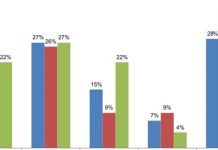

THE private sector credit grew by 9.1 percent compared with 7.3 percent in the year ending January 2019, loanable funds resulting from sustained accommodative monetary policy, expansion of various economic activities, and measures implemented by the government to improve business environment.

The Bank of Tanzania (BoT) monthly economic review, during the period under review, growth of credit was prominent in building and construction, agriculture, transport and communication and personal related activities.

It is worth noting that credit to manufacturing activities registered a turnaround, recording a growth of 3.1 percent from a contraction of 0.8 percent in the preceding month.

In terms of proportion to total outstanding credit to the private sector, personal related activities and trade continued to account for the largest share at 29.6 percent and 17.9 percent, respectively.

The monetary aggregates continued to register strong growth in the year ending January 2020, in response to the sustained accommodative monetary policy and recovery of credit to the private sector.

Extended broad money supply registered an annual increase of 2.35tri/-to 28.11tri/-in January 2020, translating into annual growth rate of 9.1 percent compared with 3.3 percent in January 2019.

The expansion of money supply was on account of accumulation of net foreign assets owing to improvement in the current account balance, and expansion of credit to various economic activities.

Likewise, broad money supply that excludes foreign currency deposits recorded an annual growth of 11.4 percent compared with 2.3 percent registered in January 2019.

Net foreign assets of the banking system recorded an annual growth of 13.9 percent in January 2020, up from a contraction of 8.9 percent in January 2019.

This was due to an increase in holdings of the BoT following continuous purchase of foreign exchange from the domestic market, mostly emanating from export proceeds of gold, manufactured goods, and tourism related activities.

Domestic credit maintained its pace, recording an annual growth of 6.6 percent in January 2020 compared with 6.3 percent recorded in the corresponding month of 2019.

This recovery was reflected in the expansion of credit to the private sector, which outweighed the contractionary impact of central government borrowing from the banking system.