Author: HILDA MHAGAMA

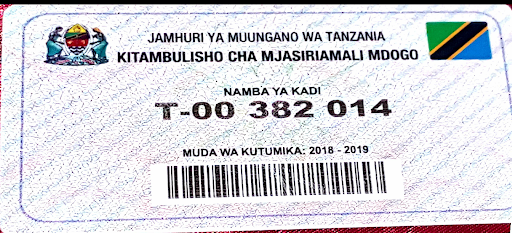

AfricaPress-Tanzania: THE introduction of Identity Cards (IDs) for petty traders (‘Machinga IDs’) has yielded positive results, enabling some of them to expand businesses and accessing commercial lo

Tanzania Revenue Authority (TRA) Taxpayer Services and Education Director Richard Kayombo told the africa-press at the just ended Dar es Salaam International Trade Fair (DITF) that some of the traders have recorded an increase in sales and business growth, in addition to conducting their businesses peacefully.

“For those who sell products worth 11,000/-and above in a day qualify to obtain Taxpayer Identification Number (TIN), thereafter making it easy for them to get business licenses and loans from several financial institutions,” Mr Kayombo said.

Mr Kayombo said previously, most of them never flourished or grew simply because they were operating clandestinely, but after obtaining IDs, they can now conduct business openly without fear of being charged levies or their goods being confiscated by militiamen.

In December 2018, President John Magufuli handled out a total of 670,000 IDs to entrepreneurs whose business capital does not exceed 4m/-, and also presented 25,000 IDs to each regional commissioner for onward distribution.

Before the exercise, President Magufuli said Tanzania’s tax base was very poor compared to neighbouring countries, including Kenya, since only 2.2 million people in the country with a population of 55 million people were taxpayers.

The president advised TRA to ensure that taxes were not too high for traders to afford. He said holders of IDs would be formally recognised by TRA officials at their work stations.

Mr Kayombo said a total of 1.59 million IDs worth 31.86bn/-had been distributed from June 2018 to June 2020. The 20,000/-worth ID cards which are renewable annually are given to traders running a business with a maximum profit turnaround of 4m/- each.

Those considered as small scale entrepreneurs include traders who earn not more than 2m/-a year and less than 12,000/-per day.

Late last year, CRDB Bank used Kigamboni District, in Dar es Salaam as a launching pad for interest free mobile phone digital micro-loans for micro entrepreneurs with ‘machinga’ identity.

The loans issued to an individual or a group starts as low as 10,000/-to 500,000/- payable in three months and are collateral free through Sim banking.

According to TRA, the petty traders being registered are those whose details are recorded in their respective municipal databases.

Entrepreneurs with IDs are required to display them, to enable them to conduct business without any problem and will be recognised by TRA officials wherever they are.

On measures taken by the government to increase the tax base, he said TRA had embarked on door to door campaigns and have so far covered Tabata in Dar es Salaam, Mbeya, Mwanza, Morogoro and Tanga.

He said they use the campaign to raise awareness to business owners on the use of EFD machines and the importance of acquiring TIN.