Africa-Press – Uganda. The Ministry of Gender, Labour and Social Development (MGLSD), in collaboration with the Private Sector Foundation Uganda (PSFU) and with technical support from the World Bank, has officially launched the Gender-Inclusive Financing Innovation Expo under the theme: “Catalysing Innovation for Gender-Inclusive Finance.”

The two-day event, part of the broader GROW Project (Generating Growth Opportunities and Productivity for Women Enterprises), aims to tackle one of Uganda’s most persistent development challenges women’s limited access to affordable, formal financing.

By convening key stakeholders including policymakers, financial institutions, fintech innovators, and women entrepreneurs, the Expo seeks to spark new partnerships, spotlight innovations, and drive systemic change.

Although Uganda has made notable strides in financial inclusion—with over 30 million active mobile money accounts and over 75% of adults accessing some form of financial service women continue to face disproportionate barriers to formal finance.

According to the Uganda Bankers’ Association, women-owned businesses account for just 24.4% of the industry’s loan book, despite women owning nearly 40% of all businesses nationwide.

Further, only 34% of women in Uganda hold accounts at banks or formal financial institutions, even though 65% have some form of financial account—mostly mobile money.

This over reliance on informal financial channels exposes women to theft, fraud, and high interest rates, stifling their ability to grow their enterprises sustainably.

The Expo provides a platform for Participating Financial Institutions (PFIs), Non-Bank Financial Institutions (NBFIs), start-ups, and software developers to showcase their tools and services, explore collaboration, and access the GROW Project’s Innovation Grants and GROW Financing Facility (GFF).

These initiatives are designed to fund gender-responsive innovations that expand women’s access to finance and catalyze market-level reforms.

Speaking at the opening ceremony, Hon. Betty Amongi, Minister of Gender, Labour and Social Development, highlighted the paradox of Uganda’s impressive financial inclusion numbers and the continued gender disparities in access to formal financing.

“Despite the progress, these statistics mask persistent inequalities,” she said. “Women entrepreneurs are not looking for charity they are looking for partnerships, tools, and financial products that recognise their potential.”

Amongi commended financial institutions already making strides in women-centered finance but emphasised the need for systemic reform.

She pointed to innovative solutions such as collateral-free lending using mobile transaction data, group lending models, and women-focused fintech platforms as the future of inclusive finance.

“Let this Expo be the moment when we say: Inclusive finance is not the exception—it is the new standard,” she concluded.

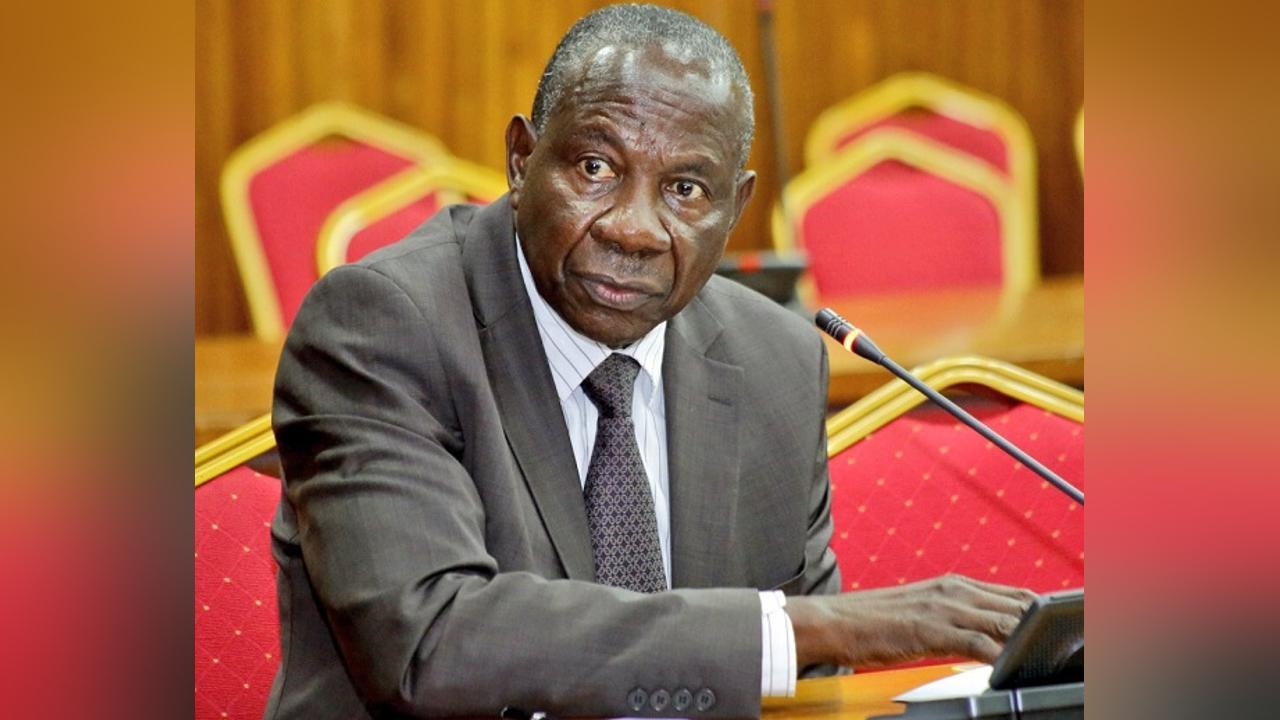

In his remarks, Matia Kasaija, Minister of Finance, Planning and Economic Development, acknowledged the role of government initiatives like UWEP, PDM, and now GROW, in expanding access to credit for women and youth.

However, he noted that the demand for unsecured loans among women entrepreneurs remains overwhelming.

“We have designed the GROW Project to serve those who have outgrown the one-million-shilling limits of previous programs,” Kasaija explained.

“But now we must go beyond programs—to funding systems that work for women.”

Kasaija praised the GROW Project’s emphasis on innovation and policy reform and called on financial institutions to embrace gender-responsive credit models and collaborate with fintech players who understand the lived realities of women entrepreneurs.

He reaffirmed the Ministry’s commitment to expanding fiscal space for women’s economic empowerment, incentivising private sector participation through risk-sharing mechanisms and ensuring public financial management systems reflect gender equity.

“As we shape Uganda’s next development plan (NDP IV), we need your experiences and insights to shape evidence-based, scalable policies. Let us ensure no woman entrepreneur is left behind.”

The Expo represents more than a networking opportunity it signals a national commitment to reimagining finance for inclusive, sustainable development.

By integrating innovation, policy support, and institutional reform, the GROW Project and its partners aim to remove the structural barriers that keep women-led businesses stuck at the micro level.

The vision is clear: a Uganda where every woman entrepreneur has access to financial services that are safe, affordable, and designed for her growth. This Expo marks a bold step toward realising that goal.

For More News And Analysis About Uganda Follow Africa-Press