Africa-Press – Uganda. The Bank of Uganda (BoU), in partnership with the Ministry of Finance, Planning and Economic Development (MoFPED), has reaffirmed its commitment to building an inclusive financial system that serves all Ugandans, especially those in rural and underserved communities.

This came during the 2025 Annual Financial Inclusion Forum held on Thursday at the Sheraton Hotel in Kampala under the theme “Access to Usage: Advancing Inclusive Financial Product Uptake in Uganda.”

The high-level meeting brought together policymakers, bankers, development partners, and innovators to discuss strategies for expanding financial access and deepening usage among low-income earners, micro-entrepreneurs, and smallholder farmers.

Opening the forum, Finance Minister Matia Kasaija applauded the Bank of Uganda and its partners for keeping the agenda of inclusive finance alive, noting that government remains committed to empowering citizens through targeted development programs.

“I want to thank the Bank of Uganda and its partners for organizing this important forum,” Kasaija said.

“Over the past decade, we have dispatched Shs11 trillion to support initiatives such as Emyooga, the Parish Development Model, and the Grow Project — all aimed at bringing more Ugandans into the money economy. My ministry will continue to back initiatives that improve access to affordable and practical financial services.”

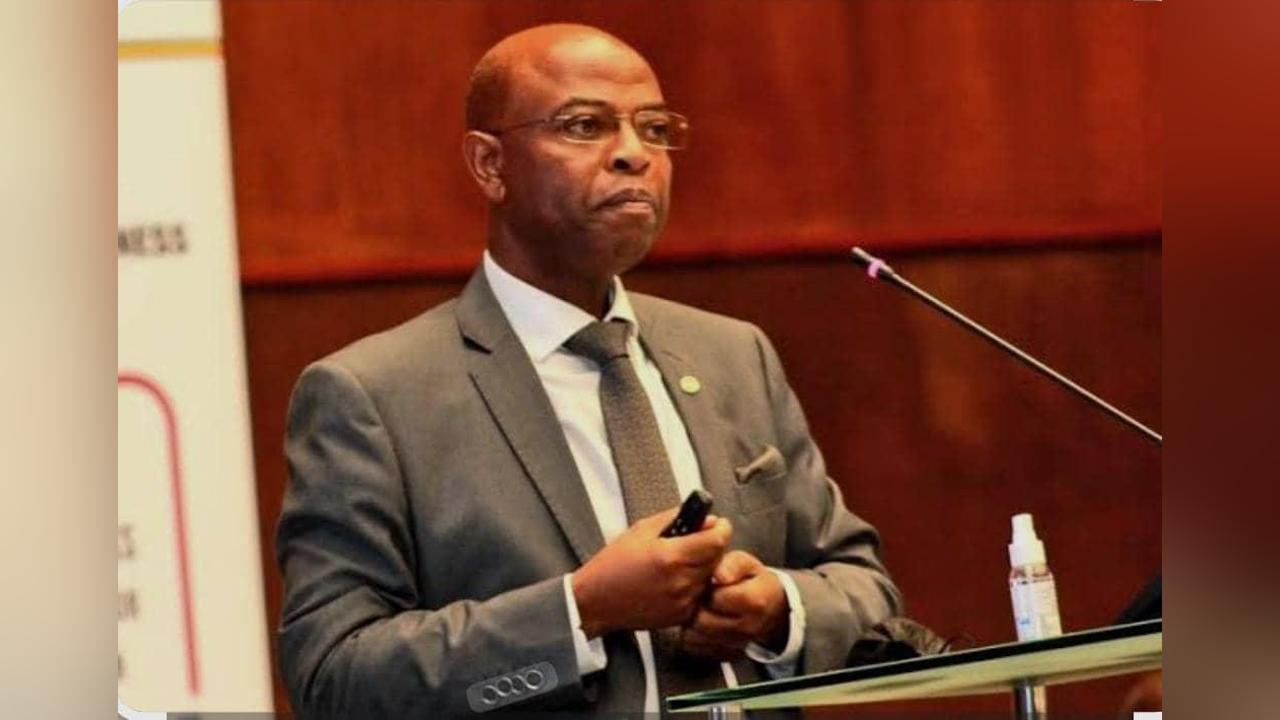

Deputy Governor Prof. Augustus Nuwagaba said financial inclusion is not only an economic goal but also a moral responsibility requiring multi-sectoral collaboration.

“Financial inclusion is both an economic necessity and a moral imperative,” he said. “The Bank of Uganda remains committed to building a financial system that leaves no Ugandan behind. Everyone — regardless of income, location, or education — deserves a fair chance to access and use financial services safely and effectively.”

Prof. Nuwagaba added that access alone is insufficient, urging stakeholders to ensure that Ugandans can meaningfully use financial services tailored to their real needs.

Julius Kakeeto, CEO of Pearl Bank, called for innovation-driven but practical solutions that align with the realities of micro, small, and medium enterprises (MSMEs) and smallholder farmers, who often face rigid lending systems and bureaucratic barriers.

“To succeed, we must start by understanding people and their businesses before designing solutions,” Kakeeto said.

“Technology should drive access, but the onboarding process must be simple. Farmers and MSMEs operate on seasonal income — our credit terms should reflect their production cycles, not the bank’s calendar.”

He further urged banks to integrate climate-smart financing models to cushion farmers from the growing impact of climate change.

In his closing remarks, Permanent Secretary and Secretary to the Treasury Ramathan Ggoobi urged participants to ground financial inclusion policies in research rather than speculation.

“Stop discussing opinions. Discuss based on researched facts,” Ggoobi said. “Financial literacy only works when lessons are practical, timely, and context-specific. Our goal should be to empower Ugandans to make informed financial decisions that improve their livelihoods.”

Participants at the forum also called for stronger outreach and localized communication to reach communities in remote areas.

Brenda Akayo, a participant from Arua District, praised BoU’s efforts but said rural communities still struggle to understand formal financial systems.

“Many people in remote areas face challenges like language barriers,” Akayo noted. “BoU should consider outreach teams that can educate citizens in their local languages about financial services and how to benefit from them. Inclusion must start with understanding.”

The 2025 Financial Inclusion Forum ended with a shared commitment to accelerate Uganda’s journey toward a more inclusive and resilient financial ecosystem — one that bridges the gap between access and usage, empowers local communities, and strengthens the nation’s economic resilience.

For More News And Analysis About Uganda Follow Africa-Press