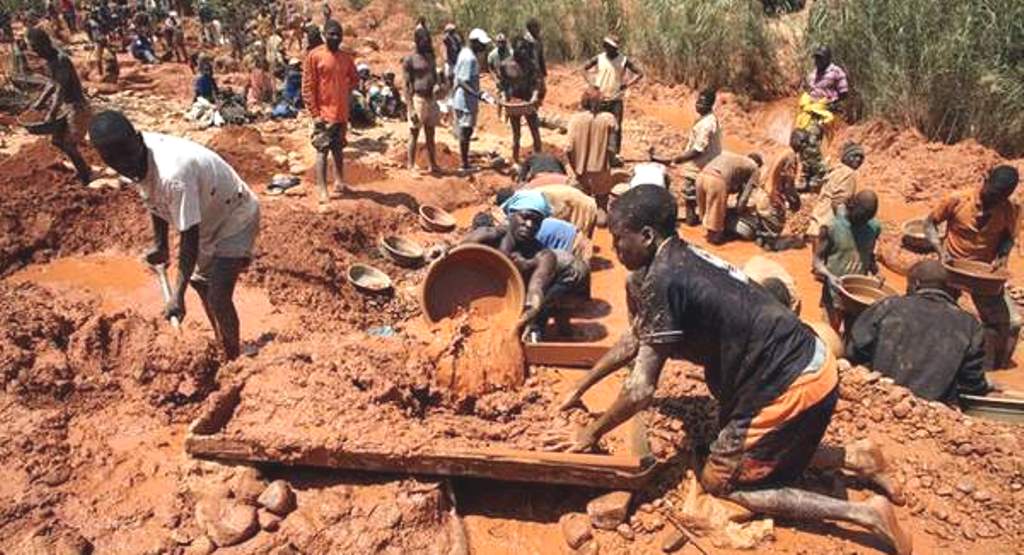

A small-scale miner and retired teacher, Mr John Luhemeja had demanded at a forum that the six per cent royalty and one per cent clearance fee are in addition to the income tax and service levy that small-scale miners are compelled to pay.

He claimed that the payments were a replica of colonial practice and needed to be removed or lowered to help artisanal miners across the country.

“We’re required to pay all these charges, yet at the end of the year we’re also forced to pay income tax,” he said at a business forum at the ongoing Geita international mining machinery technology and investment expo.

Permanent Secretary in the Ministry of Minerals Prof Simon Msanjila said the mineral resources are for the public, not individuals.

He said that the royalty and clearance fees are not taxes and that the government reforms in the mining sector abolished Value-Added Tax (VAT) of 18 per cent and withholding tax that was charged five percent to smallholder miners.

These taxes still apply on middle and large-scale mining companies, he noted.

The one per cent clearing fee on the value of mineral exports was introduced in 2017/18 financial year as part of the government measures aimed at getting a bigger share of revenues from the country’s natural resources.

The clearance fee, according to Prof Msanjila, was imposed to facilitate inspection costs incurred by state authorities.

“It is specifically charged on the value of mineral exports.” Prof Riziki Shemdoe, Permanent Secretary in the Ministry of Industry and Trade, said the government adopted a business blueprint last year that targeted to improve doing business in the country.

He explained that on the mining sector the scheme targeted the business, legal fragmentation, taxes and institutional framework.

“We adopted the blueprint amending conflicting legislation such as local government laws that imposed unstructured charges and duties to investors.

We also amended laws governing the transportation of radiations to give the country a competitive advantage in the region,” he said.